Domestic gold price today July 4, 2025: SJC shockingly drops 400 thousand VND per tael

At the time of the survey on the morning of July 4, 2025, domestic gold prices decreased simultaneously at most major brands. This is a remarkable signal, reflecting the general downward trend of the gold market in the context of fluctuating global economic factors. Specifically:

The price of SJC gold bars in Hanoi was listed at VND118.9 million/tael (buy) and VND120.9 million/tael (sell), down VND400,000/tael in both directions compared to the previous session. This trend was also recorded in other areas such as Ho Chi Minh City and Da Nang.

At DOJI Group, the gold price today also dropped sharply, with the price of 118.9 million VND/tael (buy) and 120.9 million VND/tael (sell), down 400 thousand VND/tael in both directions. This is a significant decrease, attracting the attention of investors.

Mi Hong Gold and Gemstone Company recorded prices of VND119.5 million/tael (buy) and VND120.7 million/tael (sell), a slight decrease of VND300,000/tael in both directions.

Meanwhile, the gold price at PNJ remained unchanged at VND114.8 million/tael (buy) and VND117.4 million/tael (sell). This is the only brand that did not record any fluctuations today, making a difference compared to the general downward trend of the market.

Vietinbank Gold listed the selling price at 120.9 million VND/tael, down 400,000 VND/tael, while the buying price has not been announced.

At Bao Tin Minh Chau, gold prices also decreased steadily to 118.9 million VND/tael (buy) and 120.9 million VND/tael (sell), down 400 thousand VND/tael in both trading directions.

Finally, the gold price in Phu Quy is also not out of the downward trend, at 118.2 million VND/tael (buy) and 120.9 million VND/tael (sell), down 400 thousand VND/tael in both directions.

Gold price trend forecast today 7/4/2025

Gold prices today, July 4, 2025, show a downward trend across the entire market, with a common decrease of 300 - 400 thousand VND/tael at major brands. This may stem from downward pressure on the world gold market, as investors await new signals from economic policy.

This bearish trend may provide an opportunity for investors who have been waiting to buy at low prices. However, close monitoring of economic developments and monetary policy is essential to make appropriate investment decisions.

Latest detailed gold price update table today July 4, 2025

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 118.9 | ▼400K | 120.9 | ▼400K |

| DOJI Group | 118.9 | ▼400K | 120.9 | ▼400K |

| Red Eyelashes | 119.5 | ▼300K | 120.7 | ▼300K |

| PNJ | 114.8 | - | 117.4 | - |

| Vietinbank Gold | 120.9 | ▼400K | ||

| Bao Tin Minh Chau | 118.9 | ▼400K | 120.9 | ▼400K |

| Phu Quy | 118.2 | ▼400K | 120.9 | ▼400K |

| 1. DOJI - Updated: 7/4/2025 10:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 118,900 ▼400K | 120,900 ▼400K |

| AVPL/SJC HCM | 118,900 ▼400K | 120,900 ▼400K |

| AVPL/SJC DN | 118,900 ▼400K | 120,900 ▼400K |

| Raw material 9999 - HN | 108,300 ▼500K | 112,500 ▼500K |

| Raw material 999 - HN | 108,200 ▼500K | 112,400 ▼500K |

| 2. PNJ - Updated: 7/4/2025 10:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,800 | 117,400 |

| HCMC - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Hanoi - PNJ | 114,800 | 117,400 |

| Hanoi - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Da Nang - PNJ | 114,800 | 117,400 |

| Da Nang - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Western Region - PNJ | 114,800 | 117,400 |

| Western Region - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Jewelry gold price - PNJ | 114,800 | 117,400 |

| Jewelry gold price - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Jewelry gold price - Southeast | PNJ | |

| Jewelry gold price - SJC | 118,900 ▼400K | 120,900 ▼400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,800 | 117,400 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,800 | 117,400 |

| Jewelry gold price - Jewelry gold 999.9 | 114,100 | 116,600 |

| Jewelry gold price - Jewelry gold 999 | 113,980 | 116,480 |

| Jewelry gold price - Jewelry gold 9920 | 113,270 | 115,770 |

| Jewelry gold price - Jewelry gold 99 | 113,030 | 115,530 |

| Jewelry gold price - 750 gold (18K) | 80,100 | 87,600 |

| Jewelry gold price - 585 gold (14K) | 60,860 | 68,360 |

| Jewelry gold price - 416 gold (10K) | 41,160 | 48,660 |

| Jewelry gold price - 916 gold (22K) | 104,410 | 106,910 |

| Jewelry gold price - 610 gold (14.6K) | 63,780 | 71,280 |

| Jewelry gold price - 650 gold (15.6K) | 68,440 | 75,940 |

| Jewelry gold price - 680 gold (16.3K) | 71,940 | 79,440 |

| Jewelry gold price - 375 gold (9K) | 36,380 | 43,880 |

| Jewelry gold price - 333 gold (8K) | 31,130 | 38,630 |

| 3. SJC - Updated: 7/4/2025 10:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,900 ▼400K | 120,900 ▼400K |

| SJC gold 5 chi | 118,900 ▼400K | 120,920 ▼400K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,900 ▼400K | 120,930 ▼400K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,200 ▼300K | 116,800 ▼300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,200 ▼300K | 116,700 ▼300K |

| Jewelry 99.99% | 114,200 ▼300K | 116,100 ▼300K |

| Jewelry 99% | 110,450 ▼297K | 114,950 ▼297K |

| Jewelry 68% | 72,205 ▼204K | 79,105 ▼204K |

| Jewelry 41.7% | 41,668 ▼125K | 48,568 ▼125K |

World gold price today 7/4/2025: Trump announces 10-50% tax

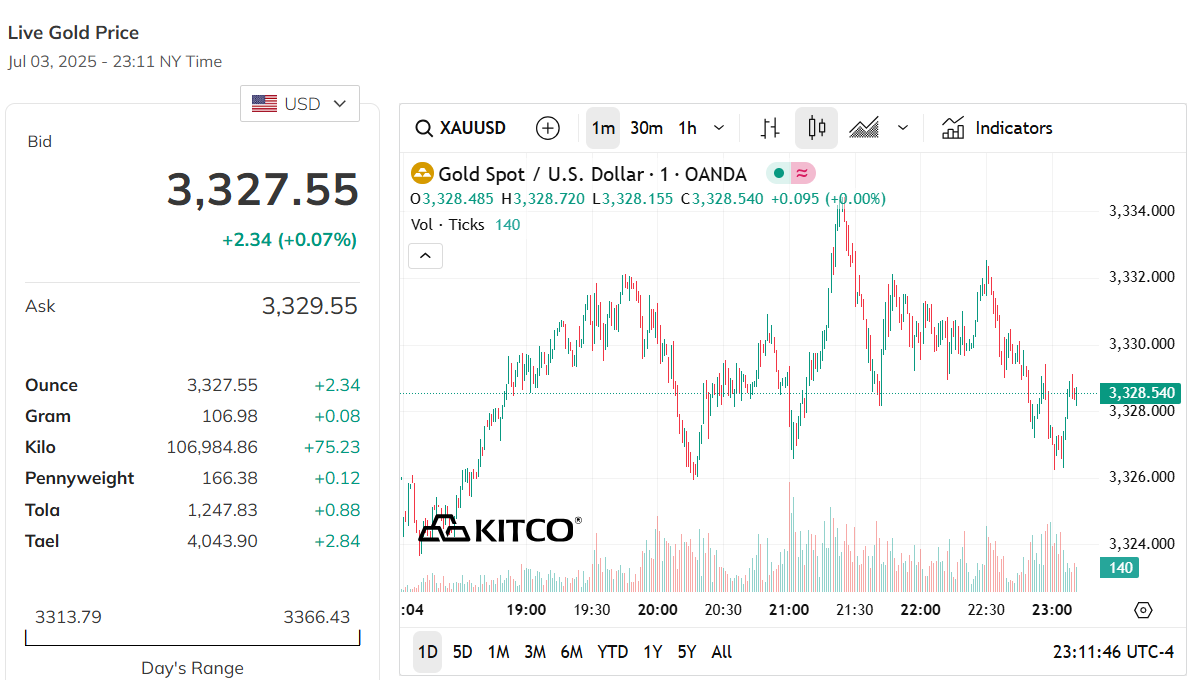

World gold price, at 10:00 on July 4, 2025 (Vietnam time), the world spot gold price was at 3,327.55 USD/ounce. Today's gold price increased by 2.34 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,370 VND/USD), the world gold price is about 110.08 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (118.9-120.9 million VND/tael), the current SJC gold price is about 10.1 million higher than the international gold price.

Gold prices today, July 4, 2025, on the world market are showing a slight upward trend. According to the latest information, the spot gold price increased by 0.1%, reaching 3,329.67 USD per ounce. Since the beginning of the week, the gold price has increased by a total of 1.7%, showing a positive trend. This is driven by important economic and political developments in the US, especially related to fiscal policy and interest rates.

One of the main factors affecting gold prices today is the US Congress's passage of a tax cut and spending bill proposed by President Donald Trump. The bill not only supports immigration policies but also extends tax cuts from 2017 and adds new tax incentives. However, the bill raises concerns about the US financial situation. According to estimates, it could increase the national debt by $3.4 trillion over a decade. This is seen as a positive signal for gold prices, because when the dollar weakens in the long term, gold often becomes a more attractive investment option.

In addition, the US labor market is also affecting gold prices today. The latest data shows that US companies added 147,000 jobs in June, exceeding expectations, and the unemployment rate fell to 4.1%. These figures show that the economy remains strong, allowing the Federal Reserve to keep interest rates unchanged. In the context of no interest rate increase, gold - an asset that does not pay interest - becomes more attractive to investors. The reason is that when interest rates are low, holding gold is less expensive than other assets such as bonds.

In addition, President Trump's trade policies also contributed to supporting gold prices today. He announced that he would impose import tariffs ranging from 10% to 50% and begin sending notices of these tariffs from July 4, 2025. If these tariffs are implemented without negotiations, the dollar could weaken, creating conditions for gold prices to rise further. Gold has long been considered a safe asset in times of economic and geopolitical uncertainty, and these policies are reinforcing that role.

In summary, the gold price today, July 4, 2025, in the world market is being supported by factors such as expansionary fiscal policy, stable interest rates and instability from trade policy. These factors make gold continue to be a notable investment choice in the context of a volatile global economy.

Gold price assessment today 7/4/2025

According to the latest jobs report from the Bureau of Labor Statistics, the US economy added 147,000 non-farm jobs in June, far exceeding the 111,000 economists expected. Notably, the unemployment rate unexpectedly fell to 4.1%, down from 4.2% in May and contrary to the forecast of an increase to 4.3%. These figures reinforce confidence in the strength of the US economy, reducing expectations that the US Federal Reserve (FED) will soon loosen monetary policy.

Strong economic data has investors believing the Fed may delay a rate cut. Chris Zaccarelli, chief investment officer at Northlight Asset Management, said the Fed may not cut rates until late in the third quarter or even the fourth quarter of this year. Higher interest rates continue to weigh on gold, which typically suffers when the dollar strengthens and other investment opportunities become more attractive.

The jobs report also showed that U.S. wage inflation is slowing, with average hourly earnings rising just 0.2% in June, below expectations of 0.3%. This eased concerns about inflationary pressures, boosting optimism in the stock market. On Wall Street, major indexes all rose sharply: the Dow Jones rose 344 points, the Nasdaq rose 207 points, and the S&P 500 rose 51 points. The stock market boom may have encouraged investors to sell gold and move capital into stocks, contributing to the decline in gold prices.

Analysts say gold prices could remain under pressure in the short term if US economic data remains positive and the Fed maintains its high interest rate policy. Spot gold is currently at its lowest level in a week. Without any unexpected factors to support, the downward trend of the precious metal could continue.

Gold fell nearly 0.9% to $3,327.18 an ounce on Thursday. It fell another 1% to $3,323.70 on Friday. The number of weekly jobless claims fell to 233,000, with the four-week average continuing to improve, further reinforcing the positive picture of the US labor market.

Despite the positive jobs data, some experts warn that the majority of new jobs are coming from the public sector, which poses a risk of unsustainability. However, with wage inflation slowing and the labor market remaining strong, the Fed has reason to maintain a cautious stance. These factors continue to pose challenges for gold prices in the short term, making it difficult for the precious metal to recover without a major change in the global economic landscape.

Source: https://baodanang.vn/gia-vang-hom-nay-4-7-2025-sjc-roi-tu-do-pnj-tro-li-dinh-120-trieu-van-tru-vung-vang-the-gioi-phuc-hoi-3264922.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)