End of stock session on July 2

VN-Index increased by 6.75 points

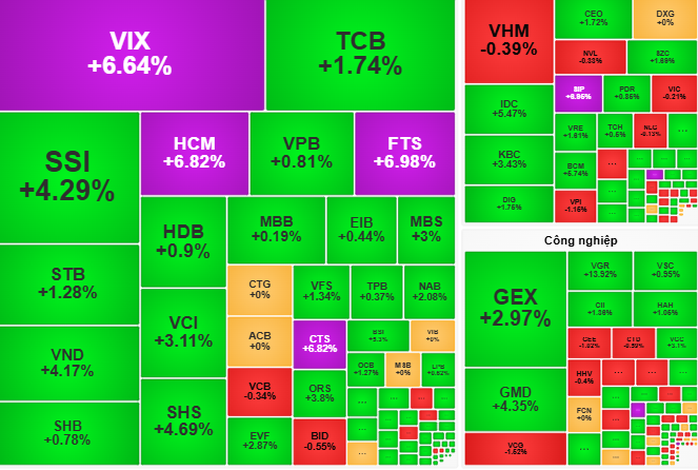

At the beginning of the trading session on July 2, VN-Index started with green. However, in the first 30 minutes, the index fluctuated around the reference level, fluctuating within a narrow range of 1-3 points, due to the clear differentiation among blue-chip stocks.

Industrial park and rubber real estate stocks increased sharply, while some Vingroup and bank stocks such as VCB and BID recorded decreases.

In the afternoon session, VN-Index maintained a steady increase thanks to strong demand from securities, steel and construction stocks.

Notably, VIX and HCM codes hit their ceiling prices, SSI increased by 4.29%, along with the breakthrough of blue-chip stocks such as HPG (up 3.8%), BCM (up 3.5%) and VPB (up 4.1%), helping the index surpass the 1,380 point mark.

At the end of the session, VN-Index closed at 1,384.5 points, up 6.75 points, equivalent to 0.49%.

Which codes lead the market?

According to VCBS Securities Company, the fact that the VN-Index surpassed the 1,380-point mark reflects positive investor sentiment, supported by purchasing power of bank stocks, securities, steel and industrial real estate.

Prominent codes such as VPB, STB (bank), HPG, HSG (steel), SSI, VND (securities), along with industrial park real estate stocks such as BCM, SZC played a leading role in the market.

VCBS Securities Company believes that the uptrend is still being maintained. Investors can continue to hold stocks in the securities, steel and industrial real estate groups, while considering increasing the proportion of stocks with good growth potential.

Based on the positive developments of the July 2 session, some other securities companies forecast that the VN-Index may continue to maintain its upward momentum in the July 3 session. The main driving force comes from banking, securities and steel stocks.

Investors need to pay attention to risk factors such as profit-taking pressure at the resistance zone of 1,390-1,400 points and international market developments. Closely monitoring macroeconomic information and upcoming financial reports for the second quarter of 2025 are also important factors in making reasonable investment decisions.

Source: https://nld.com.vn/chung-khoan-ngay-mai-3-7-nhom-co-phieu-nao-tiep-tuc-thu-hut-suc-mua-196250702171702251.htm

![[Infographic] Traditional relations and special friendship between Vietnam and Cuba](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/c4c2b14e48554227b4305c632fc740af)

![[Photo] Prime Minister begins trip to attend SCO Summit 2025 in China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/054128fff4b94a42811f22b249388d4f)

![[Photo] First Secretary and President of Cuba begins State visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/f169c1546ec74be7bf8ccf6801ee0c55)

![[Photo] Chairman of the National People's Congress of China Zhao Leji begins official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/31/fcfa5a4c54b245499a7992f9c6bf993a)

Comment (0)