The "golden" time to go public, stocks are freely bought and sold

The billion-dollar IPO deal reveals TCBS's ambition to dominate the market and make a breakthrough in the pivotal year of 2025. No longer a rumor, Techcom Securities Joint Stock Company (TCBS), one of the leading securities companies in Vietnam, has officially finalized its IPO (initial public offering) plan. This is considered one of the most anticipated deals in the financial market this year.

Accordingly, TCBS will offer a maximum of more than 231 million shares, equivalent to 11.11% of the total number of existing shares. The goal of this issuance is to increase charter capital by more than VND 2,300 billion, raising total capital from nearly VND 20,800 billion to more than VND 23,100 billion after the IPO.

It is worth noting that all shares in this IPO will be freely traded immediately after issuance, without being "locked in" like many other IPOs. This will help investors trade easily, increasing the liquidity of TCBS shares in the market.

The expected IPO implementation time is from the third quarter of 2025 to the first quarter of 2026 - a period considered the "golden season" if the market continues to thrive as it is now.

Not simply raising capital, TCBS has detailed plans on how to use the proceeds. Specifically: 70% of the money will be used for direct investment activities, including buying stocks and bonds. These are areas that are considered to have much potential when the market price is still at a reasonable level. The remaining 30% will serve to expand services for investors, including margin lending, advance payments for investors selling securities, upgrading the trading system and developing new products.

Illustration

Pre-IPO internal deals: The "trump card" of the board of directors

Before the IPO, on June 9, TCBS issued 118 million shares privately to 25 individuals, mostly senior leaders in the company, and collected nearly 1,400 billion VND, equivalent to 11,585 VND/share.

Notably, Mr. Nguyen Xuan Minh, Chairman of the Board of Directors, bought up to 106.1 million shares, accounting for nearly 90% of the shares issued this time, bringing the total number of shares he holds to more than 168 million - equivalent to 8.09% of the company's charter capital.

Not only is it an internal deal that "catches the wave" before the G hour, the recent private placement of TCBS also reveals a strong feminist imprint in the leadership team. Other leaders such as General Director Nguyen Thi Thu Hien, along with Deputy General Directors including Bui Thi Thu Hang, Pham Dieu Linh, Tran Thi Thu Trang, Nguyen Tuan Cuong also participated in buying shares in this issuance. The shares issued privately will be restricted from transfer within 1 year.

Although the shares issued privately in this round will be "held" for 1 year (not transferable), the participation of senior female leaders still shows that they do not choose to "strike quickly and withdraw quickly", but are willing to go the long way with the business. This is a big plus in terms of commitment and sustainable thinking - something often seen in female leaders in the Vietnamese financial sector.

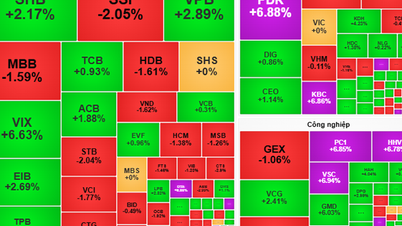

Vietnam's stock market is growing

Where does profit come from?

TCBS's IPO plan was "introduced" in the context of this enterprise showing impressive business performance. In 2025, the company aims to reach VND9,323 billion in revenue, an increase of 22% compared to the 2024 plan. Pre-tax profit is expected to reach VND5,765 billion, a growth of 20%, showing the right strategy and strong profit potential.

In the first quarter of 2025, TCBS recorded: Operating revenue reached VND 2,028 billion, up 19.7% over the same period. Pre-tax profit reached VND 1,310 billion, up 13% - a very positive start.

Margin lending – lending money to investors to buy stocks – continued to be the "trump card", bringing in VND732 billion in profit, up nearly 27.8%. Outstanding loans reached more than VND30,472 billion, accounting for 54% of total assets. Other activities also showed balanced growth. Held-to-maturity (HTM) investment activities brought in VND34 billion in profit from an investment of VND2,854 billion. Securities underwriting and agency activities contributed an additional VND361 billion. As of the end of March 2025, TCBS's total assets reached nearly VND56,330 billion, up 6% compared to the beginning of the year, marking a new milestone in the journey of sustainable development.

With a solid financial foundation, clear capital usage orientation, and support from a veteran leadership team, TCBS's IPO is considered one of the most prominent deals in the upcoming Vietnamese stock market. However, to decide to "put money down", investors still need to closely monitor factors such as: offering price, market trends, attractiveness to foreign investors, as well as actual developments during the offering period.

Source: https://phunuvietnam.vn/nhung-bong-hong-trong-thuong-vu-ipo-nghin-ty-cua-chung-khoan-ky-thuong-20250708123106654.htm

![[Photo] General Secretary To Lam attends the 80th anniversary of Vietnam's diplomacy](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/25/3dc715efdbf74937b6fe8072bac5cb30)

Comment (0)