From traditional cities to policy-friendly emerging countries, the landscape of asset allocation is changing rapidly. In that trend, emerging as a potential destination if seizing the opportunity, improving policy conditions, infrastructure and quality of life.

Quality of life and investment conditions will create attraction.

In a period of global economic fragmentation, the trend of “nearshoring” (transferring manufacturing or service activities to neighboring countries or regions close to the main consumer market) and “onshoring” (producing on-site) has become strong, especially in high-tech, AI, chip manufacturing and data center industries that require quality human resources and stable energy.

For businesses, success still hinges on three key factors: people, energy, and place. Advanced manufacturing industries need rapid access to the right talent and reliable energy, which are increasingly scarce in the age of AI and data centers. They also prioritize local ecosystems where supply chains, strategic partners, and supporting resources exist and interact effectively.

The “innovation cluster” model – where government , academia and business are closely connected – is seen as the key to future capital flows. Centers such as Silicon Valley (USA), Golden Triangle (UK) or Greater Bay Area (China) are not only headquarters but also ideal living destinations for the global elite. The intersection between quality of life and investment conditions here has created sustainable attraction.

Beyond financial factors, they are increasingly interested in “soft factors” such as culture, healthcare, education , international community and living experience. The Savills Dynamic Wealth Indices – published in the recent Savills Impacts report – identified cities that are performing well in attracting and growing wealth as well as investment flows from individuals and businesses.

“In an increasingly volatile geopolitical and economic environment, global wealth flows are changing, and UHNWIs and businesses are recalibrating their decisions about where to base and live,” said Paul Tostevin, Director of Savills World Research. “Traditional drivers of global wealth flows, such as government policy, tax incentives, the presence of a creative workforce or like-minded communities, have long been key drivers for businesses and individuals to relocate, and will continue to be important. However, ‘local identity’ and high quality of life are increasingly becoming key determinants of destination choice.”

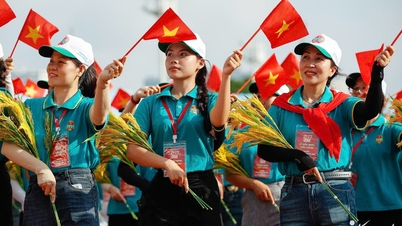

Advantages and opportunities of Vietnam

According to the Report from the Foreign Investment Agency (Ministry of Finance), inflows into Vietnam continue to grow steadily despite ongoing fluctuations in the global economy.

The latest report from the General Statistics Office (Ministry of Finance) shows that total foreign investment in Vietnam in the first half of 2025 reached 21.52 billion USD, the highest in the past 5 years. The processing and manufacturing sector continues to play a leading role, 10.57 billion USD, accounting for 57.9% of the total newly registered and increased capital; real estate business activities reached 4.84 billion USD, accounting for 26.5%; the remaining sectors reached 2.84 billion USD, accounting for 30.6%.

Commenting on Vietnam's advantages in attracting investment from businesses and the world's super-rich, Mr. Matthew Powell, Director of Savills Hanoi said: "Vietnam is converging many factors that attract the super-rich, from its strategic location in Southeast Asia, rapid economic growth, attractive natural landscapes to a significantly improved living environment. Along with that is a unique culture, rich cuisine and a lot of room for real estate investment potential."

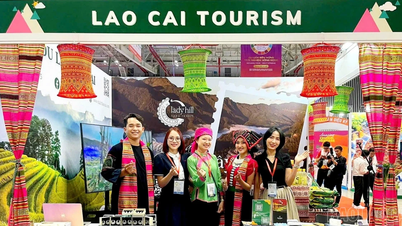

Destinations such as Da Nang and Hoi An are emerging with high-end resort real estate, international standard golf courses, and a temperate climate, with an increasingly improved quality of life. The emergence of branded real estate projects such as Nobu Residences or the Hoiana complex has contributed to reshaping the high-end segment of the market. Meanwhile, the two key economic centers of Hanoi and Ho Chi Minh City are witnessing strong growth in luxury real estate, with international standard projects, upgraded transport infrastructure, and convenient connectivity with other financial centers in the region.

In the wave of global asset reallocation, Vietnam is facing a “window of opportunity” to attract the super-rich. Possessing many natural advantages and a strategic location, Vietnam can completely become a center for investment, living and sustainable development.

New investment strategy in Vietnam

After many global fluctuations and profound changes in the socio-economic context, the world is entering a new cycle, requiring investors to reposition their strategies. In Vietnam, after a long period of purification, the market is also witnessing a series of positive recovery signals thanks to administrative reform and infrastructure investment.

In that context, real estate investment strategies in Vietnam need to be clearly reoriented based on international lessons and domestic practical conditions.

The Impact 2025 report from Savills shows that the sustainable growth cycle that once made real estate a popular source of income has now stalled. The prolonged impact of the Covid-19 pandemic, changes in monetary policy and a global economy in a long-term stagnation have made the market fragmented, unpredictable and required a completely different investment mindset. Interest rates remain high, making bond yields more competitive, while expectations for real estate capital appreciation have narrowed. The passive investment model - which depends on financial leverage and yield margins - is no longer as effective as before. In that trend, investors need to shift to a proactive strategy, taking core cash flow, asset operation capacity and long-term orientation as the foundation.

Specifically, from 2016 to 2024, the Vietnamese real estate market recorded strong growth in the residential, office and retail segments – especially in Hanoi and Ho Chi Minh City – thanks to rapid urbanization and increasing demand for modern living spaces. However, disruptions caused by the pandemic, tight credit policies and prolonged legal barriers have caused the market to enter a deep purification phase, with many projects stalled and investment sentiment gradually becoming cautious.

In response to this situation, structural reforms have been accelerated. The implementation of the revised Land Law, Housing Law and Real Estate Business Law from August 2024 will help remove bottlenecks in approval procedures and increase transparency – a key factor in attracting long-term capital flows. At the same time, public investment in infrastructure has been accelerated nationwide, from Long Thanh airport, the North-South expressway to the beltways in Hanoi and Ho Chi Minh City – facilitating regional connectivity, triggering a new wave of development in satellite cities.

Mr. Neil MacGregor, Senior General Director of Savills Vietnam, commented: “Investor sentiment will improve significantly when planning approvals are passed and projects can be deployed to the market. Easier access to land through auctions and simplified site clearance procedures will help to increase the amount of investment capital into real estate in Vietnam.”

He also said that suburban markets will benefit significantly from improved infrastructure, especially areas that can provide affordable housing. Meanwhile, in central locations, the branded residence model is expected to receive great attention, similar to Bangkok or the Middle East, attracting the super-rich at home and abroad - especially as Hanoi and Ho Chi Minh City increasingly assert their international status.

Source: https://baolaocai.vn/viet-nam-noi-len-nhu-mot-diem-den-an-toan-thu-hut-dau-tu-hieu-qua-post648293.html

![[Photo] Prime Minister hands over decisions on receiving, transferring and appointing leaders of ministries and agencies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/4/b2445ecfd89c48bdb3fafb13cde72cbb)

![[Photo] The drum beats to open the new school year in a special way](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/5/b34123487ad34079a9688f344dc19148)

![[Photo] Politburo works with the Standing Committee of Can Tho City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/4/10461762301c435d8649f6f3bb07327e)

Comment (0)