The Ministry of Finance is drafting a Decree guiding the implementation of a number of articles of Resolution No. 198/2025/QH15 dated May 17, 2025 of the National Assembly on a number of special mechanisms and policies for private economic development.

The Ministry of Finance said that according to the provisions of the Law on Personal Income Tax (PIT) and guiding documents, income from capital transfer includes income from capital contribution transfer, income from securities transfer and income from capital transfer in other forms, distinguishing between income from capital contribution transfer in enterprises and income from securities transfer. Specifically: The Law on PIT (Clause 4, Article 3) stipulates: "Income from capital transfer, including: a) Income from capital transfer in economic organizations; b) Income from securities transfer and c) Income from capital transfer in other forms."

According to the provisions of the law on tax administration, personal income tax is a type of tax declared monthly. Accordingly, the tax exemption and reduction period at this point must be calculated continuously from the month in which the tax exemption and reduction income arises. In case the income arises in a month, the tax exemption and reduction period is calculated for the full month. In reality, individuals may have multiple sources of income or income from salaries and wages in many places during the tax period.

Clause 2 and Clause 3, Article 10 of Resolution No. 198/2025/QH15 stipulate preferential personal income tax policies for individuals when transferring capital contributions, for experts and scientists working at innovative startups, research centers, innovation centers, and intermediary organizations supporting innovative startups.

Specifically: Exemption from personal income tax and corporate income tax on income from the transfer of shares, capital contributions, capital contribution rights, rights to purchase shares, and rights to purchase capital contributions in innovative start-up enterprises. Exemption from personal income tax for 02 years and 50% reduction of tax payable for the next 04 years on income from salaries and wages of experts and scientists received from innovative start-up enterprises, research and development centers, innovation centers, and intermediary organizations supporting innovative start-ups.

Based on the provisions of the Law on Personal Income Tax and guiding documents, while ensuring consistency with the amount of corporate income that is exempted from tax as stated in the policy for transfer to other individuals and organizations for tax exemption purposes, ensuring that the policy is clear and transparent, in the draft Decree, the Ministry of Finance proposes the following guidance:

Individuals with income from the transfer of shares, capital contributions, capital contribution rights, rights to purchase shares, and rights to purchase capital contributions in innovative start-up enterprises are exempt from personal income tax on this income.

Income from the transfer of shares, capital contributions, capital contribution rights, share purchase rights, and capital contribution purchase rights prescribed in this Clause is income obtained from the transfer of part or all of shares, capital contributions, capital contribution rights, share purchase rights, and capital contribution purchase rights in innovative start-up enterprises (including cases of selling enterprises), except for income from the transfer of shares of public companies as prescribed by the Law on Securities.

In case of selling the entire enterprise owned by an individual in the form of capital transfer associated with real estate, declare and pay personal income tax according to real estate transfer activities.

Individuals who are experts and scientists recognized by competent authorities under the provisions of the Law on Science, Technology and Innovation and guiding documents and have income from salaries and wages received from innovative start-up enterprises, research and development centers, innovation centers, intermediary organizations supporting innovative start-ups, intermediary organizations supporting innovative start-ups, intermediary organizations supporting innovative start-ups, and innovation recognized by competent authorities under the provisions of the Law on Science, Technology and Innovation and guiding documents are exempted from tax for a period of 02 years (24 consecutive months) and have 50% of the tax payable reduced for the next 04 years (48 consecutive months) for this income.

The tax exemption and reduction period is calculated continuously from the month in which the tax-exempt or reduced income arises. In case the income arises in a month, the tax exemption and reduction period is calculated for the full month.

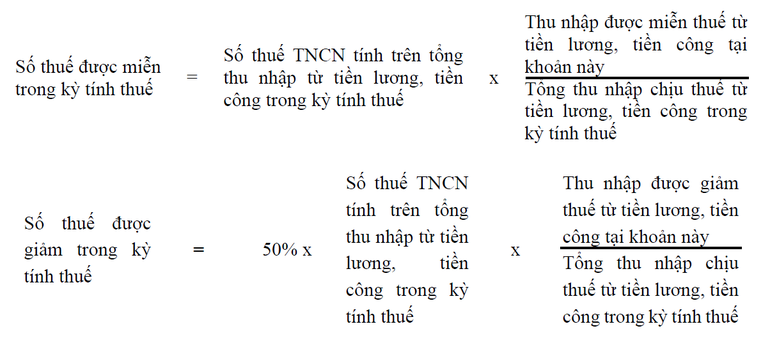

In case an individual has income from both salaries and wages exempted or reduced from tax under this regulation and income from other salaries and wages, the amount of personal income tax exempted or reduced under this regulation is determined as follows:

The Ministry of Finance is soliciting comments on this draft on the Ministry's Electronic Information Portal.

Source: https://baolaocai.vn/de-xuat-mien-giam-thue-thu-nhap-ca-nhan-mot-so-doi-tuong-post879506.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/27/a79fc06e4aa744c9a4b7fa7dfef8a266)

Comment (0)