Domestic gold price today June 7, 2025

As of 4:30 am on July 6, 2025, the domestic gold bar price is based on the closing price yesterday, July 5. cited:

The price of SJC gold bars listed by DOJI Group is at 118.9-120.9 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.9-120.9 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

If a swing trader buys gold at the beginning of the week at VND119.2 million/tael, he will still lose VND300,000/tael this week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.8-120.8 million VND/tael for buying and selling. Compared to yesterday, the gold price increased slightly by 100 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by the enterprise at 118.9-120.9 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.2-120.9 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 4:30 am on July 6, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.5-117.5 million VND/tael (buy - sell); the price remains unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell); the gold price remains unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, July 6, 2025 is as follows:

| Gold price today | July 6, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118.9 | 120.9 | - | - |

| DOJI Group | 118.9 | 120.9 | - | - |

| Red Eyelashes | 119.7 | 120.7 | - | - |

| PNJ | 118.9 | 120.9 | - | - |

| Minh Chau Newspaper | 118.9 | 120.9 | - | - |

| Phu Quy | 118.2 | 120.9 | - | - |

| 1. DOJI - Updated: June 7, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,900 | 120,900 |

| AVPL/SJC HCM | 118,900 | 120,900 |

| AVPL/SJC DN | 118,900 | 120,900 |

| Raw material 9999 - HN | 108,300 | 112,500 |

| Raw material 999 - HN | 108,200 | 112,400 |

| 2. PNJ - Updated: June 7, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,800 | 117,400 |

| HCMC - SJC | 118,900 | 120,900 |

| Hanoi - PNJ | 114,800 | 117,400 |

| Hanoi - SJC | 118,900 | 120,900 |

| Da Nang - PNJ | 114,800 | 117,400 |

| Da Nang - SJC | 118,900 | 120,900 |

| Western Region - PNJ | 114,800 | 117,400 |

| Western Region - SJC | 118,900 | 120,900 |

| Jewelry gold price - PNJ | 114,800 | 117,400 |

| Jewelry gold price - SJC | 118,900 | 120,900 |

| Jewelry gold price - Southeast | PNJ | 114,800 |

| Jewelry gold price - SJC | 118,900 | 120,900 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,800 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,800 | 117,400 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,800 | 117,400 |

| Jewelry gold price - Jewelry gold 999.9 | 114,100 | 116,600 |

| Jewelry gold price - Jewelry gold 999 | 113,980 | 116,480 |

| Jewelry gold price - Jewelry gold 9920 | 113,270 | 115,770 |

| Jewelry gold price - Jewelry gold 99 | 113,030 | 115,530 |

| Jewelry gold price - 750 gold (18K) | 80,100 | 87,600 |

| Jewelry gold price - 585 gold (14K) | 60,860 | 68,360 |

| Jewelry gold price - 416 gold (10K) | 41,160 | 48,660 |

| Jewelry gold price - 916 gold (22K) | 104,410 | 106,910 |

| Jewelry gold price - 610 gold (14.6K) | 63,780 | 71,280 |

| Jewelry gold price - 650 gold (15.6K) | 68,440 | 75,940 |

| Jewelry gold price - 680 gold (16.3K) | 71,940 | 79,440 |

| Jewelry gold price - 375 gold (9K) | 36,380 | 43,880 |

| Jewelry gold price - 333 gold (8K) | 31,130 | 38,630 |

| 3. SJC - Updated: June 7, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,900 | 120,900 |

| SJC gold 5 pieces | 118,900 | 120,920 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,900 | 120,930 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,300 | 116,800 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,300 | 116,900 |

| Jewelry 99.99% | 114,300 | 116,200 |

| Jewelry 99% | 110,549 | 115,049 |

| Jewelry 68% | 72,274 | 79,174 |

| Jewelry 41.7% | 41,710 | 48,610 |

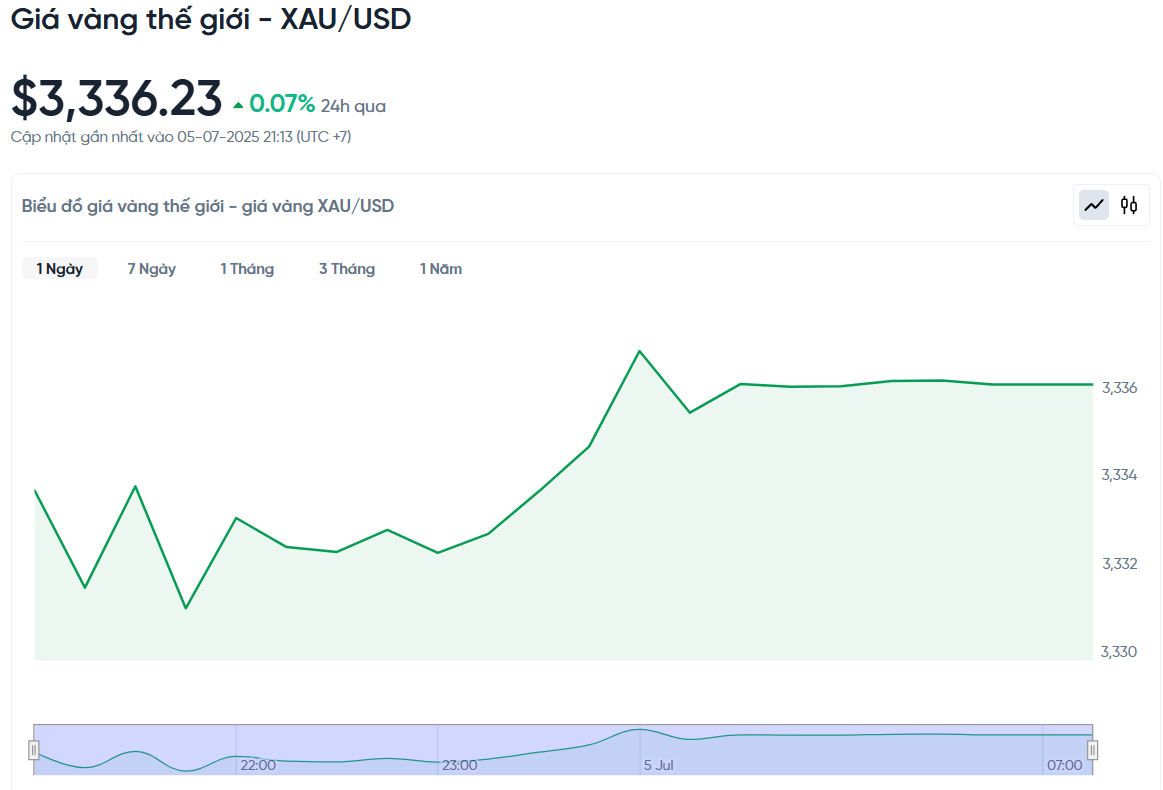

World gold price today June 7, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am on July 6, Vietnam time, was 3,336.23 USD/ounce. Today's gold price increased by 2.4 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,350 VND/USD), the world gold price is about 109.45 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.45 million VND/tael higher than the international gold price.

The global gold price has witnessed a remarkable increase despite positive economic data that often reduces the market's interest in the precious metal. The main reason comes from geopolitical concerns and public debt, causing investors to seek gold as a safe haven.

Gold prices started the week at $3,271 an ounce and experienced a slight dip below $3,250 before rebounding. By Monday morning, gold prices were approaching $3,300 and holding steady at that level in the afternoon. On Tuesday, prices continued to rise to $3,356 an ounce.

However, this price met resistance from sellers, causing gold prices to fluctuate in a narrow range between $3,330 and $3,355 for the next two days. By Wednesday afternoon, gold prices hit a weekly high of $3,365 an ounce.

Gold then corrected to the support level of $3,345 before attempting another rally but failed. Just before the US non-farm payrolls report was released, gold plunged from $3,350 to $3,312 in just 15 minutes.

Fortunately, gold quickly regained momentum, reaching $3,337 when the US stock market opened. In the final trading hours before the July 4 holiday, gold prices fluctuated steadily in a narrow range of about $10.

This week's global gold price shows that gold's appeal remains strong despite conventional factors such as economic data or market sentiment. Global political and financial risks continue to be the main factor supporting gold prices in the short term.

The gold market is in a delicate balance between concerns about public debt, monetary policy and safe-haven demand. While experts are still hesitant, individual investors remain confident in the precious metal's bullish outlook.

Gold Price Forecast

The latest weekly Kitco News gold survey shows that industry experts are bearish on gold's near-term outlook, while retail investors remain bullish.

This week, 14 experts participated in Kitco News' survey. Wall Street was largely neutral after a week of sideways gold prices: 36% predicted higher prices, 28% predicted lower prices, and the remaining 36% believed gold would continue to fluctuate in a narrow range.

In contrast, the retail investor community remains more optimistic. Of the 243 online votes, 59% expect gold prices to rise, 20% predict a fall, and 21% believe gold prices will continue to move sideways next week.

Adam Button, head of currency strategy at Forexlive.com, predicts gold will rise: 'The US dollar initially rallied after the jobs report but quickly reversed course. This strengthens the dollar selling trend that dominates the first half of the year. If this trend continues, gold will benefit.'

Rich Checkan, president and CEO of Asset Strategies International, agrees: 'The new tax bill will add $4 trillion to the US national debt over the next 10 years, with an additional $2 trillion expected each year. By 2035, the total debt could exceed $50 trillion, not to mention the Social Security Fund, which is expected to run out by 2033. Gold is the solution to this.'

However, Adrian Day of Adrian Day Asset Management has a contrarian view: 'Gold prices could fall due to a combination of negative factors such as the tariff deal and expectations of a Fed rate cut in July, along with the People's Bank of China reducing its gold purchases. However, any fall will be mild and short-lived.'

Source: https://baonghean.vn/gia-vang-hom-nay-6-7-2025-van-lo-300-nghin-dong-luong-trong-1-tuan-10301651.html

Comment (0)