The Vietnam Commodity Exchange (MXV) said that strong investment cash flows are returning to the world raw material market, with overwhelming buying power in yesterday's trading session. Notably, positive sentiment is spreading in the energy market after the US President said he had reached a trade agreement with Vietnam.

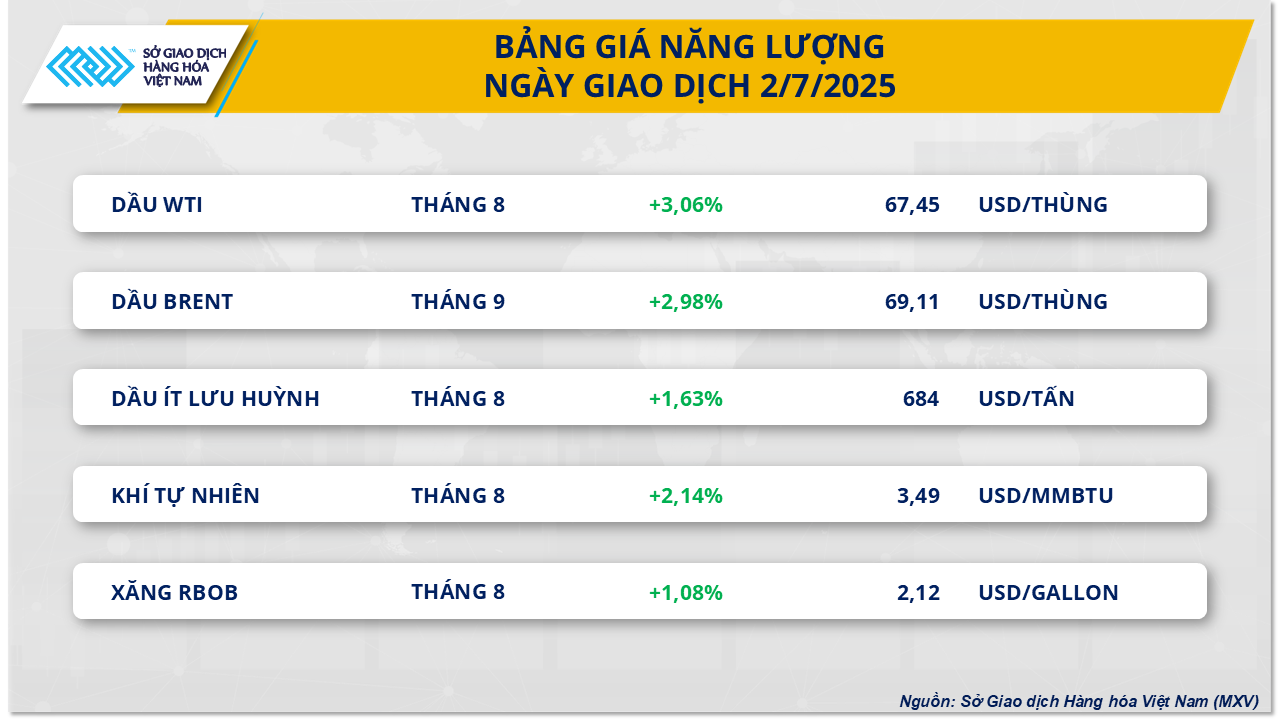

In the energy market, according to MXV, buying power dominated the energy market in yesterday's trading session. In particular, WTI oil price stopped at 67.45 USD/barrel, up 3.06%; Brent oil price is approaching the threshold of 70 USD/barrel, closing the session at 69.11 USD/barrel, up 2.98%.

The main reason supporting the increase in oil prices comes from positive signals from trade negotiations between the US and Vietnam and concerns about the risk of political tensions escalating again in the Middle East.

Yesterday (July 2), in his latest post on the social network Truth Social, US President Donald Trump provided some details about the trade agreement with Vietnam. In it, the two sides agreed that the US tax rate applied to most goods exported from Vietnam will be 20%. For transit goods, the tax rate applied is 40%. Notably, Vietnam committed to reducing the tax rate on imported goods from the US to 0%, creating more favorable conditions for US businesses to access the Vietnamese market.

In another development, concerns about the political situation in the Middle East continued to increase after Iranian President Masoud Pezeshkian signed a new law that came into effect yesterday, based on a decision passed by the parliament earlier. According to the new regulation, any future inspections of Iran's nuclear energy facilities by the International Atomic Energy Agency (IAEA) must be approved by Tehran's Supreme National Security Council.

Responding to this move, US State Department spokeswoman Tammy Bruce affirmed that this was an “unacceptable” action. Previously, the long-standing disagreements between the US and Iran regarding Tehran’s controversial nuclear program had become the main cause of tension and conflict with Israel - a close ally of the US with a tough stance on Iran. This development had caused oil prices to skyrocket during the 12 days of conflict between the two countries.

On the other hand, data from the latest weekly report of the US Energy Information Administration (EIA) showed that commercial crude oil reserves in the US increased sharply by 3.8 million barrels in the week ending June 27. The American Petroleum Institute (API) also recorded a similar trend, with an estimated increase of 680,000 barrels.

U.S. crude inventories continued to rise, rising by 4.19 million barrels last week, while refinery supplies fell by 491,000 barrels. This development raises concerns about gasoline demand in the U.S. as the summer gets underway. Currently, gasoline demand in the U.S. is estimated at only 8.6 million barrels/day, lower than the 9 million barrels/day threshold that is considered stable during the peak season.

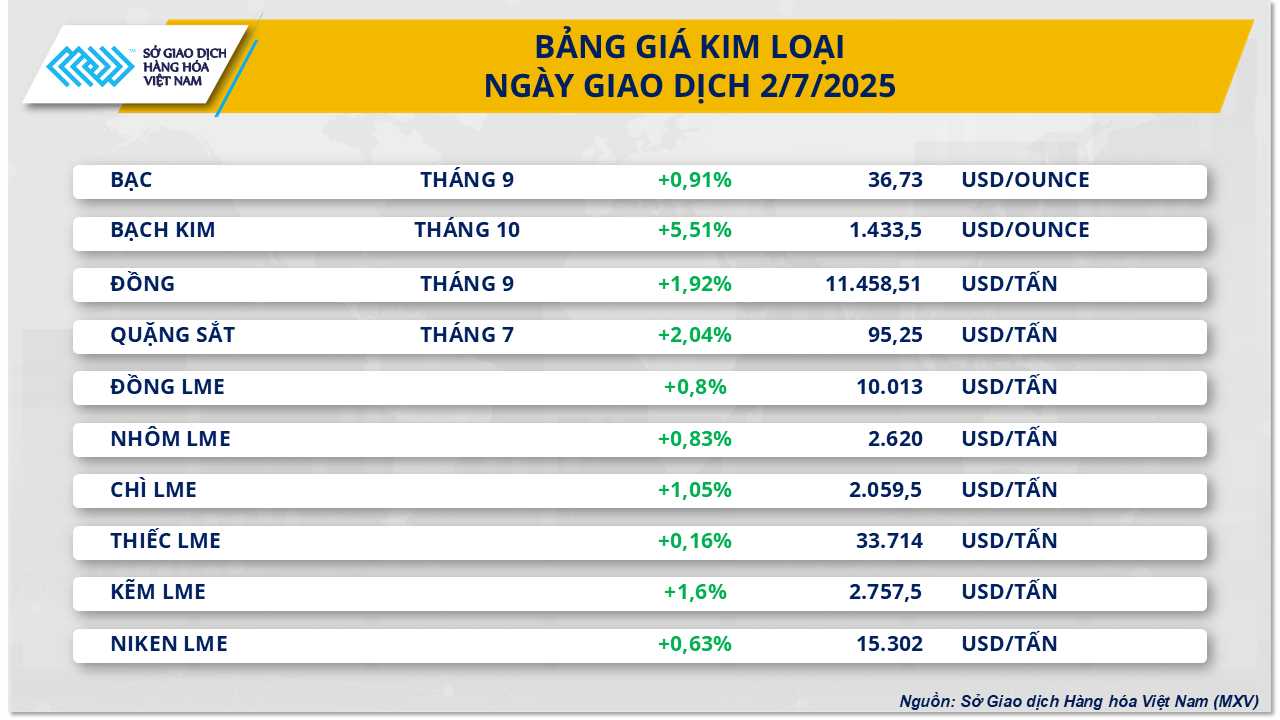

Yesterday's metal market also saw all 10 commodities in the group rise. According to MXV, this increase mainly came from market expectations that the US will loosen monetary policy and concerns about the risk of local supply shortages.

At the end of the session, platinum prices extended their upward trend by 5.51% to $1,433/ounce, continuing to anchor at a record price in nearly 11 years.

Precious metals prices rose in yesterday's trading session after the ADP national employment report showed that the number of private sector jobs in the US fell for the first time in more than two years in June, raising hopes among many investors that the US Federal Reserve (FED) could cut interest rates in September.

Traders are now focusing on the key data in the US Labor Department's June jobs report, which will be released a day before the US Fourth of July holiday. Nonfarm payrolls are forecast to increase by 110,000, down from the 139,000 increase in May.

In addition, platinum's growth momentum was also reinforced by the global supply shortage that has lasted for the third consecutive year, along with increasing demand for platinum in the jewelry industry in China.

Source: https://baolamdong.vn/thi-truong-hang-hoa-3-7-luc-mua-ap-dao-tren-thi-truong-380918.html

Comment (0)