Deputy Director of Tax Department Mai Son

Removing shortcomings in tax management of business households

The Tax Department has just held a conference to collect opinions on the draft Project "Improving policies and methods of tax management for business households when abolishing lump-sum tax". At the conference, Deputy Director of the Tax Department Mai Son emphasized that to successfully implement the Project, it requires the support and consensus of the entire industry, not just of a single unit.

According to Mr. Mai Son, the Tax Department will group taxpayers to come up with appropriate forms and methods of communication, helping taxpayers understand, know and agree. At the same time, the Tax sector will develop a set of guidelines for uniform implementation throughout the system, improving taxpayer compliance.

Mr. Son also requested that local tax units, based on their experience in managing business households, should frankly give their opinions to complete the Project.

In the context of private economic development becoming an important driving force of the economy, the household business sector contributes significantly to growth and budget revenue. However, tax management is still mainly based on the contract method, which reveals many shortcomings in terms of fairness, transparency and efficiency.

A large proportion of business households still pay taxes by lump sum method, do not implement or do not fully implement accounting, bookkeeping, invoices and documents. This causes difficulties for management and also poses a risk of tax loss.

In addition, tax policies and management procedures for business households are significantly different from those for enterprises. This unintentionally creates an advantage for the business household model in terms of legal compliance costs. This situation requires fundamental innovation in tax management policies and methods for business households, in order to create an equal business environment, encourage development and conversion to the business model when conditions are met.

On May 4, 2025, the Politburo issued Resolution No. 68-NQ/TW on private economic development, emphasizing the direction of eliminating lump-sum tax for business households. Next, the National Assembly and the Government issued Resolution No. 198/2025/QH15 and Resolution No. 138/NQ-CP to specify this policy.

Responding to the political and strategic orientation of the Finance sector, on July 8, 2025, the Tax Department issued an Action Plan to implement Resolution 68-NQ/TW (Decision No. 2456/QD-CT). Accordingly, the entire sector will completely end the lump-sum tax collection method, and switch all business households to management by the declaration method, meaning that business households self-declare and pay taxes.

Representatives of leaders of departments, units and local Tax Department exchanged opinions at the conference - Photo: Tax Department

Creating momentum for private economic development

The development of the Project on converting the model and method of tax management for business households aims to ensure that the conversion process takes place smoothly and effectively. This process must not interrupt production and business activities, nor affect budget revenue. At the same time, it also creates the premise for the private economic sector to develop more strongly, becoming one of the important driving forces of the economy.

The overall objective of the Project is to modernize tax management for business households and create an equal business environment between households and enterprises. Thereby, business households are encouraged to expand their scale and convert into enterprises when qualified.

Specifically, the Project sets out 6 orientations.

Firstly, fully institutionalize the viewpoints and objectives of Resolution 68-NQ/TW in the tax sector, especially abolishing lump-sum tax, applying transparent management methods based on actual declarations, so that taxpayers can self-declare and self-pay.

Second, build a synchronous legal policy system to reduce the difference in tax obligations between business households and enterprises.

Third, simplify and automate procedures, helping to save time and costs for taxpayers.

Fourth, strengthen the application of information technology and databases in management, widely deploy electronic invoices, improve management efficiency and prevent revenue loss.

Fifth, focus on supporting business households during the transition period, helping them understand and properly implement new policies.

Sixth, improve the capacity of tax authorities at all levels, while strengthening coordination with local authorities and relevant agencies in managing business households.

The project also aims to systematize theoretical, practical and international experience in tax management for business households. On that basis, the Tax sector will propose fundamental and comprehensive innovative solutions, contributing to preventing revenue loss and improving management capacity in the period of 2025 - 2030.

PV

See more

Source: https://baochinhphu.vn/hoan-thien-quan-ly-thue-ho-kinh-doanh-dong-luc-moi-cho-kinh-te-tu-nhan-102250825180615159.htm

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

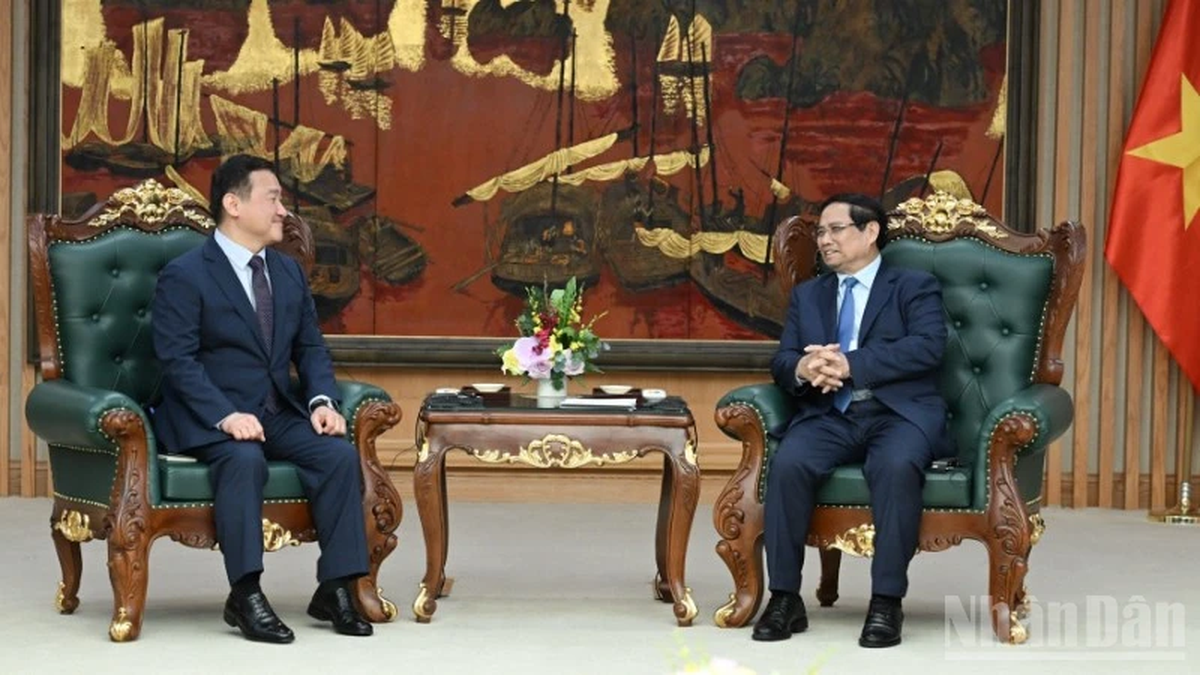

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

Comment (0)