Gold price today 7/9/2025: SJC, DOJI both decreased, attractive investment opportunity!

At the time of the survey on July 9, 2025, domestic gold prices recorded a sharp downward trend in most major brands. This is a sign that the gold market is going through a strong adjustment period.

In Hanoi , SJC gold price was listed at 118.6 million VND/tael (buy) and 120.6 million VND/tael (sell), down 400 thousand VND/tael in both directions compared to yesterday. Similarly, DOJI Group also recorded a corresponding decrease, with buying and selling prices of 118.6 million VND/tael and 120.6 million VND/tael, respectively.

In Ho Chi Minh City, PNJ gold prices fell sharply, listed at VND114.1 million/tael (buy) and VND117 million/tael (sell), down VND600,000 and VND300,000/tael respectively. SJC in this area was also not out of the trend, with a decrease of VND400,000/tael in both directions.

At Mi Hong, gold prices had mixed movements. The buying price increased slightly by VND400,000/tael, reaching VND119.4 million/tael. However, the selling price decreased by VND200,000/tael, down to VND120.4 million/tael.

Vietinbank Gold, the selling price is listed at 120.6 million VND/tael, down 400 thousand VND/tael, while the buying price is not announced.

Bao Tin Minh Chau also recorded a similar decrease, with buying and selling prices at VND118.6 million/tael and VND120.6 million/tael, respectively, down VND400,000/tael in both directions.

Phu Quy, gold price decreased steadily by 400 thousand VND/tael, pushing the buying price down to 117.9 million VND/tael and the selling price to 120.6 million VND/tael.

Gold price trend forecast today 7/9/2025

The downward trend in gold prices today, July 9, 2025, shows a strong correction in the market after a period of rapid increase. This could be an opportunity for investors to consider buying strategies at lower prices, while closely monitoring market developments in the coming days.

Gold price list this afternoon July 9, 2025 in the country in detail:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 118.6 | ▼400K | 120.6 | ▼400K |

| DOJI Group | 118.6 | ▼400K | 120.6 | ▼400K |

| Red Eyelashes | 119.4 | ▲400 | 120.4 | ▼200K |

| PNJ | 114.1 | ▼600K | 117.0 | ▼300K |

| Vietinbank Gold | 120.6 | ▼400K | ||

| Bao Tin Minh Chau | 118.6 | ▼400K | 120.6 | ▼400K |

| Phu Quy | 117.9 | ▼400K | 120.6 | ▼400K |

| 1. DOJI - Updated: 7/9/2025 15:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 118,600 ▼400K | 120,600 ▼400K |

| AVPL/SJC HCM | 118,600 ▼400K | 120,600 ▼400K |

| AVPL/SJC DN | 118,600 ▼400K | 120,600 ▼400K |

| Raw material 9999 - HN | 107,900 ▼500K | 112,000 ▼500K |

| Raw material 999 - HN | 107,800 ▼500K | 111,900 ▼500K |

| 2. PNJ - Updated: 07/09/2025 15:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,100 ▼600K | 117,000 ▼300K |

| HCMC - SJC | 118,600 ▼400K | 120,600 ▼400K |

| Hanoi - PNJ | 114,100 ▼600K | 117,000 ▼300K |

| Hanoi - SJC | 118,600 ▼400K | 120,600 ▼400K |

| Da Nang - PNJ | 114,100 ▼600K | 117,000 ▼300K |

| Da Nang - SJC | 118,600 ▼400K | 120,600 ▼400K |

| Western Region - PNJ | 114,100 ▼600K | 117,000 ▼300K |

| Western Region - SJC | 118,600 ▼400K | 120,600 ▼400K |

| Jewelry gold price - PNJ | 114,100 ▼600K | 117,000 ▼300K |

| Jewelry gold price - SJC | 118,600 ▼400K | 120,600 ▼400K |

| Jewelry gold price - Southeast | PNJ | 114,100 ▼600K |

| Jewelry gold price - SJC | 118,600 ▼400K | 120,600 ▼400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,100 ▼600K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,100 ▼600K | 117,000 ▼300K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,100 ▼600K | 117,000 ▼300K |

| Jewelry gold price - Jewelry gold 999.9 | 113,500 ▼500K | 116,000 ▼500K |

| Jewelry gold price - Jewelry gold 999 | 113,380 ▼500K | 115,880 ▼500K |

| Jewelry gold price - Jewelry gold 9920 | 112,670 ▼500K | 115,170 ▼500K |

| Jewelry gold price - Jewelry gold 99 | 112,440 ▼500K | 114,940 ▼500K |

| Jewelry gold price - 750 gold (18K) | 79,650 ▼380K | 87,150 ▼380K |

| Jewelry gold price - 585 gold (14K) | 60,510 ▼290K | 68,010 ▼290K |

| Jewelry gold price - 416 gold (10K) | 40,910 ▼200K | 48,410 ▼200K |

| Jewelry gold price - 916 gold (22K) | 103,860 ▼450K | 106,360 ▼450K |

| Jewelry gold price - 610 gold (14.6K) | 63,410 ▼310K | 70,910 ▼310K |

| Jewelry gold price - 650 gold (15.6K) | 68,050 ▼330K | 75,550 ▼330K |

| Jewelry gold price - 680 gold (16.3K) | 71,530 ▼340K | 79,030 ▼340K |

| Jewelry gold price - 375 gold (9K) | 36,150 ▼190K | 43,650 ▼190K |

| Jewelry gold price - 333 gold (8K) | 30,930 ▼170K | 38,430 ▼170K |

| 3. SJC - Updated: 7/9/2025 15:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,600 ▼400K | 120,600 ▼400K |

| SJC gold 5 chi | 118,600 ▼400K | 120,620 ▼400K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,600 ▼400K | 120,630 ▼400K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 ▼400K | 116,500 ▼400K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 ▼400K | 116,600 ▼400K |

| Jewelry 99.99% | 114,000 ▼400K | 115,900 ▼400K |

| Jewelry 99% | 110,252 ▼396K | 114,752 ▼396K |

| Jewelry 68% | 72,069 ▼272K | 78,969 ▼272K |

| Jewelry 41.7% | 41,585 ▼166K | 48,485 ▼166K |

World gold price 7/9/2025 fell dramatically after the ceasefire

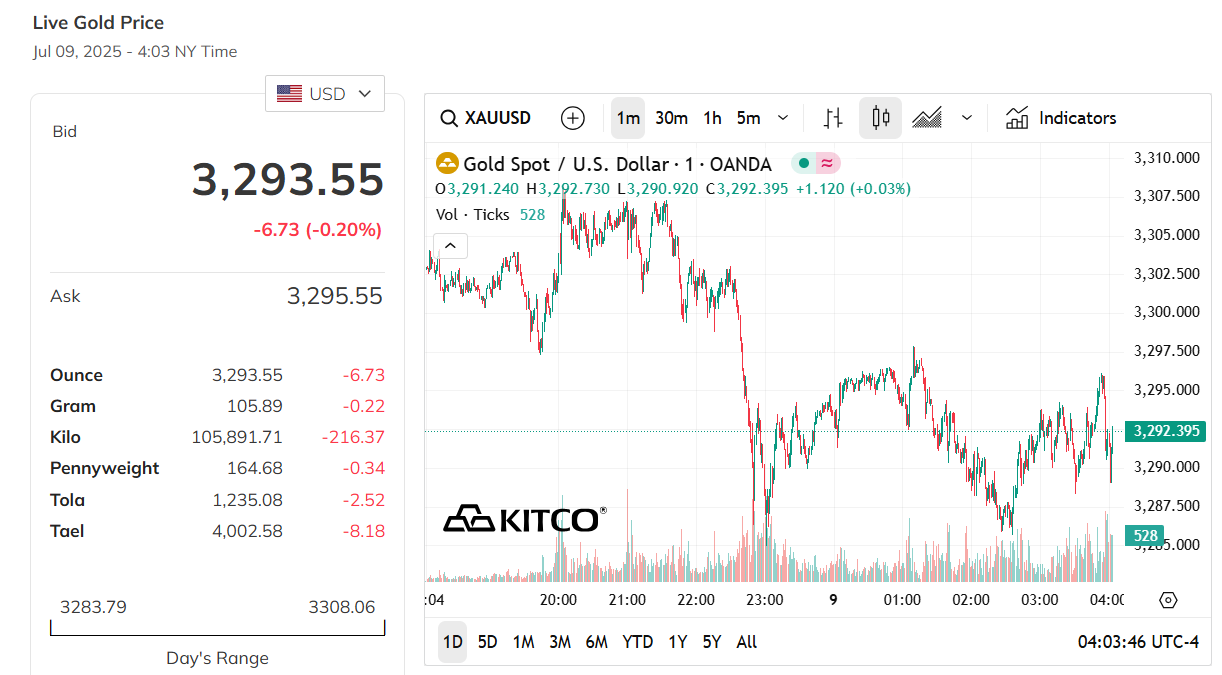

World gold price, at 10:00 on July 9, 2025 (Vietnam time), the world spot gold price was at 3,293.55 USD/ounce. Today's gold price decreased by 6.73 USD compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,320 VND/USD), the world gold price is about 104.49 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (118.6-120.6 million VND/tael), the current SJC gold price is about 16.11 million higher than the international gold price.

Gold prices today, July 9, 2025, on the world market have fallen to their lowest level in more than a week. The main reason is the increase in the US dollar and the increase in US Treasury bond yields. These factors have put great pressure on the gold market. Specifically, the spot gold price decreased by 0.4%, reaching 3,286.96 USD per ounce, while the US gold futures price also decreased by 0.7%, down to 3,295 USD. These fluctuations occurred in the context of the global financial market being affected by new tariff statements from US President Donald Trump.

One reason for the fall in gold prices is the strengthening of the US dollar. When the dollar increases in value, gold, which is priced in dollars, becomes more expensive for holders of other currencies. This reduces the appeal of gold to international investors. In addition, the rising yield on the 10-year US Treasury bond also makes gold less attractive. This is because gold does not pay interest, while higher-yielding Treasury bonds attract investors looking for better returns.

In addition, President Trump’s new tariff policies have also contributed to the volatility of the gold market. Mr. Trump announced that he would impose a 50% tariff on imported copper and impose other tariffs on semiconductors and pharmaceuticals. He also reiterated his intention to impose a 10% tariff on BRICS countries, and announced a tariff increase on 14 countries, including Japan and South Korea, starting August 1. These policies have increased market volatility, making investors more cautious when buying gold.

According to experts, the current gold price trend is weakening. Marex analyst Edward Meir said that the upward trend in gold prices since mid-February has been broken, mainly due to the strong dollar and high bond yields. Investors are now waiting for the minutes of the latest US Federal Reserve meeting, due to be released later in the day, for clues on the possibility of future interest rate cuts. Whether the Fed can keep interest rates unchanged or change its policy will have a big impact on gold prices, as high interest rates tend to reduce the attractiveness of gold.

In this context, the sentiment of Americans about inflation is also worth noting. According to the latest survey from the Federal Reserve Bank of New York, the forecast for inflation over the next year is 3%, down slightly from 3.2% in May. The forecast for inflation over the next three and five years remained stable at 3% and 2.6%, respectively. These figures show that inflation remains an important factor for investors to monitor, as it can influence their decision to buy gold as a safe-haven asset.

In summary, the gold price in the world market today is under pressure from many sides, including the strengthening dollar, rising bond yields, and uncertainties from US tariff policies. Investors need to closely monitor economic information, especially the Fed's moves, to predict the gold price trend in the coming time. Although gold is still considered a safe asset, current factors are making it difficult for gold prices to increase sharply in the short term.

Source: https://baodanang.vn/gia-vang-chieu-nay-9-7-2025-sjc-pnj-do-ruc-nhu-lua-vang-the-gioi-chim-sau-vi-con-bao-trump-3265312.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)