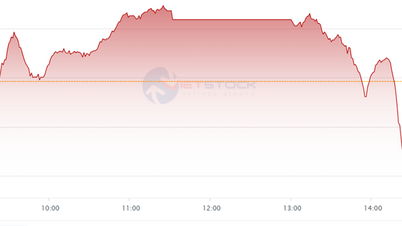

VN-Index increased slightly this morning - Photo: QUANG DINH

Industrial real estate stocks were sold heavily.

Closing the morning session on July 3, VN-Index increased more than 7 points compared to the reference, reaching 1,391 points. Liquidity on the HoSE floor reached more than 15,800 billion VND, significantly higher than the same time in many recent sessions.

The trend of high liquidity partly reflects investors' need to take profits after positive news about tariffs was announced.

In addition, as the index approaches the 1,400-point resistance level, selling pressure is also not small - something that many securities companies have warned investors about recently.

If calculated on all three floors, the total transaction value this morning reached nearly 17,600 billion VND, with more than 450 stocks increasing in price, while there were still more than 200 stocks decreasing in price.

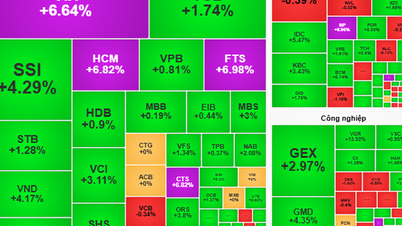

The stocks that contributed the most to the market's increase this morning were mainly bank stocks, including: VCB of Vietcombank (+1.03%), CTG of VietinBank (+1.91%), BID of BIDV (+0.7%), MBB of MBBank (+0.96%), HDB of HDBank (+2.02%).

In addition, stocks in the retail, steel, and real estate industries such as MWG of Mobile World, HPG of Hoa Phat , and VHM of Vinhomes also increased in price and were among the top 10 stocks that supported the index the most this morning.

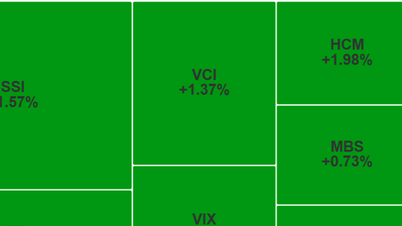

Securities stocks also recorded outstanding performance thanks to their sensitivity to market developments and prospects. The green board was covered with VIX (+5.49%), HCM (+1.98%), FTS (+1.76%), VCI (+1.37%), SSI (+1.57%)... Other stocks such as BSI, SHS, MBS, EVF also closed higher than the reference around a 1% increase.

On the contrary, a series of real estate stocks, especially industrial park real estate, were sold heavily, pulling the general index down, such as: GVR, BCM, SIP, VCG, VIC...

Regarding cash flow trends, the biggest bright spot this morning was the strong return of foreign investors. Foreign investors net bought more than VND1,000 billion, marking the second consecutive net buying session after a long streak of net selling.

Why is cash flow into stocks more active?

The market's rally this morning came on the heels of news of progress in tariff negotiations with the US.

Last night (Vietnam time), General Secretary To Lam had a phone call with US President Donald Trump about bilateral relations and reciprocal taxes. During the conversation, President Trump affirmed that the US will significantly reduce reciprocal taxes on many Vietnamese export products.

The S&P 500 index in the US stock market increased after President Trump announced that the US had reached a trade agreement with Vietnam. Nike, footwear companies, and Apple stocks all turned green, reflecting investors' optimism about the results of this preliminary negotiation.

According to experts, Vietnam becoming one of the first countries to reach an agreement with the US is a positive signal, not only reducing tariff uncertainty but also opening up great opportunities for exports, while creating more favorable conditions for US goods to access the Vietnamese market.

In addition, the Vietnamese market is also approaching the upgrade milestone. New information from state management agencies on this issue further strengthens investors' confidence.

Mr. Hoang Van Thu - Vice Chairman of the State Securities Commission - said that the commission has been making efforts to achieve the upgrade target in the FTSE assessment period scheduled for September 2025.

Rating organizations such as FTSE, MSCI and international investors all highly appreciate and believe in the upgrading process of Vietnam's stock market.

In recent times, this agency has implemented many solutions to create the most favorable conditions for foreign investors' trading activities.

The Ministry of Finance said it is finalizing the amendment of Decree 155/2020/ND-CP to remove obstacles and facilitate foreign investors in the Vietnamese stock market, including simplifying administrative procedures, increasing ownership ratios and ensuring safety for investment activities.

In addition, dialogue and investment promotion activities abroad are also being promoted; at the same time, preparations are being made to deploy technical mechanisms such as the Omnibus trading account and the Central Clearing Counterparty (CCP) mechanism.

Source: https://tuoitre.vn/chung-khoan-my-tang-thi-truong-viet-nam-phan-ung-ra-sao-truoc-tin-thue-quan-20250703122942288.htm

Comment (0)