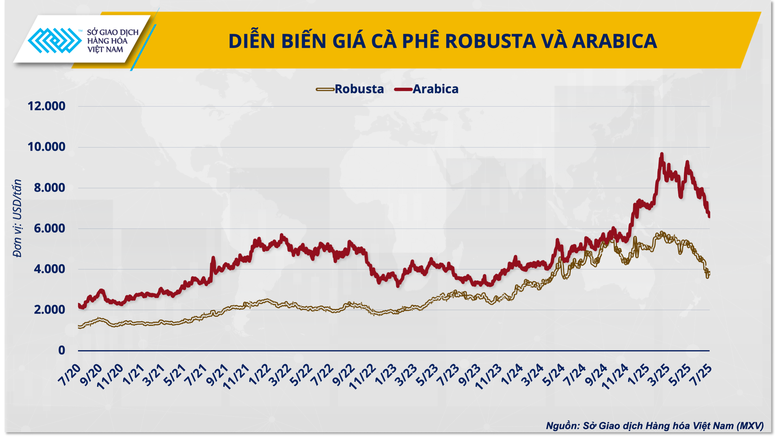

The first “shock” to the Brazilian coffee industry in particular and the global coffee industry in general came in mid-July 2021 when the coffee-producing regions in Cerrado Mineiro and South Minas Gerais (Brazil) suffered the worst frost in history. This event really created a “supply shock” for coffee traders, pushing the average price of Arabica coffee in July 2021 from 3,733 USD/ton to increase continuously by nearly 50% in several months and peaked at the average price in February 2022 of 5,427 USD/ton. Despite the harsh weather conditions, Brazil's coffee production still increased by 14% that year, leading to a surplus and a price drop by the end of 2022, to a level lower than the price in July 2021.

The next “shock” is the following year 2023. Arabica coffee prices in the first 4 months of the year increased by about 20% before falling to an average of 3,356 USD/ton in September due to increasing inventories and oversupply. The war in Ukraine further destabilized as Russia reduced imports. In addition, information about drought in Brazil and unusually hot weather in Vietnam increased concerns about the next crop.

This fear was realized in 2024 when a severe global supply shortage created a third shock. At the beginning of this year, the coffee market contracted sharply, with global coffee prices reaching a decade high, with the average price of Arabica coffee in December increasing by 73% compared to the beginning of the year, along with Robusta coffee also skyrocketing by 57% to over $5,000/ton. In Vietnam, production was recorded to have decreased by 20% due to prolonged drought, while Indonesia's production decreased by 16.5% due to excessive rain. The tight supply of Robusta coffee pushed prices to record levels and narrowed the price gap between Robusta and Arabica.

According to data from the Vietnam Commodity Exchange (MXV), at the end of the trading session on September 26, 2024, for the first time in history, the price of Arabica coffee exceeded the 6,000 USD/ton mark while the price of Robusta coffee also exceeded 5,500 USD/ton after 4 consecutive sessions of increase. The price gap between the London and New York futures markets narrowed by 31.8% to 28.2 US cents/pound in September, the lowest level since March 2003.

In Brazil, recovery hopes were dashed by heat and drought, leading to further downward revisions to crop forecasts.

On June 23, 2023, the European Union (EU) issued the EU Deforestation Regulation (EUDR) for 7 groups of imported goods into this market. Of which, Vietnam has 3 important export items to the EU, including coffee, which are subject to the EUDR. Concerns about a shortage of supply that meets the standards under this regulation have stimulated strong demand from the EU. However, in the context of low inventories in Brazil and tight production in most producing countries, the average price of Arabica coffee in February once again reached a sky-high level of 8,892 USD/ton, up 25% compared to December last year, similarly, Robusta prices increased by 10.7%.

However, at the end of the second quarter, especially in the third week of June, the price trend reversed in the context of the constantly changing and unstable political and economic situation, along with unpredictable complexity, along with abundant supply, especially Robusta coffee when the harvest season is still taking place in Brazil and Indonesia, causing the coffee market to plummet. According to MXV, at the end of the trading week from June 16-22, Arabica coffee prices lost 9% while Robusta prices plummeted by a record 12.8% compared to the previous week.

Notably, at the end of the trading session on June 18, Robusta coffee prices fell to their lowest level in the past year and Arabica to their lowest level in the past 5 months. Specifically, Robusta coffee prices on the London floor decreased by 5.85 - 6.92%, equivalent to a decrease of 233-299 USD/ton. Except for the technical near-term delivery date of July, it was still at 4,020 USD/ton after a decrease of 299 USD/ton; the remaining terms all lost the 4,000 USD/ton mark.

Similar developments on the New York floor saw Arabica prices fall by 3.05 - 3.26%, depending on the term. The July delivery term fell by 240 USD/ton to 7,160 USD/ton; the September delivery term fell by 220 USD/ton to 7,110 USD/ton.

Under pressure from falling world coffee prices, domestic coffee prices have also fallen to their lowest level since May 2023. Recorded on the morning of July 3, the price of green coffee beans in the Central Highlands and the Southern provinces fluctuated around VND95,500/kg, a decrease of about 30-32%, equivalent to about VND32,000-33,000/kg compared to the same period last year.

First is climate and crop cycles, coffee is very sensitive to weather. Brazil and Vietnam (more than 50% of world production) are constantly facing droughts and frosts. Climate change increases instability and disrupts the “high year – low year” crop cycle.

The second factor is supply - demand - inventory. When supply exceeds demand, prices fall. When demand exceeds supply, prices rise. In which, the world's coffee demand increases 1-2% per year due to population and new markets. Supply shocks simultaneously cause inventory depletion, causing the market to react strongly just because of a bad forecast.

Another important factor is geopolitics and policy, instability in Ukraine disrupts trade, increases agricultural costs. News of US tariffs, EU regulations on deforestation cause supply concerns and instability in the Middle East can put supply chains and logistics at risk of disruption, affecting not only the coffee market but also the global commodity market.

Developments in financial markets can also have a direct impact on prices beyond supply and demand. The movements of derivatives market forces such as hedge funds, roasters and farmers can skillfully follow the sharp swings reflected in prices.

Mr. Nguyen Ngoc Quynh - Deputy General Director of MXV

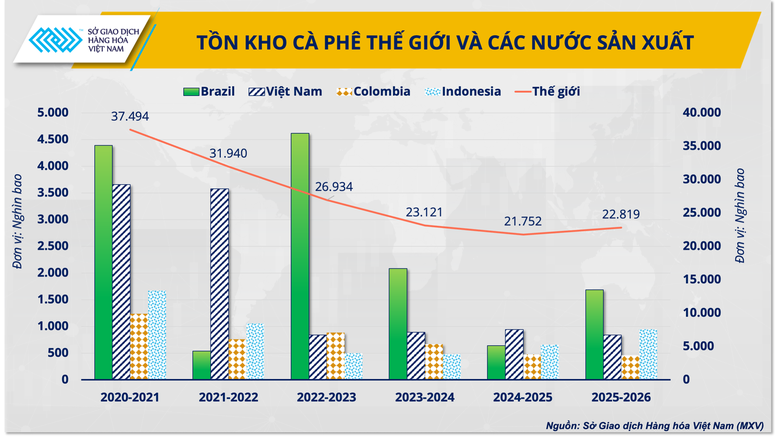

The USDA recently released forecasts showing increased production, especially Robusta in Brazil, Vietnam and Indonesia, but nothing is certain yet as experts warn that the ongoing El Niño phenomenon could continue to disrupt weather patterns, increasing the risk of another low-yield year.

In fact, in the current harvest in Brazil, many Arabica farmers are reporting a yield drop of over 20% and Robusta is also recording a drop of 10–15% in some places. The general sentiment among producers is that the total Arabica coffee output will only reach a maximum of about 36 million bags and Robusta coffee will reach a maximum of 20 million bags, meaning a total output of only 56–58 million bags.

In addition, the extremely low coffee inventory in Brazil is also alarming. According to USDA, the country's coffee inventory transferred from the 2024-2025 crop year to the 2025-2026 crop year is only 640,000 bags, not enough for 1 month of domestic consumption in Brazil. Meanwhile, the world's inventory level at the end of the period is only moderate, equal to 13.46% of consumption.

According to Mr. Nguyen Ngoc Quynh - Deputy General Director of MXV, the current coffee market is no longer affected by supply and demand factors, but by economic and political instability, such as the US-China trade war, the conflict between Russia and Ukraine and the escalation of tensions between Israel and Iran. This directly adjusts the cash flow in the derivatives market to assets of a safe-haven nature. This is a long-term factor at this time, causing coffee prices to continue to decline if the economic and political situation is not stable enough to attract investors back to the market.

Source: https://baochinhphu.vn/mua-ca-phe-dang-chin-gia-se-ngot-hay-dang-102250703142958641.htm

Comment (0)