With two main criteria being financial strength and media reputation, VIX50 reflects the internal capacity and adaptability of businesses in a volatile economic context.

Impressive numbers

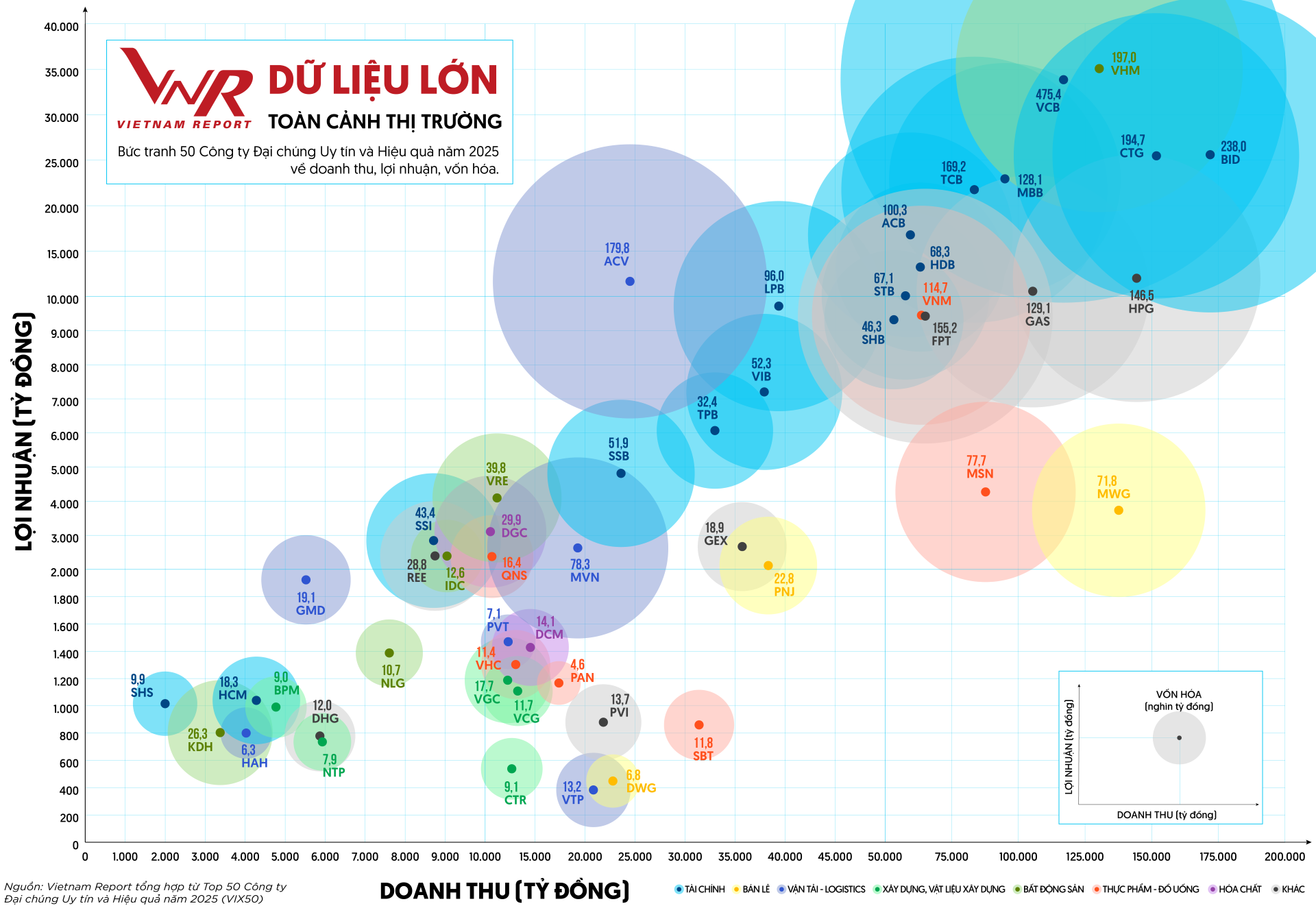

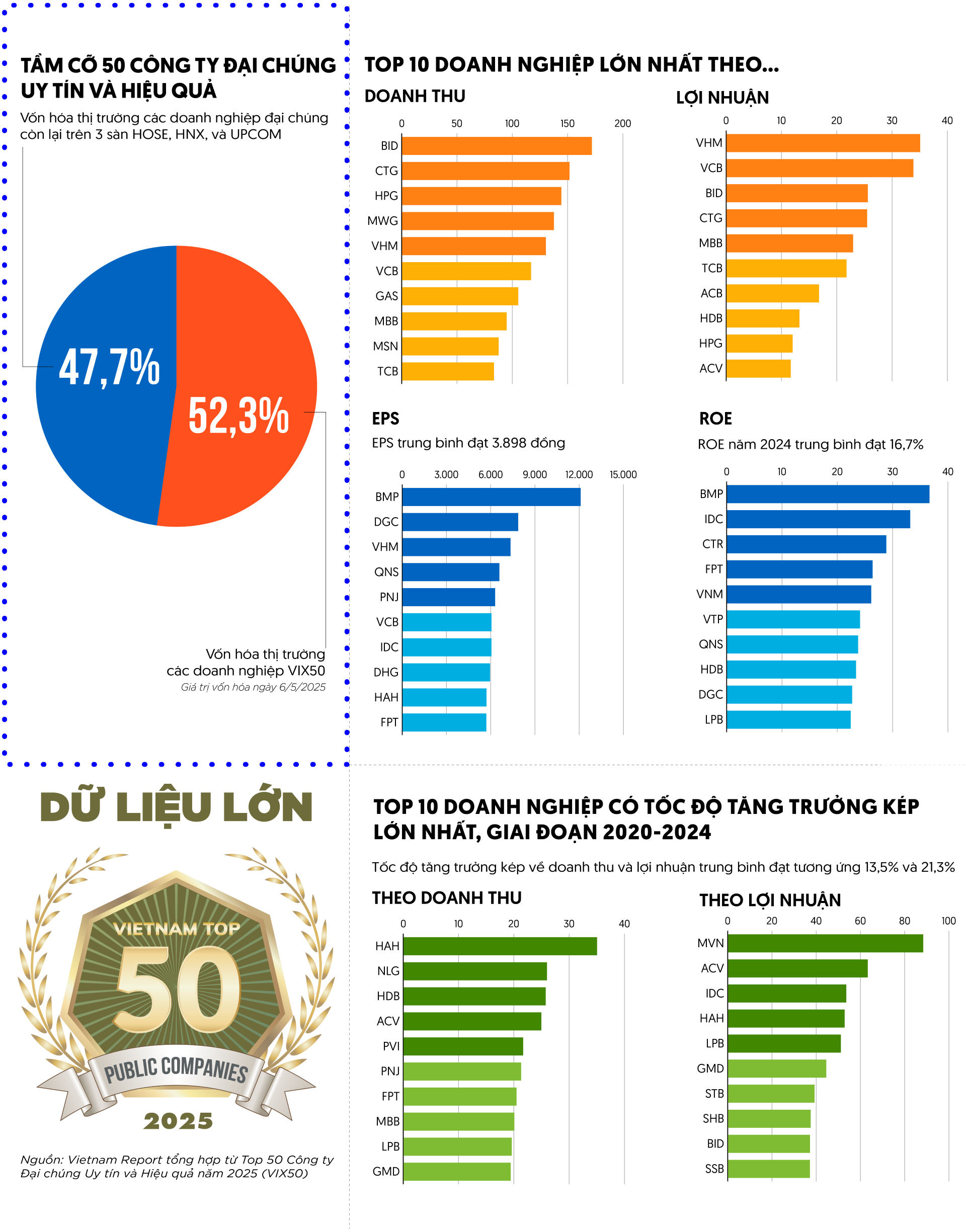

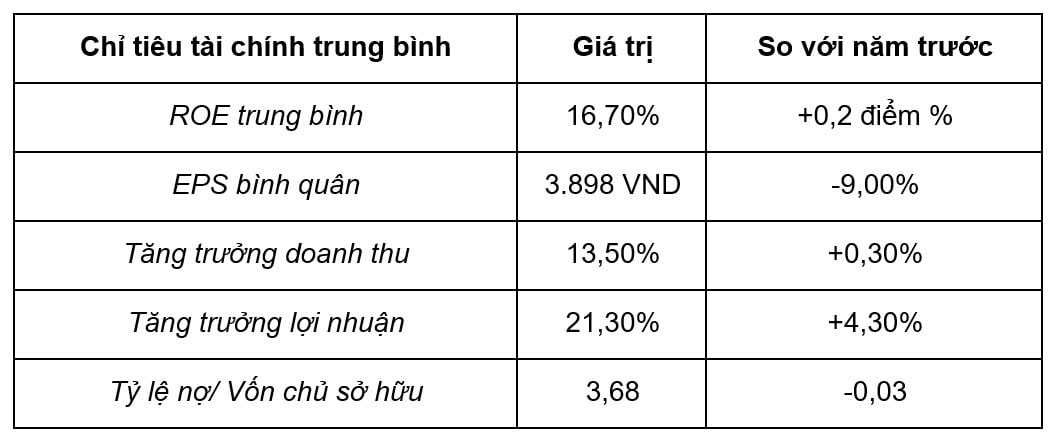

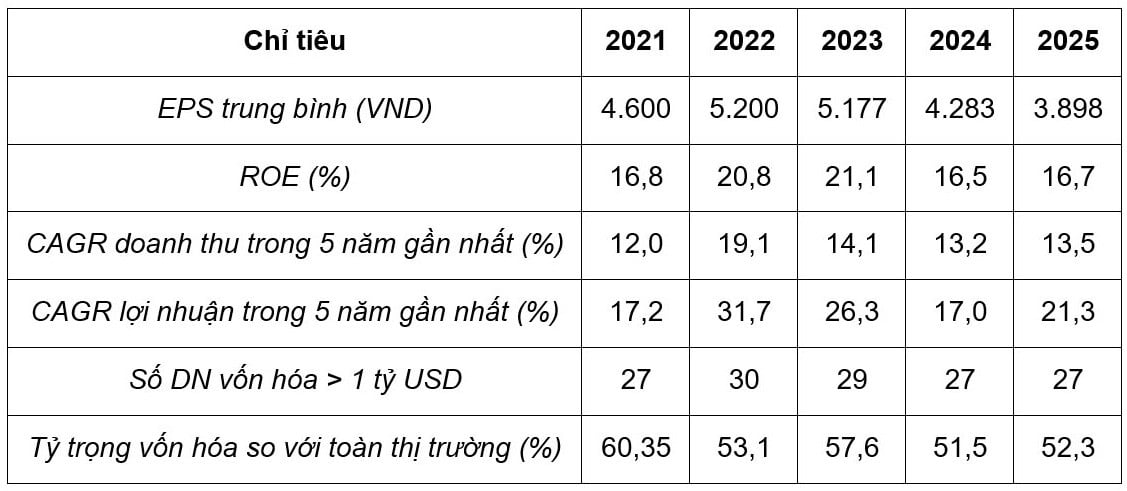

The capitalization of public companies in the VIX50 at the time of announcement accounted for more than 52.3% of the total market, the average ROE in 2024 reached 16.7%, the average 5-year compound growth rate of revenue and profit was 13.5% and 21.3%, respectively.

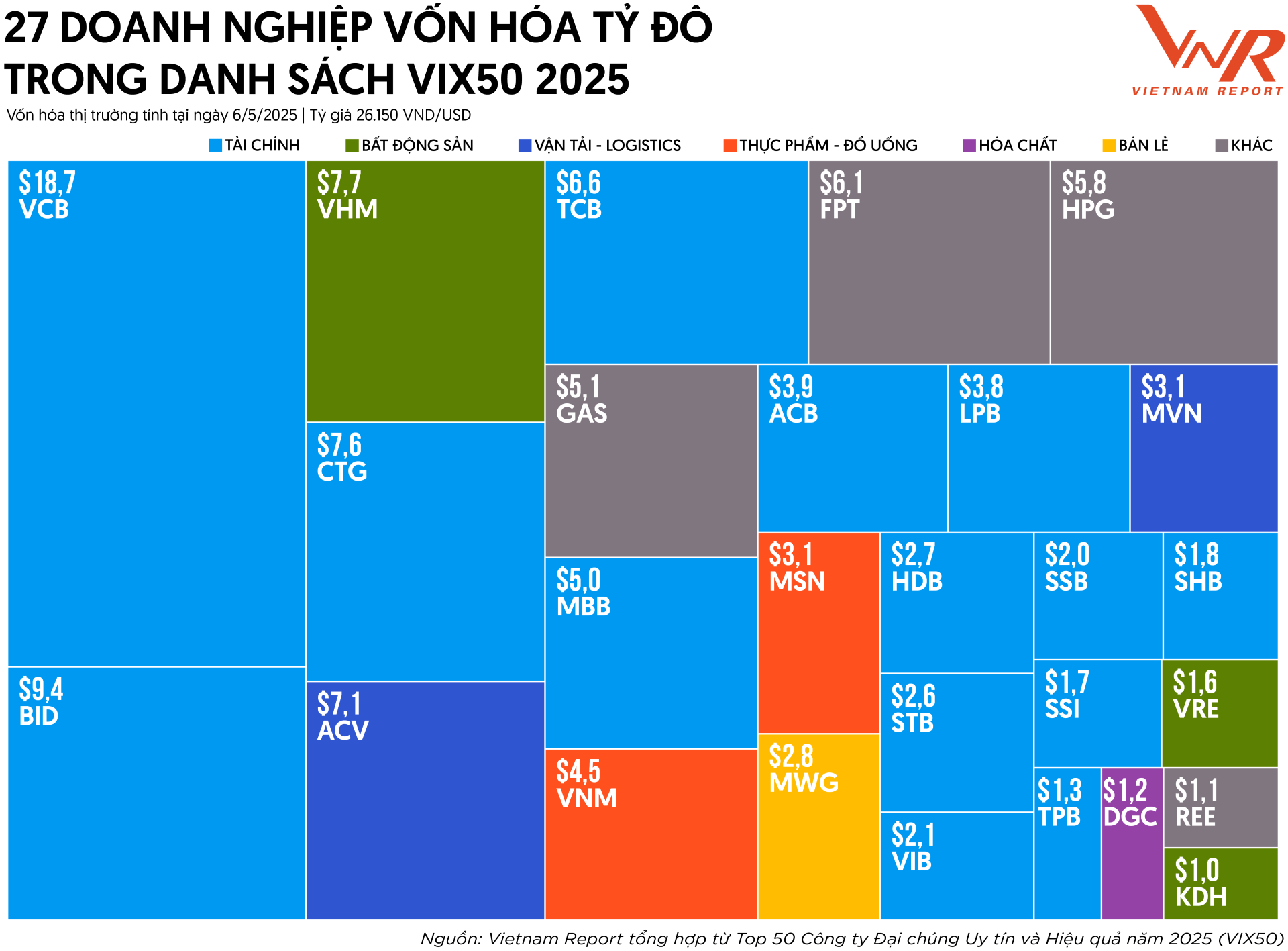

There are 27 enterprises with capitalization of over 1 billion USD, 22 enterprises with revenue of over 1 billion USD and 40 enterprises with profit of over 1,000 billion VND.

Of which, BIDV (BID) continues to lead in revenue, Vinhomes (VHM) maintains the top position in profit, Binh Minh Plastics (BMP) holds the top position in ROE. In terms of compound annual growth rate (CAGR) by revenue and profit in the period 2020-2024, representatives such as Hai An Transport and Stevedoring (HAH), Nam Long (NLG), Vietnam National Shipping Lines (MVN), Vietnam Airports Corporation (ACV) show strong recovery momentum.

Industry structure shift

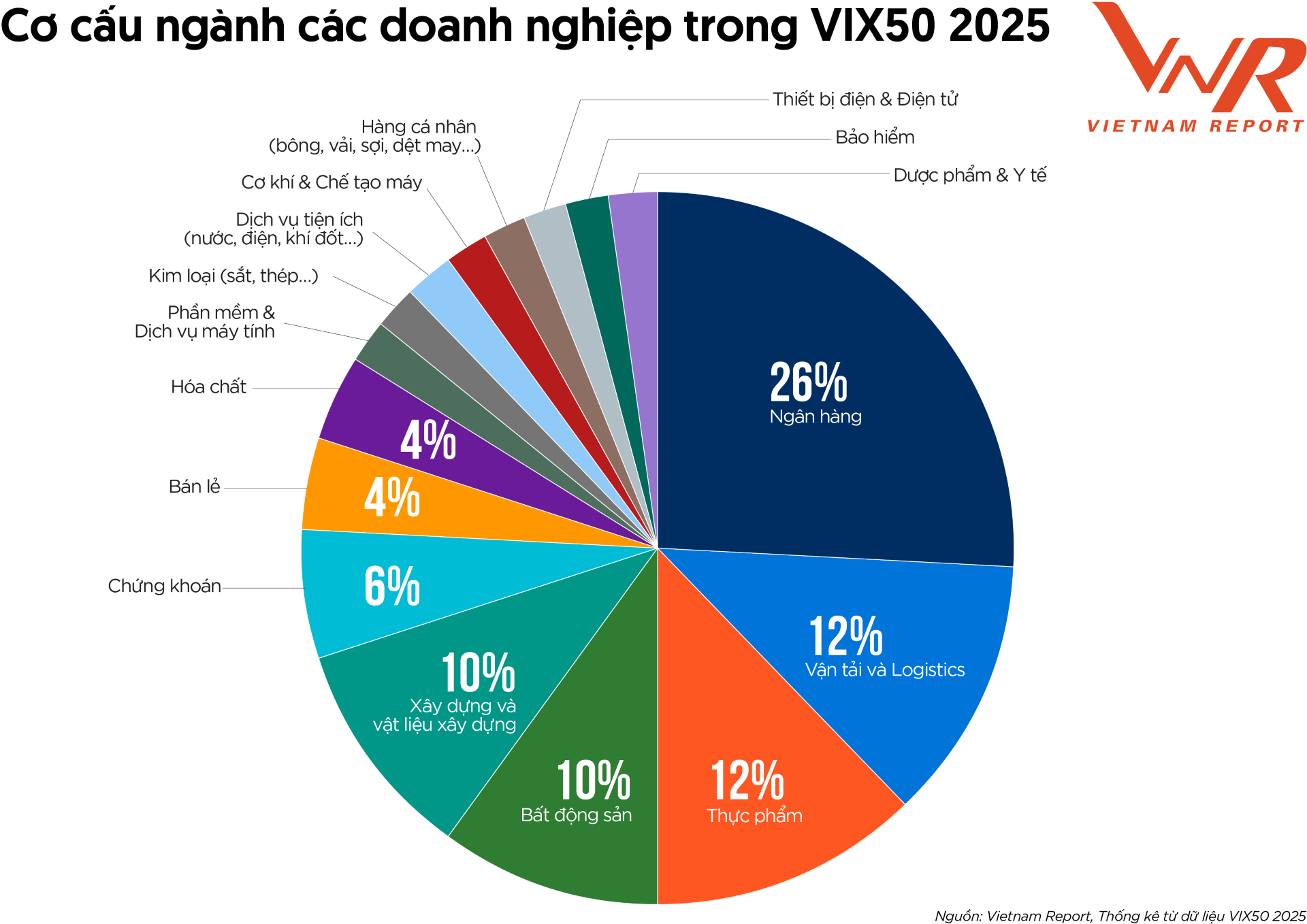

The top 10 of VIX50 in 2025 recorded the dominance of the banking sector with 7/10 positions (Vietcombank, MB, HDBank, BIDV, VietinBank, Techcombank, ACB ). Notably, FPT Corporation rose to the top for the first time, reflecting the increasingly prominent role of technology in the digital economy; ACV entered the top 5, showing the growth trend of infrastructure service industries.

The VIX50 sector structure has clearly shifted: Banking still plays a central role with 26%, Real Estate decreased from 14% to 10%, while Transport & Logistics and Food increased their proportion. This shows a strategic balance between sectors with stable financial and liquidity foundations and emerging sectors thanks to digital transformation, domestic consumption and export infrastructure.

Financial quality is increasingly outstanding

Looking at the VIX50's financial picture in 2025, capital efficiency is stable, revenue and profit growth is positive, and debt management is reasonable.

Overall, over the past 5 years, VIX50 reflects the reality of a group of businesses that have demonstrated outstanding stability in terms of operational efficiency and financial capacity in the face of many major fluctuations: ROE remains high compared to the general market level (10-13%); CAGR of revenue and profit remains positive; the rate of businesses with capitalization of over 1 billion USD is stable.

The “core business” group - the sustainable pillar of the market

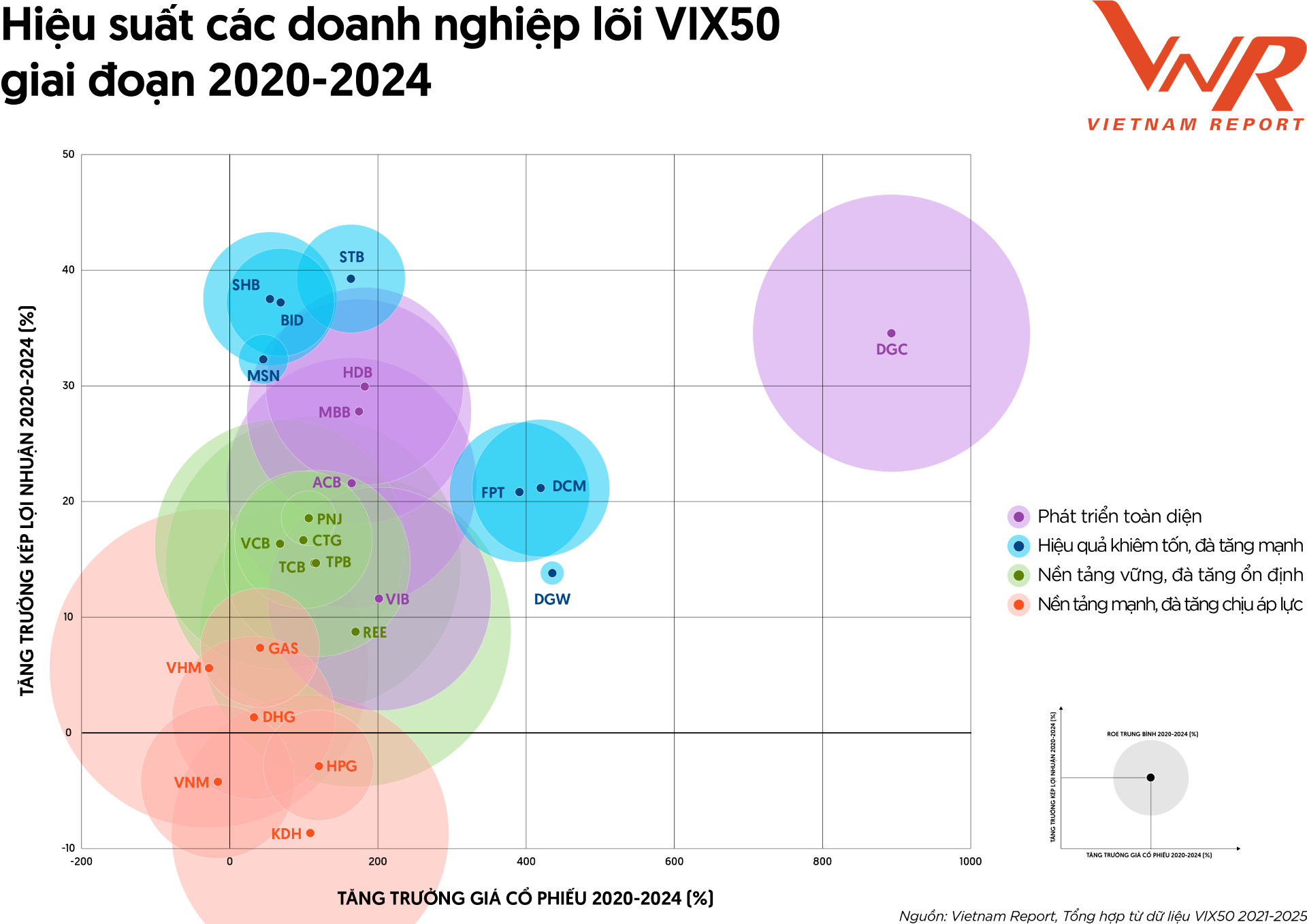

Over the past five years, the VIX50 has recorded the consistent presence of 24 companies. These are the “core companies” - pillars of sustainability in finance, operations and long-term development strategies.

The graph visualizes the performance of VIX50 core businesses based on market value (share price growth), profitability (ROE) and profit growth rate (CAGR) clearly reflecting the differentiation according to financial quality and market expectations: (1) The Comprehensive Development Group gathers outstanding businesses that excel in all three indicators; (2) The Modest Efficiency, Strong Growth Group includes businesses with modest average ROE but positive growth momentum, with room for efficiency improvement; (3) The Solid Foundation, Stable Growth Group includes businesses with high operational efficiency, sustainable growth, recognized by the market with reasonable price increases; (4) The Strong Foundation, Pressured Growth Group includes businesses with high capital efficiency but profit/market price growth is under pressure from cyclical factors or specific industries.

Multidimensional performance analysis of the “core business” group shows that businesses with healthy financial models, sustainable growth and effective capital management are clearly dominant in the long term.

In the context of investors increasingly interested in diversification strategies, optimizing risks and avoiding dependence on a few large-cap stocks, VIX50 is considered to be a valuable measurement and investment tool, with high applicability and strong potential to spread in the Vietnamese capital market. After 5 years, VIX50 has proven to be a "filter" for public enterprises, setting standards for financial performance, brand positioning and market leadership capacity.

The announcement and honoring ceremony of the Top 50 prestigious and effective public companies in 2025 organized by Vietnam Report and VietNamNet Newspaper will officially take place on August 1, 2025 in Ho Chi Minh City.

(Source: Vietnam Report)

Source: https://vietnamnet.vn/vietnam-report-cong-bo-top-50-cong-ty-dai-chung-uy-tin-va-hieu-qua-nam-2025-2417011.html

Comment (0)