Transforming business models, new tax regulations, applying technology and effectively managing cash flow - these are concepts that many individuals, small traders and business households in Vietnam are starting to approach and get familiar with in the context of many changes in tax policies.

Adaptation is not only a requirement, but also an opportunity to improve operations, increase prestige and develop more stably in the future. On that journey, Sacombank is not simply a bank providing financial services, but also plays the role of a companion, supporting the small business community, moving towards a systematic and sustainable business model.

Individuals and businesses gradually get used to and adapt to new policies.

From June 1, 2025, business households with revenue of VND 1 billion/year have officially applied electronic invoices directly connected to tax authorities. Next, all remaining business households and individuals will no longer apply the tax lump-sum method from January 1, 2026, and at the same time pay taxes according to the law on tax administration.

Business households are ready to transform and develop according to the enterprise model. |

These changes mark an important step towards transparency and professionalism in business operations - but also mean many concerns, especially for small traders and businesses that are used to traditional ways of doing things.

Understanding that, Sacombank is implementing many practical companion solutions, so that the transition process of people and business households becomes smoother, more accessible and more economical. The bank sponsors equipment, sales software, accounting software, electronic invoices, digital signatures... free of charge for up to 12 months - helping customers initially get acquainted with new tools without having to worry about initial costs.

Sacombank also promotes support for small businesses, shops, and market stalls to access cashless payments through financial solutions including payment accounts, cards, and payment speaker services; fee incentives for payment acceptance services via POS/mPOS;… These utilities not only modernize sales methods, but also help sellers save significantly on operating costs.

In addition, Sacombank is ready to provide timely capital support to business households through flexible loans with preferential interest rates, simple procedures, and quick disbursement. With sudden capital needs, customers can use overdrafts without collateral to proactively rotate business capital. In particular, Sacombank refunds up to VND 1 million per month, equivalent to about 1% of average sales on payment accounts - supporting cash flow and reducing operating costs.

Business households are ready to transform and develop according to the enterprise model.

In particular, for business households ready to switch to a business model, Sacombank waives 12 months of fees for using specialized account services, from payment accounts, business cards, e-banking services, internal and external transfers,... to online tax payment - creating a foundation for customers to start a more professional and effective business journey.

Sacombank accompanies business households in the transformation period |

In addition, Sacombank offers preferential foreign currency exchange rates of up to 100 points, cashback of up to 3 million VND/business, and many attractive gifts such as travel vouchers, business class air tickets, luxury travel bags, etc. when customers meet the conditions for corporate card transactions, applicable until December 31, 2025.

Sacombank will also continue to sponsor the use of sales software, accounting, electronic invoices, digital signatures, etc. for customers converting to a business model, to help the initial operation process become convenient and systematic without incurring additional costs.

With the spirit of dedicated service and solidarity with the community, Sacombank not only provides financial solutions but also is a reliable companion. The staff nationwide will directly guide, exchange and share information with each small trader and business household - so that everyone can clearly understand, gradually get used to and feel secure with the journey of change ahead.

Although tax policy changes pose many challenges, they will become opportunities if individuals and businesses have enough information, tools and the right companions. Sacombank is committed to continuing to accompany us for a long time, so that every business journey - whether small or large - becomes clearer and more stable every day.

Source: https://baodautu.vn/sacombank-dong-hanh-cung-ho-kinh-doanh-trong-giai-doan-chuyen-minh-d325632.html

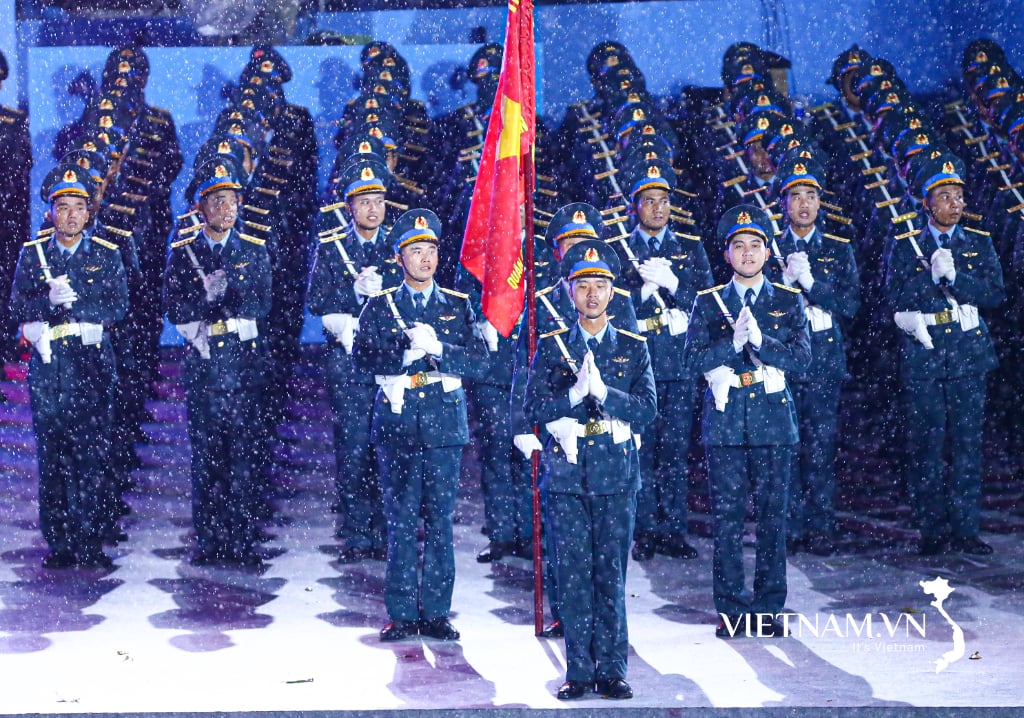

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

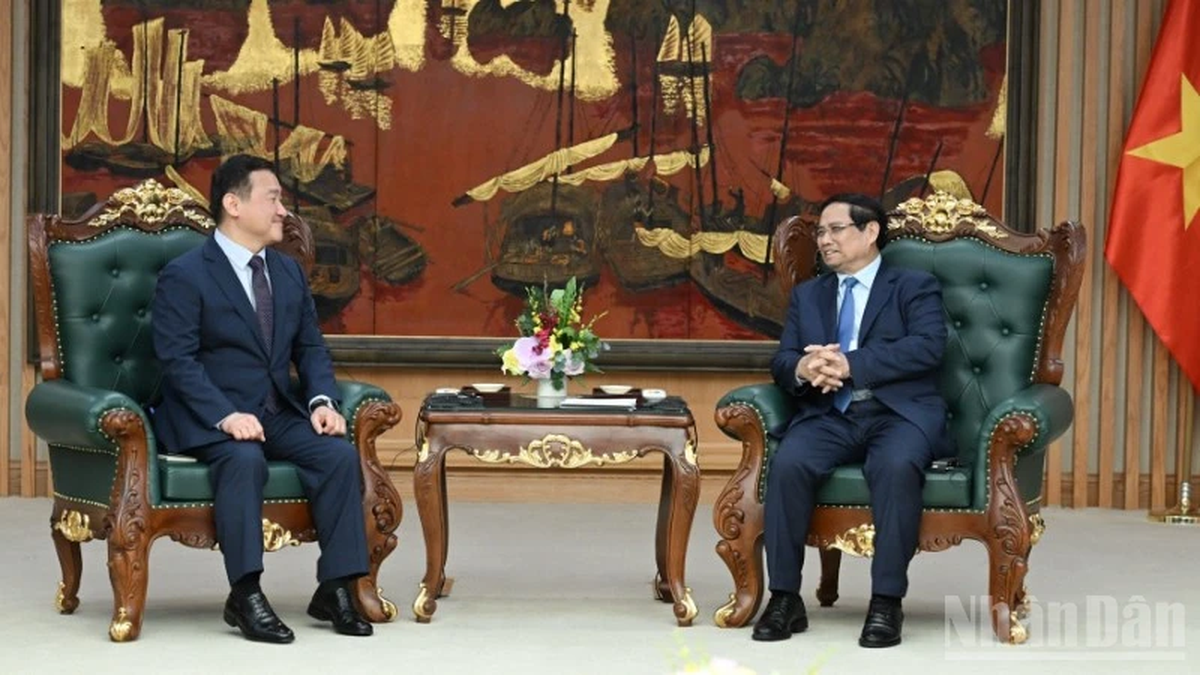

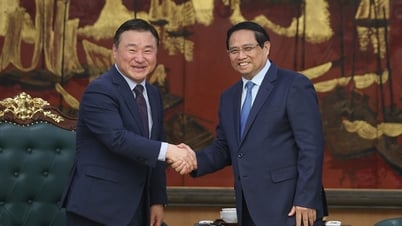

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)