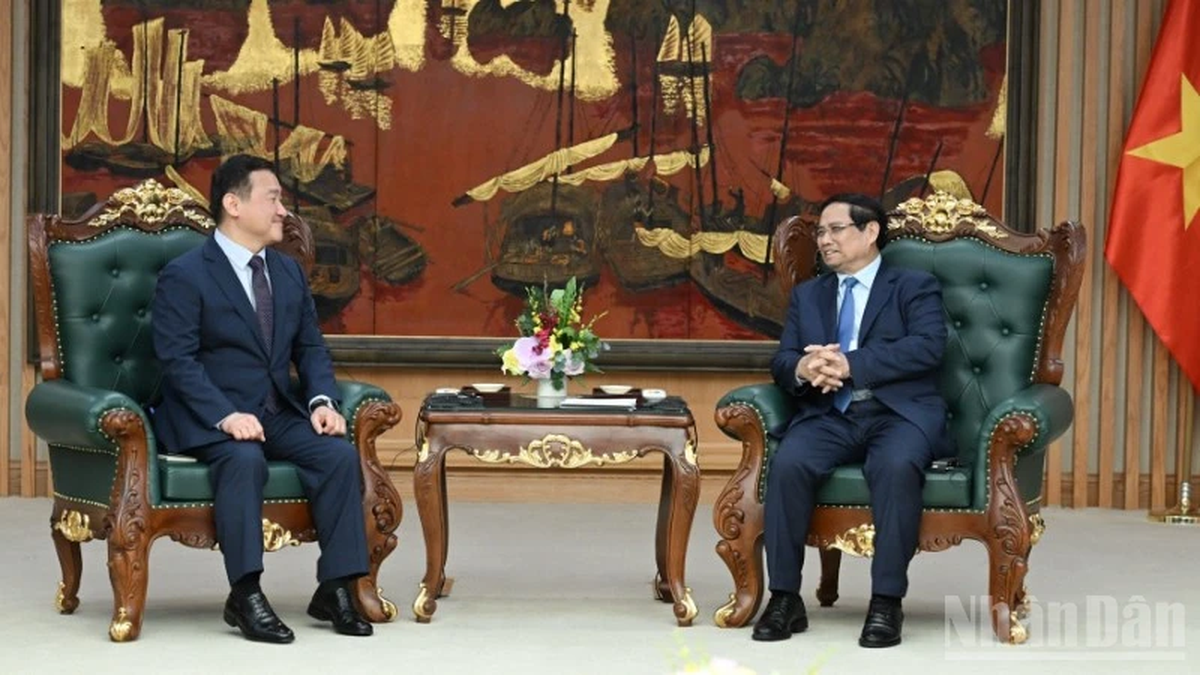

The Ministry of Finance said it is expected that in October there will be a resolution to increase the family deduction level - Photo: NGOC PHUONG

Amending the Personal Income Tax Law to reduce tax obligations for citizens

Regarding the progress of amending the Law on Personal Income Tax, answering the press at the regular press conference of the Ministry of Finance on the afternoon of July 2, Mr. Truong Ba Tuan, Deputy Director of the Department of Management and Supervision of Tax, Fee and Charge Policies (Ministry of Finance), said that the Government has assigned the Ministry of Finance to develop the Law on Personal Income Tax (replacement), and submit the draft law to the National Assembly at the session taking place in October this year.

Previously, in the proposal for this draft law, the Ministry of Finance reported to the Government to amend all regulations related to the current personal income tax policy with 6 policy groups, including policies that will contribute to reducing tax obligations for taxpayers.

That is to perfect regulations related to income subject to personal income tax and tax calculation for each type of taxable income; add tax-exempt income to promote the development of priority industries and sectors such as income from transferring green bonds and emission certificates.

In addition, the Ministry of Finance also proposed adjusting the taxable revenue level for the income of business households and individuals to suit the practical situation.

On the other hand, the progressive tax rate for income from wages and salaries is reduced.

"In particular, the Ministry of Finance will study and adjust the family deduction level to ensure it is consistent with changes in living standards, price indexes and other macroeconomic indicators. At the same time, it will supplement charitable and humanitarian contributions and other specific deductions such as medical and educational expenses when determining taxable income," said Mr. Tuan.

The Standing Committee of the National Assembly is expected to consider and pass a resolution on raising the family deduction level.

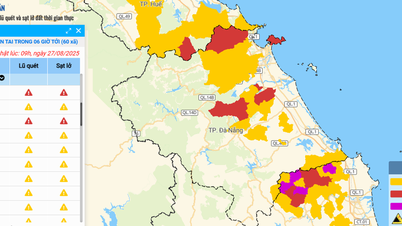

Speaking further with Tuoi Tre Online , Mr. Tuan informed that according to the current Personal Income Tax Law, in case the consumer price index (CPI) fluctuates by more than 20% compared to the time of the most recent adjustment of the family deduction level, the Government will submit to the National Assembly Standing Committee to adjust the family deduction level in accordance with price fluctuations.

Through monitoring by the Ministry of Finance, CPI fluctuations from 2020 (the time when the current family deduction level is applied) to the end of this year could reach 20%.

Therefore, to ensure the rights of taxpayers and comply with the provisions of the current Law on Personal Income Tax, the Ministry of Finance is studying and drafting a resolution of the National Assembly Standing Committee on adjusting the family deduction level of personal income tax to report to the Government and the National Assembly Standing Committee for consideration and decision.

"In Resolution No. 1326 of 2024 of the National Assembly Standing Committee on the 2025 work program, it is expected that the National Assembly Standing Committee will consider and approve a resolution on adjusting the family deduction level at the meeting taking place next October," Mr. Tuan informed.

The current family deduction level is applied from 2020. The deduction level for taxpayers is 11 million VND/month, and for dependents is 4.4 million VND/month. According to calculations by the Ministry of Finance, the consumer price index from 2020 to the end of 2024 has increased by more than 15%.

In the past two consecutive years, voters in many localities such as Ho Chi Minh City, Phu Tho... have raised the outdated family deduction level and proposed raising it to 15-18 million VND to share difficulties with taxpayers with income from salaries and wages.

Source: https://tuoitre.vn/du-kien-thang-10-co-nghi-quyet-nang-muc-giam-tru-gia-canh-20250702202441014.htm

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

Comment (0)