The gold market in August has seen a series of consecutive price increases, pushing the price of gold to an unprecedented high in history. Compared to yesterday, the price of gold increased by 900,000 VND. Currently, businesses such as PNJ, SJC, DOJI also listed the buying price at 126 million VND, down 100,000 VND, and the selling price at 128 million VND/tael, up 900,000 VND.

Bao Tin Minh Chau is listing the buying price at 125.8 million VND, down 300,000 VND compared to yesterday. The difference between the two prices is high at 2.2 million VND/tael.

Mi Hong Enterprise listed a higher buying price than other enterprises, currently trading at 126.5 million VND/tael. Meanwhile, Phu Quy currently has a buying price of 125.4 million VND, 400,000 VND lower than other enterprises.

Gold prices have been increasing rapidly and continuously over the past month. Compared to the beginning of the month, domestic gold prices have increased by 6.6 million VND. This is the fastest and highest increase ever. Experts also predict that gold prices will continue to increase and reach 130 million VND.

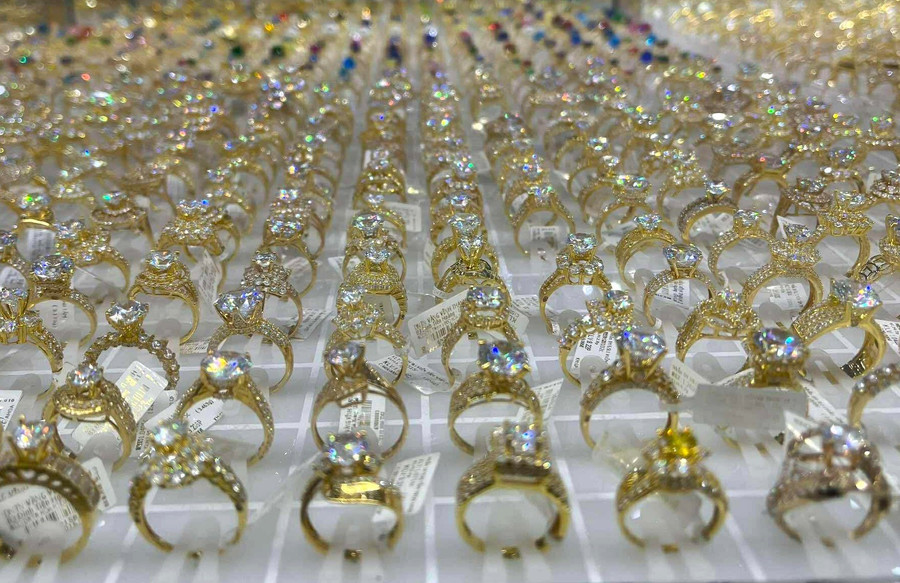

The gold ring market also increased along with the price of gold bars, depending on the business. Bao Tin Minh Chau is currently buying at 119.8 million VND, selling at 122.8 million VND/tael; Mi Hong is currently trading at 121-122.4 million VND/tael; Phu Quy is currently priced at 119.5-122.5 million VND/tael; PNJ is listed at 119.9-122.6 million VND/tael.

According to Kitco, the world gold price recorded at 4:00 a.m. on August 27, Vietnam time, was at 3,374 USD/ounce, up 4.36 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,530 VND/USD), the world gold price is about 107.95 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 20.05 million VND/tael higher than the international gold price.

The main reason for the recent surge, according to Bloomberg, is that investors have not found a more attractive place to park their money. Some experts have expressed concern that this could be a sign of a speculative price fever, also known as "irrational euphoria," and could create a gold price bubble.

The global economic backdrop also plays a role. China’s economy is showing signs of deflation and domestic demand is not really strong. This situation could weaken businesses and make the gold price rally unstable.

However, most believe that gold is still the top safe asset. Experts believe that the US Federal Reserve (Fed) will soon return to its easing policy by cutting interest rates. This often weakens the USD and creates momentum for gold prices to increase. In addition, geopolitical tensions around the world continue to push investors to seek gold as a shield to protect assets.

Source: https://baogialai.com.vn/gia-vang-tiep-tuc-bat-tang-neo-cao-o-muc-128-trieu-dongluong-post564904.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Many people eagerly await the preliminary review despite heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/4dc782c65c1244b196890448bafa9b69)

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] General Secretary To Lam attends Meeting with generations of National Assembly deputies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/27/a79fc06e4aa744c9a4b7fa7dfef8a266)

Comment (0)