At the end of the session on July 3, VN-Index stopped at 1,381.96 points, down 2.63 points (equivalent to 0.19%).

Pull from large-cap stocks

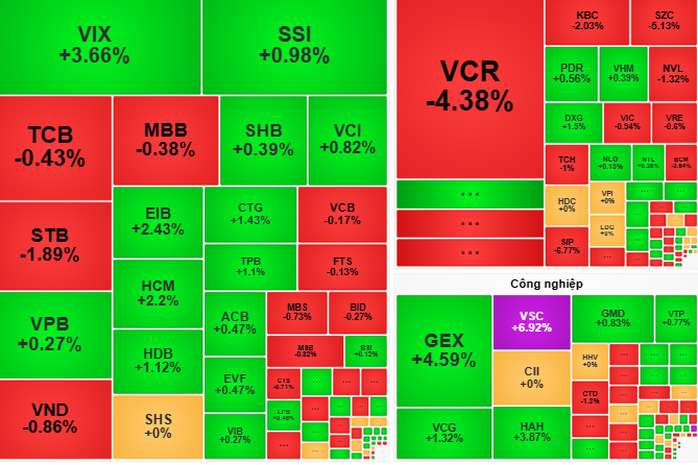

The Vietnamese stock market opened the trading session on July 3 with a slight downward trend below the reference level, affected by information related to tariff negotiations between Vietnam and the US. However, the VN-Index quickly regained green thanks to the pull from large-cap stocks such as MWG, HPG, and the banking group with typical codes such as VCB, CTG, TCB.

On the other hand, GVR and VIC continued to put pressure on the VN-Index. The securities group (VIX, HCM) and shipping (VOS, VSC) attracted strong cash flow in the morning session, pushing liquidity up 40% compared to the previous morning session. This reflects the gradual improvement in investor sentiment after the VN-Index surpassed the 1,390 point threshold.

In the afternoon session, selling pressure increased, causing the VN-Index to narrow its gains and end the session in the red. Mid-cap stocks, securities and real estate groups maintained good demand. However, profit-taking pressure on banking stocks and strong adjustments in industrial park (BCM) and rubber (GVR) groups put pressure on the general index.

At the end of the session, VN-Index stopped at 1,381.96 points, down 2.63 points (equivalent to 0.19%).

Foreign investors continued to net buy strongly on the HOSE floor with a total value of VND 2,276.41 billion, focusing on codes such as SSI (+ VND 431.6 billion), MWG (+ VND 294.3 billion), CTG (+ VND 146.9 billion), HCM (+ VND 133.2 billion), and VCI (+ VND 125.7 billion).

Cash flow is clearly differentiated

According to VCBS Securities Company, the correction in the session of July 3 is normal after the previous strong increase, when VN-Index approached the resistance zone of 1,392 points. The market is in the phase of testing supply and demand in the 1,380-1,390 point zone, with cash flow clearly differentiated, prioritizing stocks with positive business results in the second quarter of 2025 or with their own growth story. The retail, steel, and securities groups maintained green, while the industrial park, seafood, and rubber groups recorded strong corrections.

According to Dragon Capital Securities Company (VDSC), the increase in liquidity compared to the previous session shows that cash flow is still the driving force supporting the market, although profit-taking pressure increased when the index reached a new high. It is expected that supply pressure may continue to exert pressure in the trading session on July 4, but the adjustment trend is only short-term.

What should investors do?

Given the strong market fluctuations, VDSC recommends that investors carefully observe supply and demand, consider taking profits from part of the portfolio to preserve profits, especially with stocks that have increased sharply recently.

Meanwhile, VCBS Securities Company believes that investors can take advantage of the corrections to disburse into stocks with good growth models in industry groups such as securities (SSI, HCM, VCI), steel (HPG), and retail (MWG), prioritizing stocks with positive business results.

Some securities companies predict that the market on July 4 will continue to be divided, with opportunities to focus on stocks with good fundamentals and clear growth stories. Investors need to closely monitor market signals to make appropriate trading decisions.

Source: https://nld.com.vn/chung-khoan-ngay-mai-4-7-dong-tien-se-don-vao-co-phieu-co-ket-qua-kinh-doanh-tich-cuc-196250703173553197.htm

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Many people eagerly await the preliminary review despite heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/4dc782c65c1244b196890448bafa9b69)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/27/a79fc06e4aa744c9a4b7fa7dfef8a266)

Comment (0)