According to the Personal Income Tax Law (PIT) 2007 (amended in 2012, 2014 and consolidated in 2025), only income that actually increases personal assets, is repetitive or commercialized is taxed.

Circular 111/2013/TT-BTC and Circular 92/2015/TT-BTC of the Ministry of Finance also clearly guide the scope of taxable and non-taxable income.

Circular 111/2013/TT-BTC and Circular 92/2015/TT-BTC of the Ministry of Finance also clearly guide the scope of taxable and non-taxable income.

It is necessary for tax authorities to control cash flow to prevent budget losses, but people can be completely assured if their transactions are legal and have a clear basis.

Here are 9 common cases where receiving money transfers is tax-free:

1. Personal Loans – Not Taxable Income

Loans between individuals, whether relatives or friends, are considered civil relations. If no interest is incurred or only temporary support is provided, this amount is not considered income and is not subject to tax (Basis: Clause 3, Article 2, Circular 111/2013/TT-BTC; Article 463, Civil Code 2015).

2. Money transferred to repay bank loan

This is a common case: relatives transfer money to help pay off a loan that is due, then borrow again from the bank. This amount is only technical, does not increase personal assets, so it does not need to be declared for tax.

3. Receive remittances – Completely tax-free

Remittances sent from relatives working abroad through banks or legal organizations are exempt from personal income tax according to regulations to encourage national foreign currency sources.

Pursuant to: Clause 3, Article 2, Circular 111/2013/TT-BTC.

4. Collection and payment on behalf – Does not generate income

Common cases are shippers delivering goods (COD), agents collecting electricity and water bills or authorized recipients. These amounts only “pass through” the recipient’s hands, do not create real income, so they are not taxed.

Pursuant to: Circular 92/2015/TT-BTC.

5. Transfer money without charging fees

When transferring money to help others without charging a fee, it is essentially an act of helping and does not generate personal income. However, if a service fee is charged, the income from the fee may be taxed at 5%–7% depending on the type. (Basis: Circular 40/2021/TT-BTC).

6. Receive money from selling real estate – Tax obligations completed

If the real estate seller has fulfilled his tax obligations (2% personal income tax and registration fee), the transferred amount received later will not be taxed again. (Basis: Article 17, Circular 92/2015/TT-BTC; Article 50, Law on Tax Administration 2019).

7. Tax deducted salary – Transfer to relatives

When an individual receives a post-tax salary from a payroll entity and transfers it to his/her spouse, parents or other relatives, this amount is not considered new income and is not subject to additional tax.

(Based on: Clause 1, Article 7, Circular 111/2013/TT-BTC).

8. Overseas workers – Local taxes paid

If the employee has paid income tax abroad, when transferring money back to Vietnam, he/she will be exempted from re-taxation to avoid double taxation. (Based on Circular 111/2013/TT-BTC and Double Taxation Avoidance Agreements).

9. Small Civil Loans – Tax Free

Small, irregular personal-to-personal loans that are not business-related and may or may not bear small interest are not taxable.

However, if the lending occurs frequently, has high interest rates or the borrower is a business, the lender may be taxed 5% on the interest as income from capital investment. (Basis: Clause 3, Article 2, Circular 111/2013/TT-BTC).

Transparent notes

Receiving money transfers is no longer a purely private act but can become the basis for authorities to review financial obligations. However, if the transaction is clear in content and the source is transparent, people do not need to worry at all.

Clearly state the transfer content (loan, support, transfer on behalf of others, etc.); Keep related documents such as contracts, receipts, statements; Consult an accountant or lawyer in high-value transactions.

Correctly understanding tax exemption cases when receiving money transfers will help people feel more confident in transactions, limit unnecessary legal risks, and contribute to increasing transparency in personal financial management in the digital era.

Source: https://baonghean.vn/nhung-truong-hop-chuyen-khoan-khong-bi-danh-thue-10301332.html

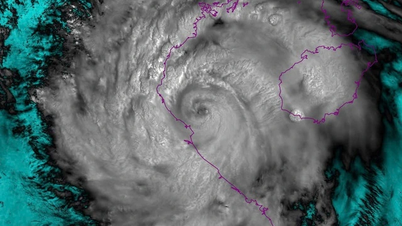

![[Photo] Hanoi: Authorities work hard to overcome the effects of heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/380f98ee36a34e62a9b7894b020112a8)

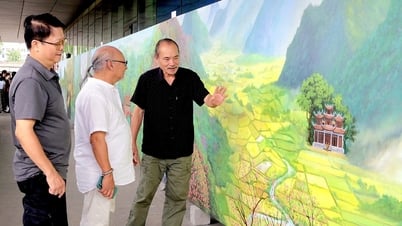

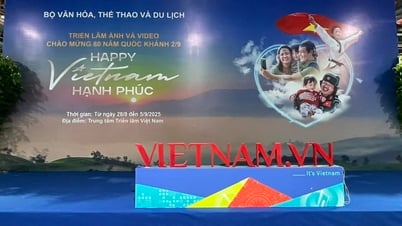

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

Comment (0)