In the telegram on increasing the effectiveness of monetary and fiscal policy management, Prime Minister Pham Minh Chinh requested the State Bank to preside over and coordinate with relevant agencies to strengthen appropriate and effective measures to manage the gold market.

|

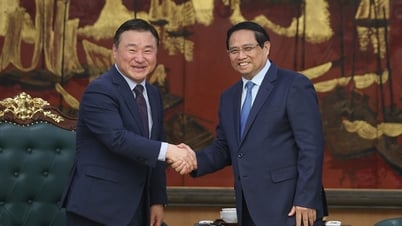

Illustration photo. |

The agency is seeking comments on a draft decree amending Decree 24/2014 on gold trading management. Government leaders have asked them to submit the draft decree before July 15.

In 2014, Decree 24 was issued by the authorities with the aim of preventing the goldification of the economy . Since then, SJC has been considered a national gold bar brand. The State Bank does not import gold to produce gold bars, causing the gold supply to decrease. This leads to the fact that the market is often out of balance between supply and demand, with world prices increasing little while domestic prices have increased very high.

At the meeting on gold market management on May 24, in addition to the difference in domestic and international prices, the Prime Minister stated that the gold market has recently been complicated by manipulation, hoarding, and smuggling. Therefore, he requested to amend Decree 24 in a shortened form, and to build a database on the gold market.

According to the draft revised decree, the monopoly mechanism for gold bar production is removed. Instead, the management agency will control the market by granting import limits and licenses to credit institutions and qualified businesses. Businesses wishing to be licensed to produce gold bars must have a minimum charter capital of VND1,000 billion, while banks must have VND50,000 billion.

Also in the telegram, the Prime Minister requested the State Bank and relevant parties to submit a draft Resolution on piloting the crypto asset market before July 15.

Regarding monetary policy, management agencies need to closely monitor developments and the world and domestic economic situation to proactively, flexibly, promptly and effectively manage. They also need to direct credit institutions to continue reducing costs to lower lending interest rates and support production and business.

The Prime Minister reiterated the request to promote credit programs for people under 35 years old to buy or rent social housing. Last week, the State Bank announced the fourth interest rate reduction for this group, down to 5.9% per year. This rate will apply until the end of 2025.

Regarding fiscal policy, the Ministry of Finance is assigned to work with other agencies to review and assess the impact of the US's reciprocal tax policy on Vietnam and report to the Government before July 15. This is to help the operator have policies to support businesses and people in affected areas in a timely manner.

Source: https://baobacninhtv.vn/thu-tuong-yeu-cau-trinh-quy-dinh-moi-ve-quan-ly-vang-truoc-ngay-15-7-postid421415.bbg

![[Photo] Parade blocks pass through Hang Khay-Trang Tien during the preliminary rehearsal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/456962fff72d40269327ac1d01426969)

![[Photo] Images of the State-level preliminary rehearsal of the military parade at Ba Dinh Square](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/807e4479c81f408ca16b916ba381b667)

Comment (0)