In the draft amendment to Decree 126 guiding a number of articles of the Law on Tax Administration, the Ministry of Finance proposed to clearly stipulate the time for deduction and declaration of tax on income from dividends and bonuses in securities to avoid prolonging tax obligations.

Specifically, the Ministry of Finance proposed that personal income tax (PIT) would be deducted, declared and paid immediately when investors receive dividends or bonuses in the form of shares, instead of waiting until the shares are sold as is currently the case. Enterprises issuing shares will be responsible for deducting and paying taxes on behalf of individuals.

Speaking to a reporter from Nguoi Lao Dong Newspaper, an inspector from the Tax Department of Region II said that according to the Personal Income Tax Law, investors receiving cash dividends must pay 5% tax, which is deducted and paid by the paying enterprise. For dividends or bonuses in shares, investors only pay tax when selling shares, including 5% tax on the par value (VND10,000) and 0.1% on the transfer value, which is collected by the securities company.

However, in reality, many large investors often hold long-term or do not sell shares received from dividends, resulting in the budget not being able to collect taxes immediately when income arises, causing temporary loss of revenue.

To overcome this, the Ministry of Finance wants to collect taxes as soon as the shares are allocated, and at the same time determine the price of the shares at the time the investor receives them to calculate taxes, in order to ensure timely budget revenue. According to this plan, the securities company will separate the number of shares received from dividends to collect personal income tax on behalf of the investor. Later, when the investor sells the shares, there will be no additional tax of 0.1% on the transfer value, avoiding the situation of double tax.

However, according to the inspector of the Tax Department of Region II, collecting taxes immediately upon receiving dividends in shares may cause problems because many investors do not have cash available to pay taxes. In addition, if taxes are continued to be collected upon selling shares, the price may have fluctuated, making it difficult to determine the exact amount of tax.

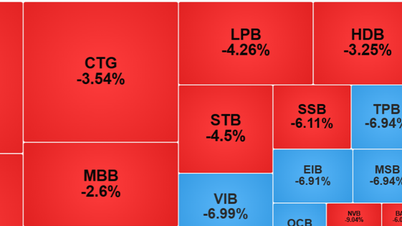

Illustration

This draft regulation is also facing many conflicting opinions from experts and investors. The head of brokerage at VPS Securities Company commented that, although still in draft form, the regulation has revealed its unreasonableness, causing many investors to react. He said that when receiving dividends in shares, investors have not really gained any benefits but have to pay taxes, while the price of shares on the market can completely decrease, leading to losses if sold.

Sharing the same view, Mr. Phu Hoai, an investor in An Lac Ward (HCMC), said he is willing to fulfill his tax obligations when he has actual profits. However, receiving dividends in shares is not always beneficial, because the share price can decrease immediately after purchase, causing the asset value to decrease. Meanwhile, investors currently have to pay taxes and fees when receiving cash or selling shares.

Dr. Le Dat Chi, Head of the Faculty of Finance and Banking, Ho Chi Minh City University of Economics , also disagrees with the tax collection at the time of receiving stock dividends. According to him, the nature of receiving stock dividends is that investors have not yet received cash flow, so it is unreasonable to force them to pay taxes immediately. In addition, the current tax collection method is also inappropriate, because only when investors sell stocks, can the tax authority determine the dividend arising from stocks.

"Because the dividend payment by shares is essentially just dividing the number of shares, and the share price has been adjusted down accordingly, the tax collection plan at the time the investor sells the shares will be more reasonable," Dr. Le Dat Chi commented.

Meanwhile, leaders of some securities companies in Ho Chi Minh City said that the tax collection as proposed by the Ministry of Finance can be implemented by all securities companies. The Ministry of Finance only needs to provide reasonable stock prices and tax rates to ensure budget revenue and create favorable conditions for investors and securities companies in the process of fulfilling tax obligations.

Source: https://nld.com.vn/de-xuat-nop-thue-ngay-khi-nhan-co-tuc-bang-co-phieu-nha-dau-tu-lo-bi-lo-kep-196250701133903094.htm

![[Photo] Parade blocks pass through Hang Khay-Trang Tien during the preliminary rehearsal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/456962fff72d40269327ac1d01426969)

![[Photo] Images of the State-level preliminary rehearsal of the military parade at Ba Dinh Square](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/807e4479c81f408ca16b916ba381b667)

Comment (0)