Jerome Powell leaves open the possibility of lowering interest rates in July

At the European Central Bank Forum (ECB Forum) in Sintra, Portugal, on June 30, US Federal Reserve (Fed) Chairman Jerome Powell left open the possibility of cutting interest rates at the meeting on July 30.

“I really can’t say. The decision on interest rates will be data- driven,” Mr. Powell said. “We are not ruling out, nor are we confirming any meeting” that would discuss a rate cut, he added.

The remarks marked a sharp shift from his previous cautious stance, when he had hinted that the Fed might wait until the fall, around September, to consider easing monetary policy.

Mr. Powell's new signal was given in the context of the USD falling to a 3.5-year low. The USD Index (DXY) on the evening of July 1 (Vietnam time) decreased by 0.35%, reaching 96.5 points - the lowest level since the beginning of 2022.

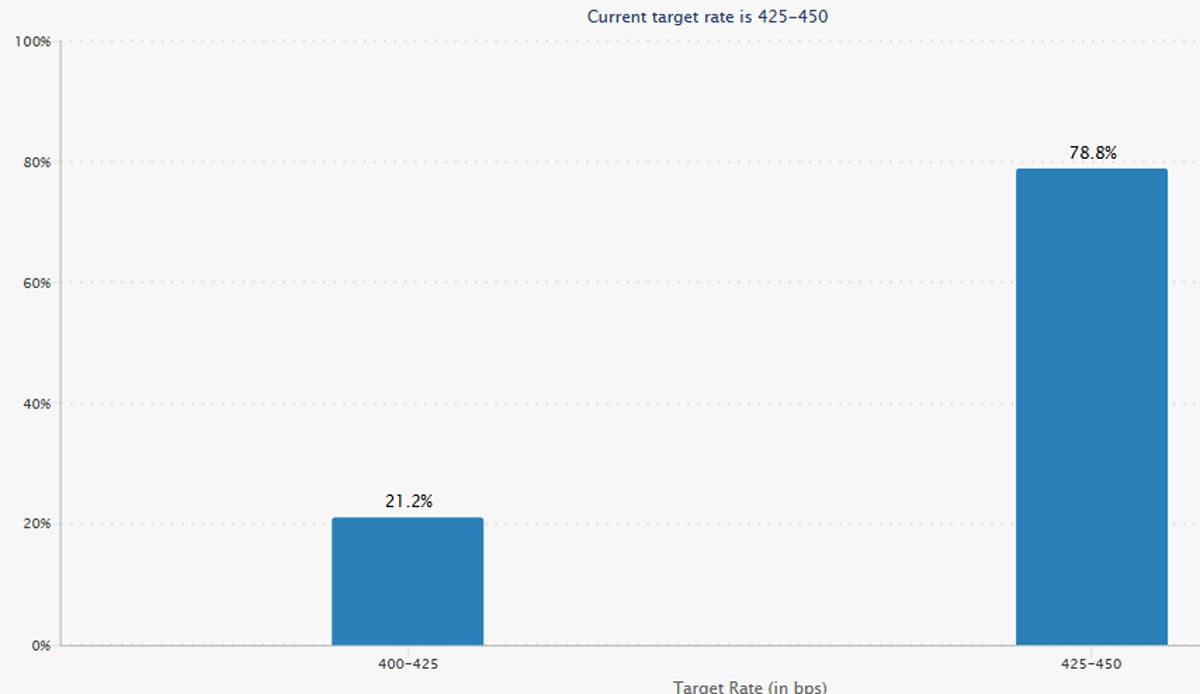

The weakening of the US dollar has further increased market expectations for a rate cut, with the CME FedWatch tool on July 2 recording a 21.2% probability of the Fed cutting interest rates in July, compared to 18.6% on June 27 and 14.5% on June 20.

The market is also betting heavily on the possibility that the Fed will cut interest rates at its meeting on September 17, with a probability of up to 91%. Of these, 72.3% expect a 0.25 percentage point cut and 18.8% predict a 0.5 percentage point cut, bringing interest rates to 3.75-4%/year.

While leaving open the possibility of easing monetary policy, Mr. Powell still emphasized the Fed's independence from political pressure, especially from President Donald Trump, who has repeatedly called for aggressive interest rate cuts.

At the conference in Sintra, ECB President Christine Lagarde urged delegates to give Powell a round of applause, praising him as “the epitome of a courageous central banker” for standing firm on economic data despite harsh criticism from Mr Trump.

Jerome Powell's dilemma and the US economic outlook

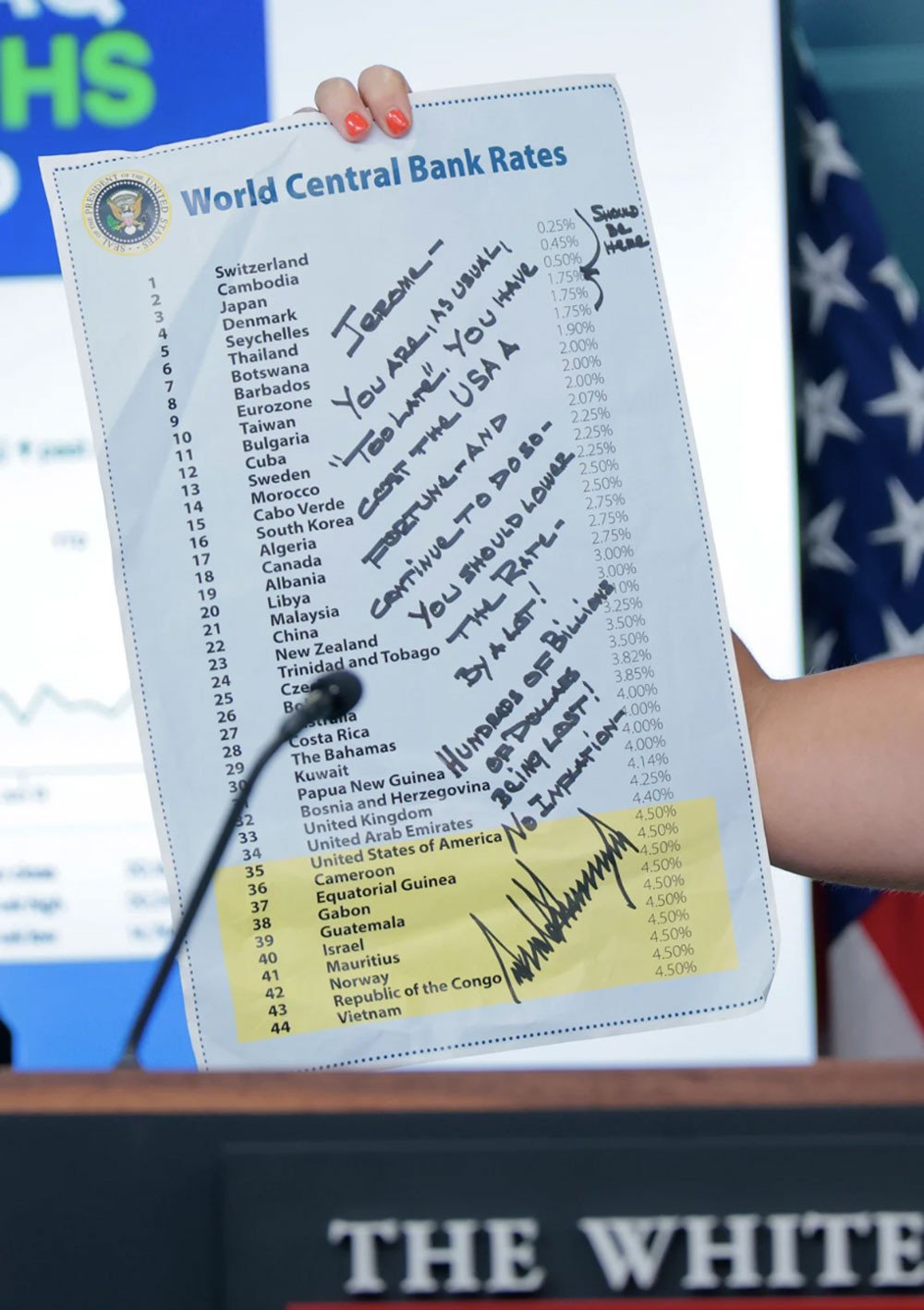

Fed Chairman Jerome Powell is facing a challenging situation. Pressure from President Trump has been mounting, from public criticism calling him an “idiot” to sending a letter demanding that interest rates be cut to 1% or lower, with comparison charts of central banks like Japan (0.5%) and Denmark (1.75%).

Mr. Donald Trump also accelerated plans to find a replacement for Powell when his term ends in May 2026, with potential candidates such as Kevin Warsh, Christopher Waller, Kevin Hassett, David Malpass and Treasury Secretary Scott Bessent.

The possibility that Mr. Trump could announce a successor as early as September or October is seen as a move to weaken Powell's power now.

On the US economy, recent indicators have sent mixed signals. The June jobs report is expected to show the US economy added 116,000 non- farm jobs, down from 139,000 in May, with the unemployment rate forecast to rise slightly to 4.3% from 4.2%. While the labour market remains strong, Fed Governor Michelle Bowman said it is “not as dynamic as it once was”.

Meanwhile, the personal consumption expenditures (PCE) price index - the Fed's preferred inflation gauge - showed price pressures rising in May, remaining above its 2% annual target. The tariffs imposed by Mr Trump since April have prompted the Fed to pause its plans to cut interest rates, due to concerns about rising inflation.

However, Treasury Secretary Scott Bessent said Mr Trump’s tariffs are unlikely to be as inflationary as the Fed fears and predicted the Fed would cut interest rates in September. This view is reinforced by a forecast from Goldman Sachs, which also expects the Fed to ease monetary policy in the fall, with three cuts in 2025.

Signals of lower interest rates and a weaker dollar could have significant impacts on the US and global economies. A weaker dollar typically supports higher commodity prices, especially gold.

The world gold price is currently fluctuating around 3,300-3,350 USD/ounce. If the Fed lowers interest rates, the gold price could exceed 3,400 USD/ounce, although profit-taking pressure still exists in the context of the Middle East gradually stabilizing.

Globally, the Fed’s easing of monetary policy could spur other central banks, such as the ECB or the Bank of Japan, to consider adjusting interest rates, thereby boosting global economic growth. However, the risk of inflation remains a concern, especially as Mr. Trump’s protectionist policies could increase the price of imports, putting pressure on American consumers and businesses.

In this context, the Fed's policy still has to balance the task of controlling inflation and protecting the labor market. However, Mr. Powell is inevitably confused when making decisions in the context of pressure from Mr. Trump and mixed economic data.

Source: https://vietnamnet.vn/dong-usd-xuong-day-3-5-nam-chu-tich-fed-dau-dau-truoc-ap-luc-tu-ong-trump-2417384.html

Comment (0)