Stock market ends 4 consecutive accumulation sessions - Photo: AI drawing

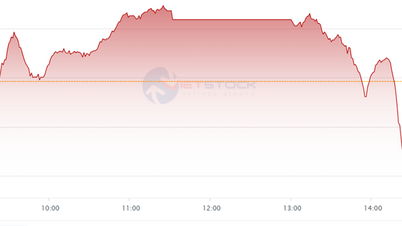

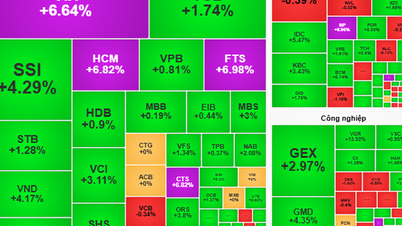

In the session on July 3, the stock market opened down but quickly regained momentum thanks to dominant active buying power, mainly coming from the banking - securities - steel trio.

However, supply pressure in the early afternoon caused the VN-Index to lose steam and narrow its growth momentum. In the end, the selling side dominated, causing the index to lose nearly 3 points, falling back to the 1,381.96 point area.

Notably, while many domestic investors were cautious about taking profits early, foreign investors made strong net purchases with a total value of VND 2,276 billion, focusing on SSI, MWG and CTG.

Why does the stock market correct?

Speaking to Tuoi Tre Online , Mr. Nguyen Anh Khoa - director of Agribank securities analysis and research - said that the industrial park and export group (aquatic products, textiles, etc.) recorded selling pressure at the beginning of today's trading session, but the decline slowed down somewhat afterwards.

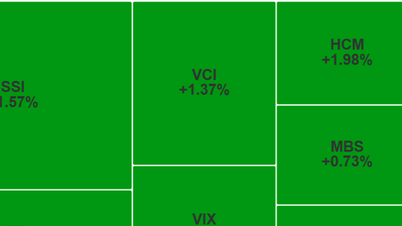

In return, many industry groups continue to maintain a positive growth trend, notably securities, retail, banking, and steel. According to Mr. Khoa, cash flow is prioritizing groups of stocks that have their own stories or are expected to have positive second-quarter business results, as well as benefit from policies in the last months of 2025.

Although the market situation is still relatively positive at the present time, Mr. Khoa said that there are still many unclear factors ahead, especially when the corresponding tax rates with Southeast Asian countries as well as the detailed content of the Vietnam - US agreement have not been announced.

According to Mr. Quach Anh Khanh, analyst at Vietcombank Securities (VCBS), the selling pressure increased sharply in today's session, focusing on some stocks in the industrial park group (BCM) and rubber group (GVR), along with profit-taking pressure at high prices of the banking group, causing the general index to end the session slightly down.

"The market opened slightly lower than the reference level after information related to the tariff negotiation process between Vietnam and the US, but quickly regained green and increased points. However, in the afternoon session, the early supply pressure caused the VN-Index to lose steam and narrow the increase," said Mr. Khanh.

However, according to VCBS experts, liquidity increased by 40% compared to the previous morning session, showing that investor sentiment has somewhat improved after the market surpassed the 1,390 point threshold.

Mr. Khoa said that investors should continue to hold their portfolios, prioritizing industry groups with expected profit growth in the second quarter and benefiting from policies, such as banking, securities, retail, construction, and steel.

"However, we should also maintain a reasonable cash ratio, about 30% of the portfolio, to prepare buying power in case the market experiences an unexpected correction," Mr. Faculty recommended.

Foreign investors increase disbursement, narrow net selling momentum

The biggest highlight of today's session was the strong return of foreign investors. Foreign investors net bought more than VND2,276 billion, marking the second consecutive net buying session.

Previously, this group mainly maintains a net selling trend. Since the beginning of the year, foreign investors have net sold more than 38,000 billion VND on the Vietnamese stock market.

Looking back, foreign investors have maintained net selling for many consecutive months, except for May. However, the total for the first 6 months of this year is still significantly more positive than the net withdrawal of more than VND 52,000 billion in the same period.

The early return of foreign investors to the market comes as the Government is closely directing the upgrading of the Vietnamese stock market – one of the factors attracting foreign capital flows.

Mr. Hoang Van Thu, Vice Chairman of the State Securities Commission, said that the commission has been working hard to achieve the upgrade target in the FTSE review scheduled for September 2025. Rating organizations such as FTSE, MSCI and international investors all highly appreciate and believe in the upgrading process of the Vietnamese stock market.

The Ministry of Finance is currently finalizing the amendment of Decree 155/2020/ND-CP to remove obstacles and facilitate foreign investors, including simplifying administrative procedures, increasing ownership ratios and ensuring safety for investment activities.

In addition, dialogue and investment promotion activities abroad are also being promoted, while preparations are being made to deploy technical mechanisms such as the Omnibus trading account and the Central Clearing Counterparty (CCP) mechanism.

Mr. Quach Anh Khanh, VCBS expert, said that the correction in today's session is common after the index has had a strong increase. The market is in the phase of re-testing supply and demand in the 1,380-1,390 range. At the same time, the cash flow has a clear differentiation, focusing on groups of stocks with their own stories or expectations of positive Q2 business results.

Source: https://tuoitre.vn/dong-thai-la-khoi-ngoai-tren-thi-truong-chung-khoan-sau-tin-thue-quan-viet-my-20250703183354431.htm

![[OCOP REVIEW] Bay Quyen sticky rice cake: A hometown specialty that has reached new heights thanks to its brand reputation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/3/1a7e35c028bf46199ee1ec6b3ba0069e)

Comment (0)