Update gold price today 7/10/2025 latest in domestic market

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 118.8 | ▲200 | 120.8 | ▲200 |

| DOJI Group | 118.8 | ▲200 | 120.8 | ▲200 |

| Red Eyelashes | 119.6 | ▲200 | 121.0 | - |

| PNJ | 114.3 | ▲200 | 117.2 | ▲200 |

| Vietinbank Gold | 120.8 | ▲200 | ||

| Bao Tin Minh Chau | 118.8 | ▲200 | 120.8 | ▲200 |

| Phu Quy | 118.1 | ▲200 | 120.8 | ▲200 |

At the time of survey at 10:00 on July 10, 2025, domestic gold prices recorded a slight increase in all major brands, creating excitement and investment opportunities for the market. Specifically:

In Hanoi, SJC gold price was listed at 118.8 million VND/tael (buy) and 120.8 million VND/tael (sell), an increase of 200 thousand VND/tael in both directions compared to yesterday.

DOJI Group also recorded a similar increase, with gold bar prices reaching 118.8-120.8 million VND/tael.

In Ho Chi Minh City, Mi Hong gold price has slightly adjusted in the buying direction, reaching 119.6 million VND/tael, an increase of 200 thousand VND/tael. Meanwhile, the selling price remains unchanged at 121 million VND/tael.

DOJI Group also recorded a similar increase, with gold bar prices reaching 114.3-117.2 million VND/tael.

At other brands such as Vietinbank Gold, the selling price increased to 120.8 million VND/tael, an increase of 200 thousand VND/tael. Bao Tin Minh Chau Company also recorded a similar increase, with the listed price of 118.8-120.8 million VND/tael.

In Phu Quy, today's gold price increased to 118.1 million VND/tael (buy) and 120.8 million VND/tael (sell), an increase of 200 thousand VND/tael in both directions.

Gold price trend forecast today 7/10/2025

With a slight upward trend in most major brands, today's gold price on July 10, 2025 continues to confirm the recovery of the gold market. This is an ideal time for investors to consider appropriate strategies to optimize profits. Stay tuned for the latest gold price updates today.

Gold price list this afternoon 7/10/2025 in the country in detail:

| 1. DOJI - Updated: 10/7/2025 10:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 118,800 ▲200K | 120,800 ▲200K |

| AVPL/SJC HCM | 118,800 ▲200K | 120,800 ▲200K |

| AVPL/SJC DN | 118,800 ▲200K | 120,800 ▲200K |

| Raw material 9999 - HN | 108,100 ▲200K | 112,200 ▲200K |

| Raw material 999 - HN | 108,000 ▲200K | 112,100 ▲200K |

| 2. PNJ - Updated: 10/7/2025 10:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC PNJ gold bars | 118,800,000 ▲200,000 | 120,800,000 ▲200,000 |

| PNJ 9999 plain gold ring | 114,300,000 ▲200,000 | 117,200,000 ▲200,000 |

| Kim Bao 9999 Gold | 114,300,000 ▲200,000 | 117,200,000 ▲200,000 |

| Gold Phuc Loc Tai 9999 | 114,300,000 ▲200,000 | 117,200,000 ▲200,000 |

| PNJ Gold Bar - Phuong Hoang | 114,300,000 ▲200,000 | 117,200,000 ▲200,000 |

| PNJ 9999 Gold Jewelry | 113,800,000 ▲300,000 | 116,300,000 ▲300,000 |

| PNJ 24K Gold Jewelry | 113,680,000 ▲300,000 | 116,180,000 ▲300,000 |

| 916 Gold (22K) | 104,130,000 ▲270,000 | 106,630,000 ▲270,000 |

| 18K PNJ Gold | 79,880,000 ▲230,000 | 87,380,000 ▲230,000 |

| 680 Gold (16.3K) | 71,730,000 ▲200,000 | 79,230,000 ▲200,000 |

| 650 Gold (15.6K) | 68,250,000 ▲200,000 | 75,750,000 ▲200,000 |

| 610 Gold (14.6K) | 63,590,000 ▲180,000 | 71,090,000 ▲180,000 |

| 14K PNJ Gold | 60,690,000 ▲180,000 | 68,190,000 ▲180,000 |

| 416 Gold (10K) | 41,030,000 ▲120,000 | 48,530,000 ▲120,000 |

| 375 Gold (9K) | 36,260,000 ▲110,000 | 43,760,000 ▲110,000 |

| 333 Gold (8K) | 31,030,000 ▲100,000 | 38,530,000 ▲100,000 |

| 3. SJC - Updated: 10/7/2025 10:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,800 ▲200K | 120,800 ▲200K |

| SJC gold 5 chi | 118,800 ▲200K | 120,820 ▲200K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,800 ▲200K | 120,830 ▲200K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,200 ▲200K | 116,700 ▲200K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,200 ▲200K | 116,800 ▲200K |

| Jewelry 99.99% | 114,200 ▲200K | 116,100 ▲200K |

| Jewelry 99% | 110,450 ▲198K | 114,950 ▲198K |

| Jewelry 68% | 72,205 ▲136K | 79,105 ▲136K |

| Jewelry 41.7% | 41,668 ▲83K | 48,568 ▲83K |

Update gold price today July 10, 2025 latest on the world market

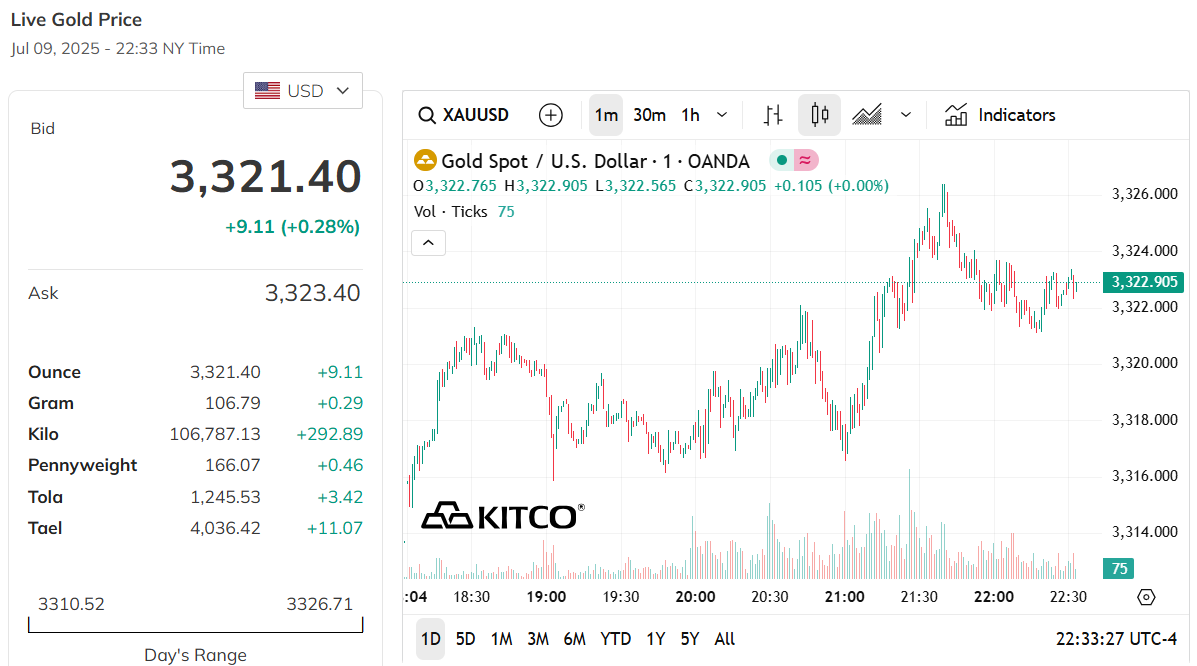

World gold price, at 09:30 on July 10, 2025 (Vietnam time), the world spot gold price was at 3,321.4 USD/ounce. Today's gold price increased by 9.11 USD compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,310 VND/USD), world gold is priced at about 105.14 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (118.8-120.8 million VND/tael), the current SJC gold price is about 15.66 million higher than the international gold price.

On July 10, 2025, the price of gold on the world market today increased slightly, reaching $3,322.46 per ounce. This increase in price is partly due to the slight decrease in the US dollar and bond yields. When the dollar weakens, gold becomes cheaper for people using other currencies, making more people want to buy gold. Similarly, when bond yields decrease, holding gold – a non-yielding asset – becomes more attractive because investors do not have to give up too much profit from other investments.

The gold market is also being affected by US President Donald Trump’s trade policies. Trump has stepped up tariffs, imposing a 50% tax on US copper and Brazilian goods starting August 1. He has also announced a 25% tax on seven other countries, including South Korea and Japan, unless a trade deal is reached. These moves are being closely watched by investors, as tariffs could increase commodity prices and put pressure on the economy, which in turn could impact gold prices.

Still, the market seems to have gotten used to the tariff news. One analyst said the constant tariff announcements are no longer causing as much volatility as they used to. Investors are waiting for a new factor to change the market trend. Meanwhile, Mr. Trump said that trade negotiations with China and the European Union are going well, which could help stabilize the gold market in the short term.

On interest rate policy, the minutes of the US Federal Reserve's mid-June meeting showed that most officials did not want to cut interest rates this month. They were concerned that Mr. Trump's tariff policies could increase inflation, making it difficult to cut interest rates. Instead, the Fed is expected to keep interest rates steady at its next meeting in late July. High interest rates usually make gold less attractive, but gold prices still rose today thanks to other factors such as a weak dollar and cautious investor sentiment.

In addition to gold, other precious metals also had small changes. Silver prices rose slightly to $36.41 per ounce, while platinum fell to $1,343.22 and palladium rose slightly to $1,106.25. These fluctuations show that the precious metals market is responding to global economic and trade factors, with gold prices today, July 10, 2025, still the focus of attention.

News, gold price trends today 7/10/2025

Gold prices today, July 10, 2025, on the world market are attracting the attention of many investors after a sharp increase in the first half of the year. According to Mr. Ole Hansen, an expert from Saxo Bank, gold, silver and platinum prices still have the potential to continue to increase in the second half of the year thanks to strong supporting factors. Although gold is moving sideways around $3,322.46/ounce, lower than the peak of $3,500/ounce in April, he believes that gold prices have not reached their limit.

A major reason why gold prices are expected to rise today is the possibility of lower US interest rates. When interest rates are low, holding gold becomes more attractive because it is less competitive with interest-bearing assets such as bonds. In addition, gold is favored because it is neutral, not dependent on the creditworthiness of any country. This explains why many central banks are buying gold for their reserves.

A weaker US dollar is also supporting gold prices today. When the dollar falls, gold becomes cheaper for investors using other currencies, stimulating demand. However, in some regions such as Switzerland and Europe, the increase in gold prices is more modest, only about 11% since the beginning of the year. However, factors such as inflation, geopolitical tensions and trade conflicts are providing momentum for gold and other precious metals.

Despite positive signs in the US economy, such as a 9.4% increase in home loan demand in the first week of July, gold has maintained its appeal. Although the world's largest gold ETF has reduced its holdings and the dollar has recovered at times, gold prices have not been sold off sharply today. This shows that gold is still an asset that many people trust. If the US Federal Reserve (Fed) cuts interest rates sooner than expected, gold prices could rise more sharply in the near future.

Source: https://baodanang.vn/gia-vang-hom-nay-10-7-2025-vang-lai-ra-vang-sjc-phuc-hoi-sat-dinh-121-trieu-vang-the-gioi-tang-nho-dong-do-la-yeu-3265379.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)