Momentum up but technical risks loom

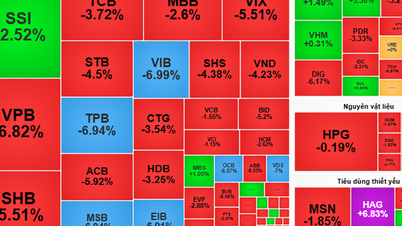

According to Asean Securities Company (AseanSC), the VN-Index is moving in the overbought zone, as shown by the RSI indicator continuously maintaining at a high level. At the same time, the strong resistance level of 1,390-1,400 points is creating significant resistance to the current uptrend, likely triggering short-term profit-taking sentiment.

However, the positive point is that cash flow is still circulating flexibly between industry groups, supporting the general price level from falling sharply. AseanSC recommends that investors maintain holding stocks with good fundamentals, positive Q2 business results prospects and are less affected by tariff risks. Limiting FOMO psychology is considered necessary to avoid negative impacts on portfolio performance.

What are the signs from 3 consecutive weeks of increase?

AIS Securities Company commented that the market has just ended its third consecutive week of gains, with the VN-Index increasing by more than 15 points (+1.13%), accompanied by improved liquidity. However, pillars such as MSN, VIC, VHM have begun to show signs of slowing down, giving way to leading names such as BVH (+5.17%), SSI (+5.07%),FPT (+4.43%).

In particular, foreign investors had two strong net buying sessions at the end of the week, a positive signal after a long period of net selling. However, AIS believes that short-term fluctuations and adjustments, if they occur, are normal and technical. During this period, investors need to limit FOMO and avoid chasing stocks that have increased sharply.

Illustration

Be careful with large-scale disbursement decisions

Meanwhile, Pinetree Securities Company believes that the market may enter a technical correction phase, with the expected support zone in the range of 1,355-1,364 points. This move is considered necessary so that cash flow can "rest" and restructure into groups of stocks with good business prospects, especially those attracting foreign capital.

The recommended strategy is to select stocks based on fundamental factors, instead of massive disbursement in the context of a general market trend that has not yet reached a clear consensus.

Increased points but not enough to break out

According to Vietnam Construction Securities Company (CSI), although the recovery session last weekend helped VN-Index regain green, the demand was not strong enough to overcome the profit-taking selling pressure. The narrow increase range and reduced liquidity showed that market sentiment was still cautious in the face of uncertain information such as tax negotiations and international fluctuations.

CSI said that although the uptrend is still dominant, after three consecutive months of increase and when the index approaches the resistance zone, caution with new buying positions is necessary. At the same time, investors should consider taking partial profits when the index approaches the 1,400 point zone.

Short-term investment strategy based on speculative cash flow

Vietcombank Securities Company (VCBS) believes that while large-cap stocks continue to play a supporting role, speculative cash flows are tending to real estate and securities groups. These are the sectors that have attracted attention recently thanks to expectations of a recovery in business results and benefits from improved liquidity.

VCBS recommends that investors continue to hold stocks that are maintaining an uptrend and can consider short-term investment opportunities with stocks that benefit from speculative cash flow.

Big challenge from the old peak

SHS Securities Company noted that the market is moving in a short-term overbought state, both in the VN-Index and VN30. In particular, the 1,400-point mark of the VN-Index and the 1,500-point mark of the VN30 are historical resistance zones from 2021-2022, which can create strong correction pressure if there is no clear support from liquidity and fundamental factors.

However, SHS also believes that the short-term trend of the market remains positive as the VN-Index maintains the support zone of 1,350 points - an important milestone in the medium term.

The Vietnamese stock market is still in an uptrend, but the risk of a short-term correction is increasing as the index approaches strong resistance zones and many groups of stocks have entered overbought zones. Selecting stocks with good fundamentals, avoiding chasing and considering partial profit-taking is considered a suitable strategy in the current period.

Source: https://phunuvietnam.vn/chung-khoan-tiem-can-dinh-cu-1400-diem-rui-ro-dieu-chinh-ngan-han-gia-tang-20250706214422489.htm

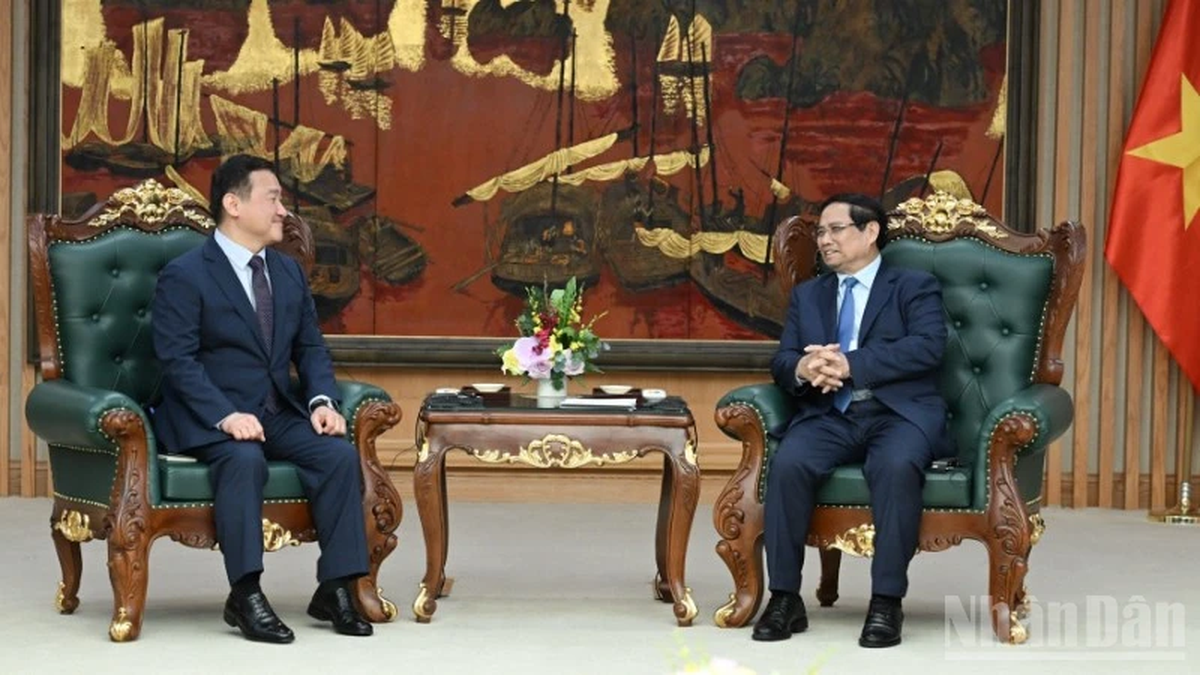

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

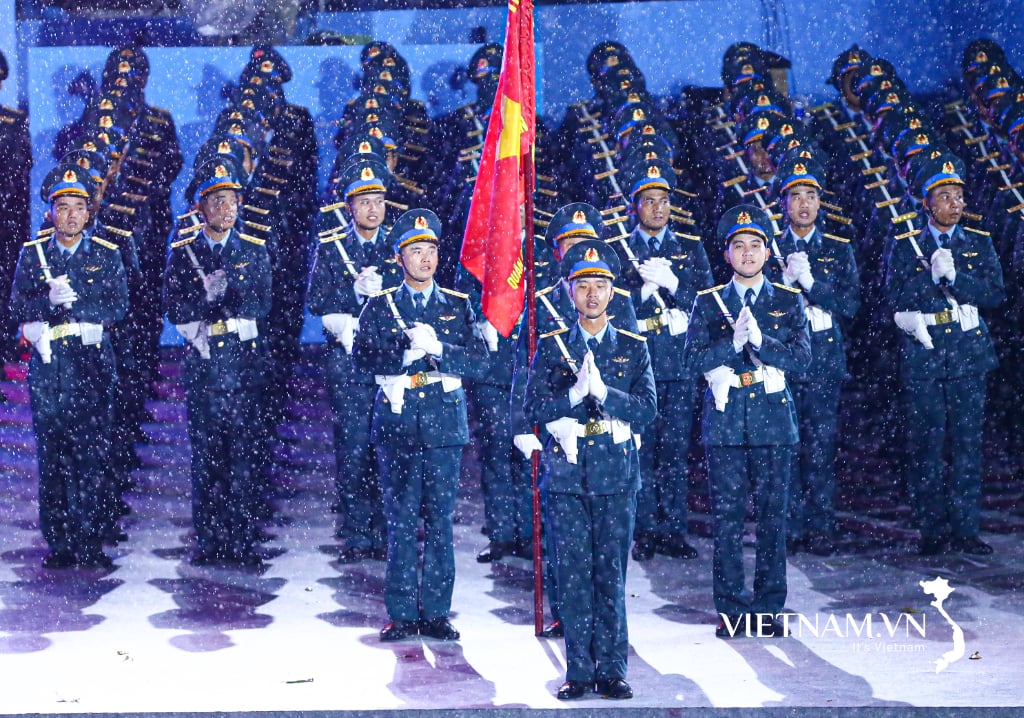

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)