Domestic gold price today 7/3/2025

As of 4:30 a.m. on July 3, 2025, the domestic gold bar price is based on the closing price yesterday, July 2. Specifically:

The price of SJC gold bars listed by DOJI Group is at 118.7-120.7 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.7-120.7 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.5-120.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 300 thousand VND/tael for buying - unchanged for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.7-120.7 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.1-120.7 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 4:30 a.m. on July 3, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.4-117.4 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell); the gold price remained unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, July 3, 2025 is as follows:

| Gold price today | July 3, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118.7 | 120.7 | - | - |

| DOJI Group | 118.7 | 120.7 | - | - |

| Red Eyelashes | 119.5 | 120.5 | +300 | - |

| PNJ | 118.7 | 120.7 | - | - |

| Bao Tin Minh Chau | 118.7 | 120.7 | - | - |

| Phu Quy | 118.1 | 120.7 | - | - |

| 1. DOJI - Updated: 7/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,700 | 120,700 |

| AVPL/SJC HCM | 118,700 | 120,700 |

| AVPL/SJC DN | 118,700 | 120,700 |

| Raw material 9999 - HN | 108,200 ▼1200K | 112,400 |

| Raw material 999 - HN | 108,100 ▼1200K | 112,300 |

| 2. PNJ - Updated: 7/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,500 | 117,000 |

| HCMC - SJC | 118,700 | 120,700 |

| Hanoi - PNJ | 114,500 | 117,000 |

| Hanoi - SJC | 118,700 | 120,700 |

| Da Nang - PNJ | 114,500 | 117,000 |

| Da Nang - SJC | 118,700 | 120,700 |

| Western Region - PNJ | 114,500 | 117,000 |

| Western Region - SJC | 118,700 | 120,700 |

| Jewelry gold price - PNJ | 114,500 | 117,000 |

| Jewelry gold price - SJC | 118,700 | 120,700 |

| Jewelry gold price - Southeast | PNJ | 114,500 |

| Jewelry gold price - SJC | 118,700 | 120,700 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,500 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,500 | 117,000 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,500 | 117,000 |

| Jewelry gold price - Jewelry gold 999.9 | 113,900 | 116,400 |

| Jewelry gold price - Jewelry gold 999 | 113,780 | 116,280 |

| Jewelry gold price - Jewelry gold 9920 | 113,070 | 115,570 |

| Jewelry gold price - Jewelry gold 99 | 112,840 | 115,340 |

| Jewelry gold price - 750 gold (18K) | 79,950 | 87,450 |

| Jewelry gold price - 585 gold (14K) | 60,740 | 68,240 |

| Jewelry gold price - 416 gold (10K) | 41,070 | 48,570 |

| Jewelry gold price - 916 gold (22K) | 104,220 | 106,720 |

| Jewelry gold price - 610 gold (14.6K) | 63,650 | 71,150 |

| Jewelry gold price - 650 gold (15.6K) | 68,310 | 75,810 |

| Jewelry gold price - 680 gold (16.3K) | 71,800 | 79,300 |

| Jewelry gold price - 375 gold (9K) | 36,300 | 43,800 |

| Jewelry gold price - 333 gold (8K) | 31,060 | 38,560 |

| 3. SJC - Updated: 7/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,700 | 120,700 |

| SJC gold 5 chi | 118,700 | 120,720 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,700 | 120,730 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 ▼300K | 116,500 ▼300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 ▼300K | 116,600 ▼300K |

| Jewelry 99.99% | 114,000 ▼300K | 115,900 ▼300K |

| Jewelry 99% | 110,252 ▼297K | 114,752 ▼297K |

| Jewelry 68% | 72,069 ▼204K | 78,969 ▼204K |

| Jewelry 41.7% | 41,585 ▼125K | 48,485 ▼125K |

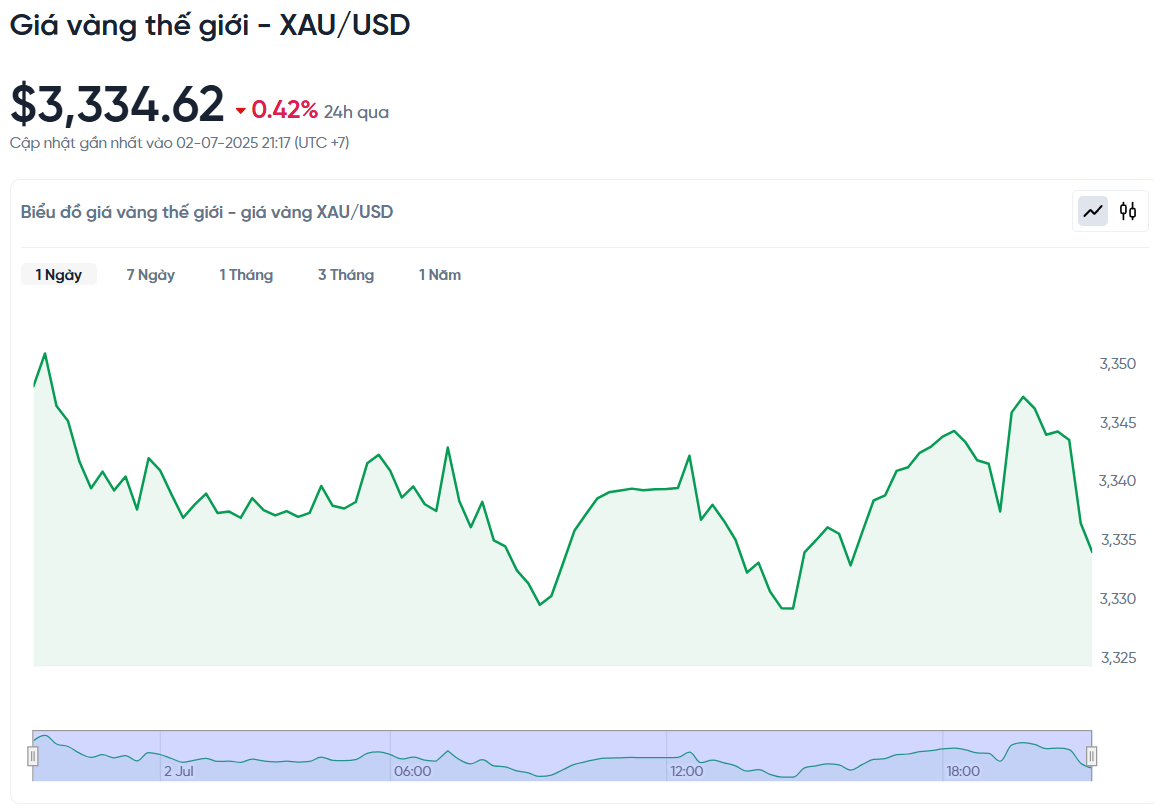

World gold price today 7/3/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 3, Vietnam time, was 3,336.27 USD/ounce. Today's gold price decreased by 14.11 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,323 VND/USD), the world gold price is about 109.3 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.4 million VND/tael higher than the international gold price.

Gold prices fell slightly after weaker-than-expected US jobs data raised hopes that the Fed could cut interest rates in the near future. Specifically, spot gold prices fell 0.42%, while US gold futures also fell slightly 0.1% to $3,347.4/ounce.

The number of private payrolls in the US unexpectedly fell in June, while the number of jobs increased less than expected last month, according to the ADP report. This has led investors to raise expectations that the Fed will cut interest rates by a total of 67 basis points this year, higher than the previous forecast of 64 basis points.

Tai Wong, an independent metals trader, said: 'The negative 33,000 ADP jobs figure, the first decline since early 2023, helped limit the downside in gold prices.'

Earlier, data showed the number of US job openings unexpectedly rose in May, but the hiring rate fell, adding to evidence that the labor market is losing momentum. Fed Chairman Jerome Powell said the central bank would be patient before deciding on further interest rate cuts, but he did not rule out an adjustment at its next meeting this month.

It all depends on new economic data, especially the Non-Farm Payrolls report due out on Thursday. If the results are negative, the possibility of the Fed cutting interest rates as early as July is entirely possible.

Gold is often seen as a hedge against risk in times of uncertainty, while also benefiting from a low-interest-rate environment. Investors are also closely watching developments on U.S. tariffs ahead of a July 9 deadline, as well as President Trump’s tax and spending bill that could add $3.3 trillion to the national debt, which is due to go to the House of Representatives for final approval.

Besides gold, silver price also increased by 0.7% to 36.33 USD/ounce, platinum increased by 1.9% to 1,375.91 USD, while palladium increased by 1.9% to 1,120.87 USD.

Gold Price Forecast

The gold market is witnessing a slight correction after a series of US economic data showed that the labor market is still quite strong. Specifically, the number of new jobs created in May increased to the highest level since the beginning of the year, far exceeding analysts' forecasts. This makes many people believe that the US economy is still on the recovery path, reducing expectations that the Federal Reserve (Fed) will cut interest rates soon.

Not only the labor market, the manufacturing sector also showed positive signs when the PMI index in June increased slightly, although it was still below the 50-point threshold, the dividing line between growth and recession. This shows that the rate of decline in the manufacturing sector is slowing down thanks to improvements in output and inventory management.

However, gold prices are still supported by a weaker US dollar and falling US bond yields. Many investors still expect that the Fed may have to cut interest rates in the future if the global economy continues to show signs of slowing.

According to experts, gold prices are benefiting from uncertainties over US tariff policies and concerns about the fiscal situation. In addition, geopolitical tensions and demand for gold from central banks are still strongly supporting the market.

In the first half of 2025, gold prices increased by nearly 25%, continuing the strong increase from 2024. Silver and platinum also recorded significant growth and are forecast to remain high in the coming time.

Gold prices are forecast to increase by about 35% year-on-year in 2025, thanks to strong investment demand and geopolitical uncertainties. However, prices may decline slightly in 2026 if some risk factors are resolved.

However, experts believe that gold prices will remain much higher than in the previous period, even about 150% higher than the average level in the period 2015-2019. The risk of prices continuing to increase remains, especially if geopolitical tensions persist and negatively impact global financial markets.

Source: https://baonghean.vn/gia-vang-hom-nay-3-7-2025-gia-vang-trong-nuoc-va-the-gioi-giu-gia-muc-cao-gan-121-trieu-dong-luong-10301456.html

Comment (0)