At the end of the session on August 28, VN-Index closed at 1,680 points, up 8 points (0.48%).

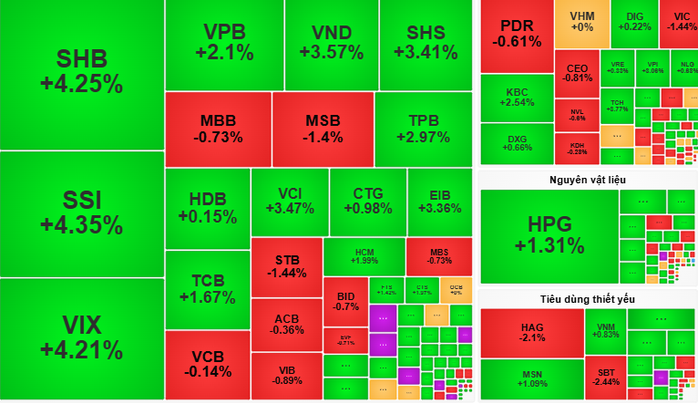

The morning session of August 28 started positively when the VN-Index increased by 7 points. However, the index quickly came under pressure to correct when the real estate group and large-cap stocks such as Vingroup (VIC, VHM, VRE) faced strong selling pressure. Meanwhile, the securities group (SSI, VND, ORS) and steel (HPG, NKG, HSG) continued to be the focus of attracting cash flow, helping the market maintain balance.

In the afternoon session, the market gradually regained green thanks to increased demand for banking stocks. Codes such asSHB (+4.25%), VPB (+2.10%) and TCB (+1.67%) led the recovery, while Vingroup narrowed the decline. The rise of the real estate group (DXG, KBC, TCH) and the maintenance of green in the securities group since the morning session reinforced the uptrend.

At the end of the session, VN-Index closed at 1,680 points, up 8 points (0.48%).

The entire HoSE recorded 11 stocks hitting the ceiling, 177 stocks increasing and 137 stocks decreasing, showing that the sentiment was leaning towards the buying side. However, foreign investors continued to sell strongly with a value of VND 2,574 billion, focusing on stocks such as HPG, MSB and MBB, creating considerable pressure on the market.

According to Vietcombank Securities Company (VCBS), the fact that the VN-Index closed above 1,680 points is a positive signal, showing that the market's recovery efforts are still being maintained. The active cash flow between industry groups has helped the index consolidate important support zones. However, the differentiation between stock groups is still strong, requiring investors to be cautious in their trading decisions.

VCBS recommends that investors avoid chasing stocks that have increased rapidly in the session of August 29, due to the risk of short-term corrections still existing; maintain a safe margin lending ratio, avoid abusing financial leverage in the context of market fluctuations. Stock "players" can consider disbursing part of their investment into sectors with positive signals, such as securities (SSI, VND, HCM) and retail (MWG, FRT), which are showing signs of attracting strong cash flows.

Other securities companies also advised investors to closely monitor developments of foreign investors, who have maintained a continuous net selling trend in recent sessions. This could affect market sentiment, especially in large-cap stocks.

Source: https://nld.com.vn/chung-khoan-ngay-29-8-tranh-mua-duoi-co-phieu-tang-gia-manh-196250828171915993.htm

![[Photo] General Secretary To Lam attends the opening ceremony of the National Achievements Exhibition](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/d371751d37634474bb3d91c6f701be7f)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

Comment (0)