High value-added goods are expected to have favorable tax rates - Photo: Q.DINH

Speaking with Tuoi Tre Online , Mr. Nguyen Tuan Viet, director of VIETGO Company Limited - an export consulting unit, said that there were two positive things from the phone call between General Secretary To Lam and US President Donald Trump.

Open the door to American goods, stimulate investment?

That is the information that the US will significantly cut tariffs in reciprocal tax negotiations, while Vietnam will grant preferential market access to US goods and proposals to soon recognize Vietnam as a market economy .

Looking at the advantages that Vietnam is opening up for the US, President Donald Trump highly appreciated Vietnam's commitment to providing preferential market access for US goods, including large-engine cars. Mr. Viet said that this is a strategic step.

Because this policy will create conditions for American investors and American businesses to exploit the Vietnamese market more effectively. In addition, the fact that Vietnam opens its doors to American goods will also help high-quality American goods enter Vietnam, creating an advantage for our country to become a "gateway" for American businesses to invest more in Asia and Vietnam.

Looking at the situation of the US president's tariffs on other countries and the risk of the US-China trade war, Mr. Viet said that through export consulting activities, many buyers from China have calculated to move to neighboring countries, including Vietnam.

In fact, right after the US announced the tax rate, VIETGO's survey of 50 buyers showed that the need to shift orders and find new suppliers to replace China began to take place.

“Our advantage is the free trade agreements (FTAs) that have been signed. Vietnam is the champion of FTAs. The Government also actively supports investors, so the tariff incentives from FTAs will help Vietnam have an advantage to welcome the wave of foreign investment,” Mr. Viet assessed.

At the same time, Vietnam has tax incentives for US goods, which also helps promote trade. Many US goods enter Vietnam to serve domestic consumers, or even continue to go to ASEAN and Asian countries when Vietnam has the advantage of being a gateway. This will be a great opportunity to accelerate the import of quality US goods at reasonable prices.

Goods originating from Vietnam have many advantages

On the other hand, for Vietnamese goods exported to the US, the official tax rates have not yet been fully announced by the parties. However, with the information provided by the US President on his personal page, Mr. Viet believes that Vietnam can have many advantages if it takes advantage of the opportunity.

In which, goods originating from Vietnam, with domestic value added content will have an advantage. For products with a low proportion of raw materials, low value content and especially goods with transit elements, high tax rates may be imposed.

"Whether the specific tax rate is considered high or low depends on the relative picture of the results of the US's tax negotiations with other countries. Not to mention the opportunity to continue reducing taxes that may occur if the upcoming commitments and implementation measures achieve positive results, beneficial to both the US and Vietnam," Mr. Viet commented.

Further analysis shows that the group of Vietnamese goods that are strongly exported to the US, including electronic components, mobile phones, etc., are mainly from FDI enterprises, while items such as textiles, footwear, agricultural products, wooden furniture, etc. are from small and medium-sized enterprises and domestic enterprises.

Vietnam’s competitors with these products, such as India, Asian countries, ASEAN, etc., have not yet negotiated tariffs with the US. Therefore, Mr. Viet believes that Vietnam will have a strategic advantage by going first in negotiations, reaching certain agreements, and we affirm that we will “reserve preferential market access for US goods”.

At the same time, Mr. Viet assessed that with the advantage of 17 free trade agreements signed by Vietnam, which means Vietnamese goods go everywhere and have reduced or exempted taxes, export enterprises have many options to enter different markets, not necessarily entering the US.

“Within the tax thresholds set out in free trade agreements, the applied rate will fluctuate from 0-20%. Therefore, if the tax rate is still within this threshold, it is also acceptable, because that is the world average threshold for goods to be competitive. While we affirm that opening the door to American goods, which means activating a wave of investment and consumption from the US, will be a clear advantage for all parties to benefit from,” Mr. Viet analyzed.

Source: https://tuoitre.vn/thue-doi-ung-voi-my-kich-hoat-dau-tu-nho-uu-dai-hang-my-hang-xuat-khau-nao-huong-loi-20250703112525832.htm

![[Photo] Brilliant red of the exhibition 95 years of the Party Flag lighting the way before the opening](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/27/e19d957d17f649648ca14ce6cc4d8dd4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

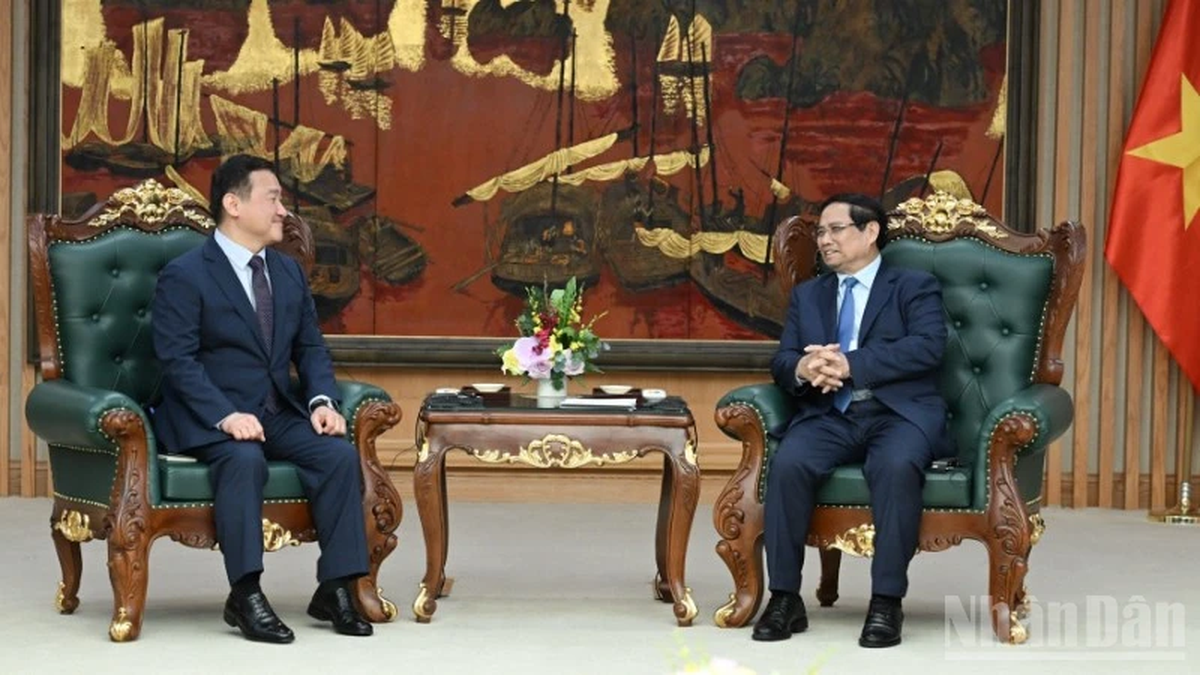

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] General Secretary To Lam attends the 80th Anniversary of the Cultural Sector's Traditional Day](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/23/7a88e6b58502490aa153adf8f0eec2b2)

Comment (0)