On July 8, UOB Bank (Singapore) released its report on Vietnam's economic growth in the second quarter. According to UOB, Vietnam's real GDP in the second quarter recovered strongly, reaching an increase of 7.96% compared to the same period last year, far exceeding Bloomberg's forecast of 6.85% and UOB's own forecast of 6.1%.

|

Vietnam's real GDP in the second quarter recovered strongly, reaching an increase of 7.96% over the same period last year. |

Specifically, in the first half of this year, Vietnam's economy grew by 7.52% compared to the same period last year, the strongest growth in the first half of the year since data began in 2011. Vietnam's outstanding growth in the first half of the year mainly came from export activities boosted before the US imposed tariffs.

“We have revised up our 2025 GDP growth forecast for Vietnam by 0.9 percentage points to 6.9%. GDP growth in the third and fourth quarters of this year is expected to be around 6.4%. Under these conditions, realized FDI inflows are expected to reach around US$20 billion this year,” said a UOB expert.

However, experts from UOB Bank warned that even though the new tax rate has been adjusted down to 20% instead of the previous high of 46%, Vietnam and other exporting countries will still face weakened consumer demand and orders from the US, as American consumers and businesses will have to pay higher prices for imported products.

With headline and core inflation remaining below the official target of 4.5% in the first half of 2025 and most of 2024, UOB believes the SBV is likely to consider easing monetary policy. FX market developments are also an important factor for the SBV to consider. The VND was the worst-performing currency in Asia in the first half of 2025, down 2.5% against the USD.

“The positive growth performance of the economy in general may have reduced the pressure for policy easing. Therefore, we expect the State Bank to keep the current policy rate unchanged, with the refinancing rate maintained at 4.5%,” said a UOB representative.

|

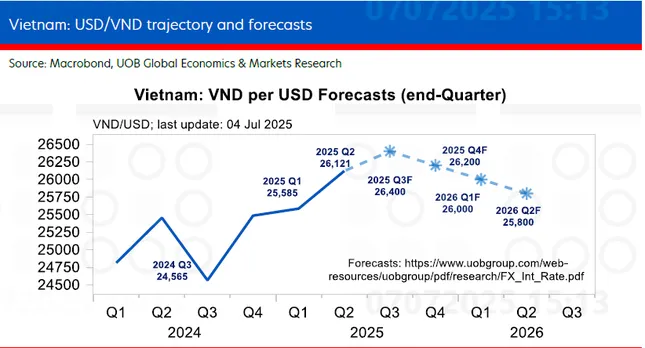

UOB forecast on USD/VND exchange rate. |

However, if the domestic business and labor market conditions deteriorate significantly in the next 1-2 quarters, UOB believes that the SBV could lower the policy rate once to the COVID-19 low of 4% and then follow it up with another cut to 3.50%, provided the foreign exchange market stabilizes and the Fed implements rate cuts.

UOB forecasts that the VND will remain near the low end of its trading range against the USD until the end of the third quarter. However, the VND may start to recover in the fourth quarter of this year, in line with the general recovery trend of Asian currencies as trade uncertainties ease. UOB’s updated USD/VND forecasts are 26,400 in the third quarter, 26,200 in the fourth quarter, 26,000 in the first quarter of 2026 and 25,800 in the second quarter of 2026.

Source: https://tienphong.vn/du-bao-moi-nhat-ve-tang-truong-gdp-viet-nam-nam-nay-post1758490.tpo

![[Photo] Red flag with yellow star flutters in France on National Day September 2](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/f6fc12215220488bb859230b86b9cc12)

![[Photo] General Secretary To Lam presents the 45-year Party membership badge to comrade Phan Dinh Trac](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/e2f08c400e504e38ac694bc6142ac331)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the New Zealand Parliament Gerry Brownlee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/cec2630220ec49efbb04030e664995db)

![[Photo] Politburo works with the Standing Committee of Cao Bang Provincial Party Committee and Hue City Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/28/fee8a847b1ff45188749eb0299c512b2)

Comment (0)