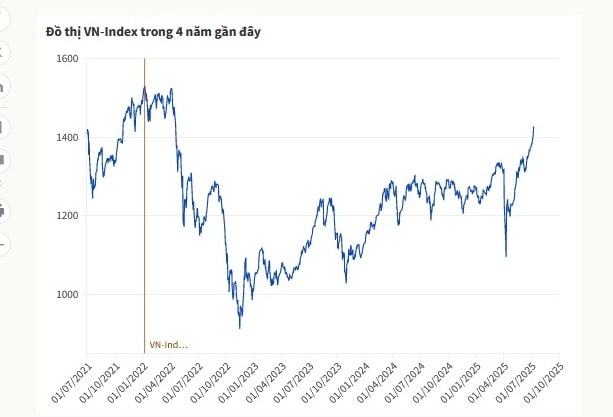

VN-Index was at 1,426 points in the mid-morning session on July 9. The excitement of domestic and foreign investors helped the index representing the Vietnamese stock market extend its four-session winning streak. Compared to the historical peak set in early January 2022, the index is still about 100 points, or 7%.

Mr. Tyler Nguyen Manh Dung, Senior Director of Market Strategy Research, HSC Securities Company, believes that the scenario of VN-Index conquering its historical peak this year is completely feasible.

Mr. Dung initially projected that the VN-Index could reach around 1,431 points by the end of this year and 1,521 points in the first half of next year. The forecasts were made in the context of the unclear level of tariffs from the US. Therefore, when the tariff picture gradually becomes clearer and more positive than predicted, Mr. Dung expects the market to have a psychological boost to prolong the state of excitement.

"Thanks to positive information about tariffs, the index has continuously broken through technical resistance after a long rally from the 1,300-point accumulation zone. The psychological thresholds we are monitoring are 1,400 points and 1,450 points before heading towards the 1,500-point mark," Mr. Dung said.

This expert commented that the current market context has many similarities with the period before the VN-Index surpassed the 1,400-point mark in 2021 and set a historic peak in early 2022.

First, the global value chain faces major challenges, first with Covid-19, and now with tariffs from the Trump administration. Second, Vietnam has maintained relative stability, demonstrated by its control of the pandemic four years ago and now with trade negotiations. The other factor is that monetary policy is being loosened to stimulate economic growth.

"The current economic outlook is even more positive as GDP growth is outperforming the pandemic period, domestic investment is increasing and institutional reforms are taking place strongly," Mr. Dung analyzed.

In addition to the macro factors that are the catalyst for the growth of VN-Index, Ms. Do Minh Trang, Director of the Analysis Center, ACB Securities Company, is optimistic about the possibility of the index re-establishing the old peak and reaching a new peak in the short term (next 3-6 months) thanks to the support of cash flow.

Last year, the average trading volume per session reached VND21,100 billion. After a sharp correction in early April due to tariff information, liquidity began to improve and reached an average of VND24,000 billion per session. The two most recent trading sessions have had stable liquidity at over VND28,000 billion, in which many large-cap stocks recorded matching orders worth thousands of billions.

Foreign investors also showed signs of a strong return after net withdrawal of VND40,700 billion in the first half of the year. Foreign investors have been buying for 6 consecutive sessions with a total net purchase value of more than VND8,000 billion.

"Foreign investors used to buy heavily when the market fell and sell when it turned up. Their trading trend now seems to have changed as they continuously disburse while the VN-Index is climbing to the top. This cash flow is contributing significantly to the index's growth," Ms. Trang commented.

For domestic investors, Mr. Tran Hoang Son, Director of Market Strategy, VPBank Securities Joint Stock Company (VPBankS), said that confidence also returned quickly. In addition to liquidity, Mr. Son cited the continuously increasing number of newly opened securities accounts. In the first half of this year, the market welcomed nearly 1 million new accounts, bringing the total to 10.2 million.

According to Mr. Son, stock market valuation is at an attractive level for a new growth cycle with P/E at 13.9 times, lower than the median P/E of the last 10 years (16.6 times).

He added that the market has many other catalysts to help the VN-Index return to its old peak. First, the probability of Vietnam's stocks being upgraded from frontier to emerging market in the September review is up to 70%, according to VPBankS. Thanks to that, the prospect of attracting active and passive capital flows is estimated at about 3-7 billion USD.

Second is the possibility of many IPO (initial public offering) deals and transfer of listing from HNX to HoSE in the period from now to 2027. The total value of these deals is expected to reach 47.5 billion USD, which is the driving force for the stock market to attract more foreign capital.

Finally, the profit growth of listed companies this year is expected to reach 16.5%. The main growth driver is still the financial group, while the non-financial group (real estate, energy, retail...) can increase by more than 10.4% in the context of an increasingly high comparison base.

"We once predicted that the VN-Index would fluctuate between 1,420 and 1,450 points, and now it is almost there. It is expected that in the next 6 months, the market will witness a threshold of 1,500 and 1,550 points," said Mr. Son.

Although optimistic about the scenario of setting a new peak this year, experts all emphasize that the market may experience many technical corrections.

VPBankS’s head of market strategy said that some technical indicators are entering the overbought zone, indicating that the market is heating up. He predicted that when the VN-Index approaches 1,430 points and 1,450 points, the market will correct, then continue to gain momentum to the new price zone.

Similarly, HSC experts believe that the recent increase is a positive signal but contains the risk of profit-taking pressure. Some technical support zones that Mr. Dung recommends investors to observe carefully are 1,380, 1,350 and 1,340 points.

"These could be strong bottom-fishing thresholds when corrections occur. However, the market outlook remains positive thanks to the strong return of foreign investors, which could shorten the correction and allow the VN-Index to regain its upward momentum soon. The market's correction due to profit-taking demand at the current stage could help consolidate long-term stability," said Mr. Dung.

HA (according to VnE)Source: https://baohaiphongplus.vn/chung-khoan-co-the-tai-lap-dinh-lich-su-415970.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)