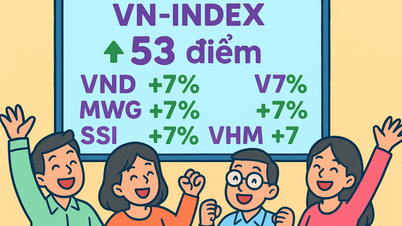

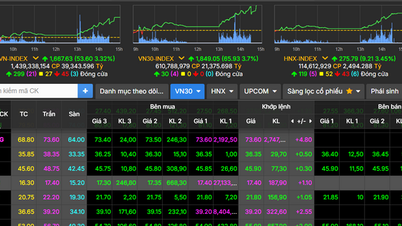

At the opening of the trading session on August 25, profit-taking pressure caused most of the key stocks on the Vietnamese stock market to decrease in price, thereby causing the VN-Index to drop more than 10 points. In the afternoon session, the decline was stronger, at one point the VN-Index lost 35 points. At the end of the session, the index decreased by 31.44 points (equivalent to a decrease of 1.91%) to 1,614.03 points.

In the last session of the week, August 22, VN-Index decreased nearly 43 points (-2.5%).

Thus, in total, the main stock index of the Vietnamese stock market has decreased by more than 74 points in two sessions, equivalent to a decrease of nearly 4.4% after increasing by about 50%, about 550 points in nearly the past 6 months, from 1,100 points in April to over 1,650 points.

It can be seen that the decrease of nearly 4.4% compared to the continuous increase of 50% in the previous half year is not much and is not yet a signal for a downward trend.

Up to this point, it is not possible to confirm whether the market is entering a downtrend or just a correction because the market has only experienced 2 sessions of decline and the decline is not too large.

However, this price drop has been warned by experts from many securities companies and is considered a correction after the market experienced a long and large increase. Many experts believe that such a strong increase of one and a half times could lead to a correction of 10-15%.

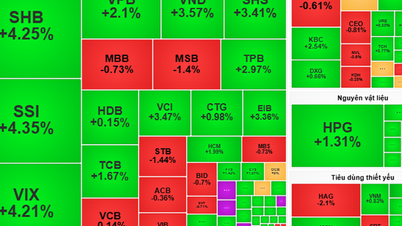

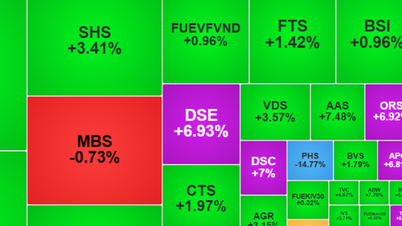

In the trading session on August 25, bank stocks fell sharply. Many codes hit the floor in the session such as: VPBank (VPB), TPBank (TPB), VIB,ACB Bank (ACB), Sacombank (STB) and many other bank stocks fell sharply. This is also a group that has increased strongly and is a pillar that has helped the stock market explode in recent times.

By the end of the session on August 25, only VPBank , TPBank and VIB hit the floor and only TPBank had a large remaining sell order at the floor price, with more than 12.7 million units.

Bottom-fishing demand has pulled most bank stocks down to a moderate level.

Many other pillar stocks decreased slightly in the session on August 25. Some codes even increased quite impressively such as: Vingroup (VIC), VietJet (VJC), SSI Securities (SSI), GAS...

Vingroup shares on August 25 rose to a new record high: VND131,000/share, thereby bringing the capitalization of the corporation led by billionaire Pham Nhat Vuong to exceed VND500,000 billion for the first time, second only to Vietcombank (VND540,000 billion). Since the beginning of the year, Vingroup's capitalization has increased more than 3 times.

Vingroup's capitalization increased sharply when this stock skyrocketed from VND40,000 to the current level. Vingroup broke out in the context that this enterprise started and completed many large real estate projects and recently expanded its development strategy to the infrastructure and energy sectors, in addition to the three pillars of industry, technology and trade and services that this enterprise established its strategy since 2018. Previously, Vingroup mainly developed in the real estate sector.

Despite the sharp decline for the second consecutive session, cash is still pouring into the stock market strongly. The session on August 25 recorded 46 trillion VND poured into the 3 floors. In the previous session, nearly 67 trillion VND was poured into stocks, equivalent to about 2.6 billion USD.

Cash flow is still expected to flow into the stock market in the context of operating interest rates and interest rates in the banking system remaining low. Last weekend, the State Bank pumped a lot of money into the market through the open market. Investors also expect high profit growth of listed enterprises and banks and the possibility of the stock market being upgraded...

In recent years, banks have had very positive business results and have also started paying cash dividends after many years of not paying cash. Companies on the stock exchange have also returned to paying dividends. During the week of August 25-29, there were companies paying 45% dividends.

The stock market is expected to benefit in the coming time with the possibility that the US Federal Reserve (Fed) will cut interest rates at its meeting on September 17. The USD/VND exchange rate will also be more stable. Listed companies will also announce their third quarter business results.

Source: https://vietnamnet.vn/chung-khoan-giam-manh-phien-thu-hai-lien-tiep-dong-tien-ty-usd-van-do-vao-2435847.html

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with New Zealand Parliament Chairman](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/c90fcbe09a1d4a028b7623ae366b741d)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

Comment (0)