With these tireless efforts, Agribank has been recognized and honored in the Top 100 Green Vietnam ESG Enterprises 2025, Top 10 ESG Enterprises in the Banking Industry 2025 - a ranking announced by Viet Research in collaboration with the Finance - Investment Newspaper.

Top 100 Green ESG Enterprises in Vietnam (ESG100) and Top 10 ESG Enterprises by Industry (ESG10) are two prestigious rankings announced by Viet Research in collaboration with the Finance - Investment Newspaper, to honor pioneering enterprises in implementing sustainable development strategies in Vietnam. This is not only a recognition of the specific and practical efforts of the business community but also opens an important milestone on the journey of transforming the green growth model, towards a transparent, responsible and deeply integrated economy .

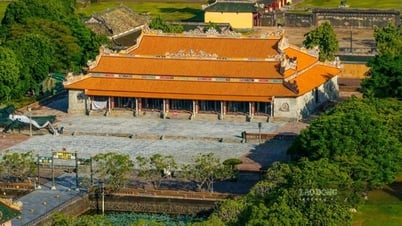

Agribank is in the Top 100 Green ESG Enterprises in Vietnam 2025 |

Not only assessing business performance, ESG100 and ESG10 focus on measuring the level of integration of Environmental - Social - Governance factors into the strategy, operating model and governance system of the enterprise. These are key indicators, reflecting the adaptability and long-term development capacity of the enterprise in the context of the world placing increasing demands on transparency, responsibility and sustainable development.

At Agribank, sustainable development is realized through a solid value system of three pillars: Environment, Society and Governance. Each pillar is implemented through clear and synchronous actions, programs and strategies throughout the system.

In terms of environmental factors, Agribank is one of the pioneering organizations promoting green credit. The bank prioritizes funding for high-tech agricultural projects, renewable energy, afforestation and circular economy. Not only providing capital, Agribank accompanies customers in building sustainable production models, reducing emissions and being environmentally friendly. In particular, Agribank's sustainable development strategy to 2030, with a vision to 2045, takes ESG as a guiding principle throughout, with a clear commitment to work with the Government to achieve the goal of net zero emissions by 2050.

An organic agricultural production model from investment capital of Agribank |

In terms of social factors, Agribank continues to affirm its mission of “Tam Nong” through a series of specific action programs. The bank promotes policy credit for remote and isolated areas while investing in key areas such as education, health care and social security. From scholarships to new schools, from medical station construction to disaster relief… all activities clearly demonstrate the philosophy of putting people at the center, demonstrating the role of a bank for the community.

From within, Agribank has been building a modern and humane working environment, focusing on gender equality, improving welfare, and inspiring innovation and creativity among its staff and employees - those who inspire and realize ESG commitments from within the enterprise.

Top 10 ESG Enterprises in Banking Industry |

In terms of governance, Agribank maintains a transparent governance platform, strictly adhering to domestic and international financial and legal standards. The ESG governance system is established synchronously, integrated into all credit and investment appraisal processes. The bank's sustainable development reports and financial reports are periodically published, contributing to strengthening the trust of domestic and international investors, partners and communities. This is a major competitive advantage in the context of markets increasingly demanding higher accountability and transparency.

It can be seen that ESG10 and ESG100 are not only recognition titles for Agribank but also open up a series of long-term strategic opportunities, leading to stronger trust for the public, customers, investors and international partners. On the other hand, the convergence of ESG criteria helps Agribank more easily access global green capital sources, while enhancing competitiveness when cooperating with multinational corporations that have strict requirements on sustainable development.

Not stopping at compliance, Agribank has been rising to play the role of trend-setter, contributing to the process of forming a sustainable financial and banking ecosystem in Vietnam. Through green credit products and services, cooperation models and internal communication activities on ESG, Agribank has gradually formed a distinctive “green identity”, creating a strong ripple effect throughout the system and out into the community.

In particular, in the context of Vietnam's economy transforming towards a green and circular economy, Agribank is not only a policy implementer, but also an agent creating new momentum for growth. The bank's methodical ESG steps are contributing to changing awareness every day, promoting changes in production and consumption behavior and suggesting a fair and sustainable development future for the country. From ESG10 and ESG100 achievements in 2025 to long-term goals, Agribank is affirming its role as a national bank for sustainable development. Each green credit, each community security program, each step forward in transparent governance are bricks building a green future for Vietnam.

Source: https://baodautu.vn/agribank---doanh-nghiep-esg-viet-nam-xanh-2025-d320964.html

![[Photo] Hanoi is ready to serve the occasion of the 80th National Day Celebration on September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/29/c838ac82931a4ab9ba58119b5e2c5ffe)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

Comment (0)