The stock market is approaching its historical peak - Photo: AI drawing

Foreign investors have the strongest week of net stock buying since November 2022

* Mr. Dong Thanh Tuan, analyst of Mirae Asset Vietnam Securities:

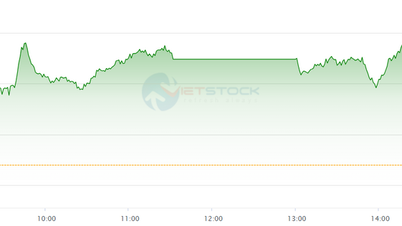

News of a tariff deal with the US helped to bolster overall trading sentiment last week, with the VN-Index recording its third consecutive weekly gain.

Foreign investors net bought VND5,170 billion last week, recording the strongest net buying week since November 2022 and at the same time reducing net selling volume since the beginning of the year to more than VND35,000 billion. Most of the net buying volume focused on securities stocks.

Meanwhile, domestic institutional investors net sold 2,000 billion VND, bringing the total net selling value since the beginning of the year to more than 12,000 billion VND. Self-employed investors net sold 1,970 billion VND.

On the other hand, ETFs withdraw a net VND322 billion last week, with the net withdrawal since the beginning of the year increasing to nearly VND8,140 billion as of July 4. Most of the selling value came from VanEck Vietnam (-VND109 billion) and Fubon FTSE Vietnam (-VND121 billion).

Overall, last week's tariff deal news seems like a not-so-bad scenario compared to the threatened 46% tariff.

However, the actual impact will depend on the negotiation progress of other countries in the region such as Indonesia, Malaysia, India, Thailand and Bangladesh.

For the stock market, we continue to expect the spread of cash flow to help the market maintain a sustainable upward momentum and conquer the psychological resistance zone of 1,400 points in July.

Besides, unpredictable events regarding tariff developments next week, combined with the information gap, still have the potential to cause the market to adjust to establish a new balance at the support level of 1,350 points.

New week, what's on the market's radar?

* Mr. Dinh Quang Hinh, head of macro and market strategy department, VNDIRECT Securities:

The Vietnamese stock market experienced a series of increases in the first three consecutive sessions of the week thanks to positive information about the Vietnam-US trade negotiations with more "affordable" reciprocal tariffs for Vietnam.

The market corrected slightly in Thursday's session as the "news release effect" prompted investors to take profits.

However, the market quickly regained momentum in the last session of the week with the support of technology stocks. At the same time, the securities group also had a positive trading week thanks to expectations of the market upgrade story.

Moving into the next trading week, the market will gradually shift its attention to the Q2 business results of listed companies. Regarding the market trend, I maintain my assessment from 2 weeks ago that the VN-Index is in a short-term uptrend, heading towards the strong resistance zone of 1,400 points.

With a positive macro context when Vietnam's GDP growth in the first 6 months of 2025 could reach the highest level in nearly 20 years, approximately 7.5-7.6%; 6-month exports increased by about 14.4%; total social investment in the first 6 months increased by 9.8%; FDI realized in the first 6 months increased by 8.1%; and especially credit growth as of June 26 reached 8.3%, the picture of the market's second quarter business results will have many bright colors.

In that context, investors can take advantage of the volatile and adjusting sessions to restructure their portfolios, increasing the proportion of sectors with positive business results prospects in the second quarter such as banking, securities, consumer goods and retail.

Which stocks are attracting cash flow?

* Mr. Quach Anh Khanh, VCBS analyst:

VN-Index had a volatile trading week with an amplitude of +/- about 12 points and headed towards the 1,390 point area in the last sessions of the week, thanks to the large contribution from large-cap stocks such as FPT , HPG and the banking group.

Cash flow from pillar stocks spread to the entire market, especially to sectors that have not increased strongly such as securities and real estate, thereby helping the general index expand its growth momentum.

Therefore, we recommend that investors continue to hold stocks that are still maintaining a good growth rate. They can look for short-term investment opportunities following speculative cash flows in industries and stocks that have attracted this cash flow in recent sessions, such as real estate and securities.

Source: https://tuoitre.vn/chung-khoan-tuan-moi-len-1-400-hay-lui-ve-1-350-diem-dieu-gi-dang-cho-thi-truong-2025070709103967.htm

Comment (0)