At the second quarter press conference of the Ministry of Finance on July 2, Mr. Truong Ba Tuan, Deputy Director of the Department of Tax, Fee and Charge Policy Management and Supervision, updated the progress of the draft Law on Personal Income Tax (replacement).

Mr. Tuan said that the Ministry of Finance has coordinated with ministries, branches and localities to propose the development of the above Law, report to the Government and the National Assembly Standing Committee to add it to the National Assembly's 2025 law and ordinance development program.

He said the Ministry of Finance has reported to the Government its plan to amend the entire legal regulations, focusing on 6 main contents, including amending and perfecting regulations related to determining taxable income, calculating tax on each income item in accordance with the current context, reviewing and supplementing tax-exempt income items according to recent policies of the Party and State such as high-tech and green fields...

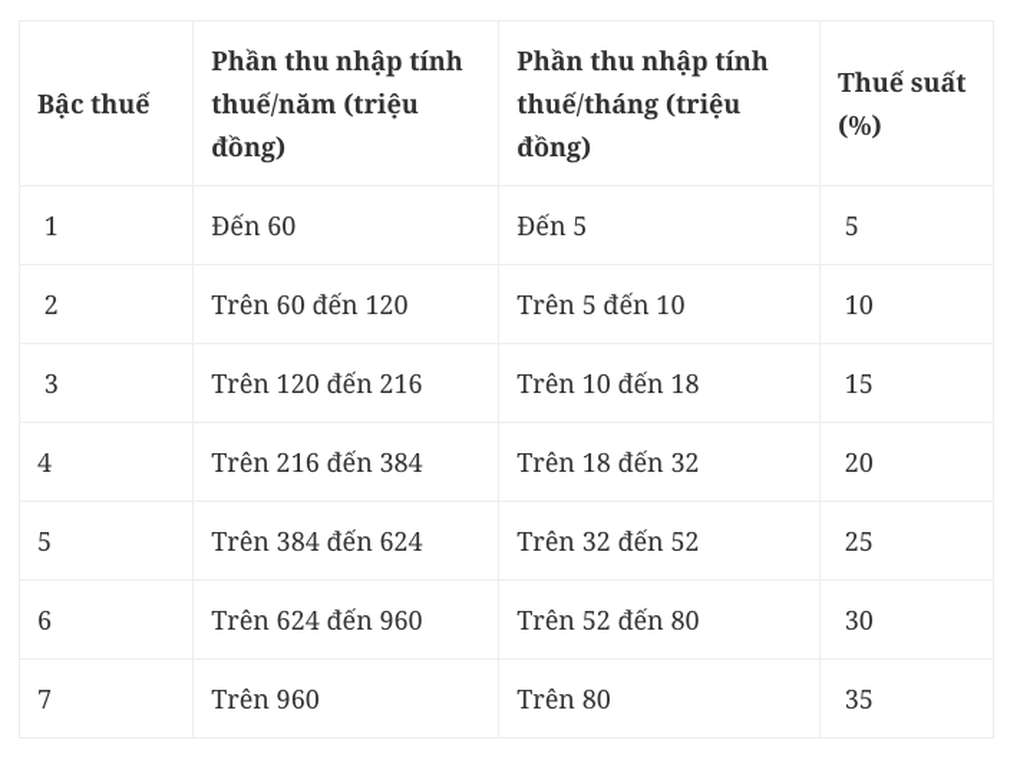

7 personal income tax rates (Photo: My Tam).

In the upcoming draft Law on Personal Income Tax (replacement), the drafting agency will study increasing the family deduction level when calculating tax to promptly reflect changes in people's living standards. In addition, the Ministry will report to the Government and the National Assembly to add deductions when calculating personal income tax to promote development and support people in a number of areas such as education and health.

The new law will also amend the progressive tax schedule for wages and salaries, in a streamlined manner. "Currently, there are seven tax brackets, which are expected to be reviewed and streamlined in the near future," he said at a press conference.

Mr. Tuan said the Ministry is still closely following the progress assigned by the Government to ensure timely submission to the Government and the National Assembly at the upcoming October session.

In the submission to the Government to develop the Law on Personal Income Tax (replacement), one content that the Ministry of Finance is oriented to amend and supplement is the progressive tax schedule for income from wages and salaries after 15 years of application.

The Ministry of Finance said that there is a view that the current tax schedule is unreasonable. The current 7 tax brackets are too many. The narrow gap between the brackets leads to a jump in tax brackets when summing up income in the year, increasing the amount of tax payable. On the other hand, the number of tax settlements increases unnecessarily, while the amount of additional tax payable is not much.

According to this Ministry, the application of personal income tax collection according to progressive tax rates is commonly implemented in countries around the world.

"Vietnam can reduce the number of tax brackets to below 7. At the same time, consider widening the income gap in tax brackets to ensure higher regulation for those with high incomes. Reducing the number of tax brackets will facilitate tax declaration and payment," said the Ministry of Finance.

Source: https://dantri.com.vn/kinh-doanh/du-kien-giam-tru-chi-phi-giao-duc-y-te-khi-tinh-thue-thu-nhap-ca-nhan-20250702154922676.htm

Comment (0)