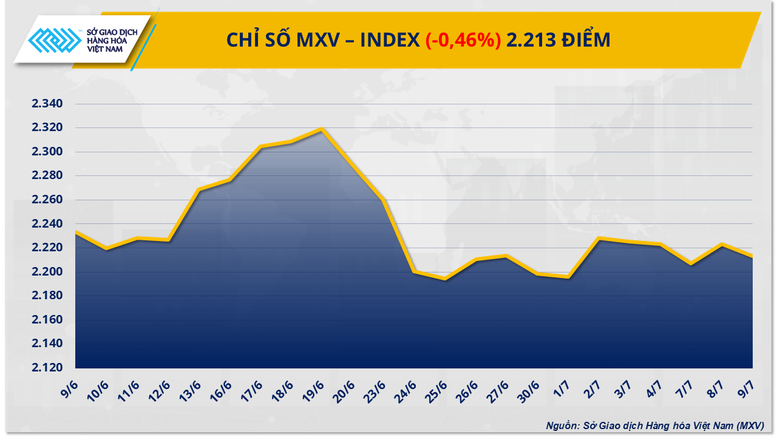

Photo 1: MXV-Index

Energy Markets in Turmoil

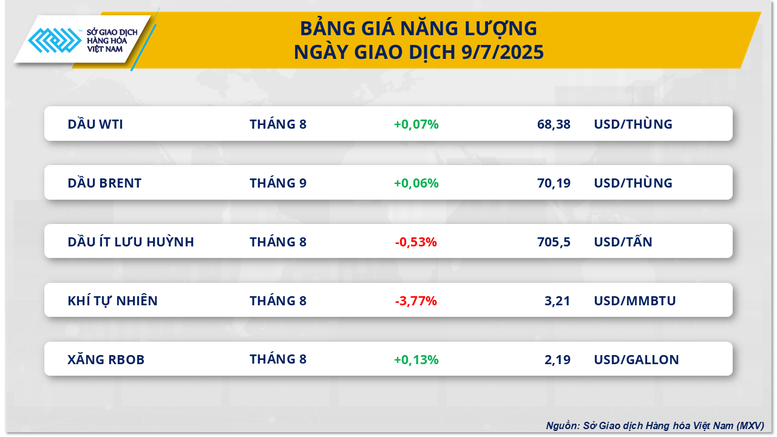

According to MXV, the energy market recorded mixed developments in yesterday's trading session as investors continued to assess the outlook for future demand amid the US announcing tariffs on its trading partners.

At the end of the session, the prices of both crude oil products only increased slightly by less than 0.1%. Brent crude oil price closed at 70.19 USD/barrel, up 0.06%, while WTI oil price increased slightly by 0.07% to 68.38 USD/barrel.

According to the weekly report released by the American Petroleum Institute (API) and the US Energy Information Administration (EIA), commercial crude oil reserves in the US in the week ending July 4 increased sharply by more than 7 million barrels, creating significant pressure on oil prices in the international market.

However, on the contrary, data from the EIA showed that US petroleum inventories fell by 2.66 million barrels in the same period. This move has somewhat eased the downward pressure on prices, while creating momentum for price increases thanks to expectations that gasoline demand will recover in the near future.

In another development, natural gas prices on the NYMEX floor fell sharply by 3.77% to $3.21/MMBtu - the lowest level recorded since the beginning of June. The main reason for this sharp decline is the latest forecasts of electricity demand in the US tending to decrease as the hot weather begins to cool down. This will lead to a decrease in demand for natural gas fuel from power plants, creating great pressure on market prices.

In addition, most market forecasts currently predict that natural gas inventories in the US will continue to increase next week, reflecting a surplus of supply compared to actual demand. The latest inventory data is expected to be released by the EIA today and is being closely watched by investors to assess the short-term gas price outlook.

In addition, according to the latest forecast from the US National Oceanic and Atmospheric Administration (NOAA), the frequency of extreme weather events in the Gulf of Mexico will increase significantly in the coming time. This development has the potential to disrupt liquefied natural gas (LNG) exports from key transit ports, especially the Henry Hub area in Louisiana - considered the largest natural gas trading center in the US and also the price reference point for the NYMEX floor.

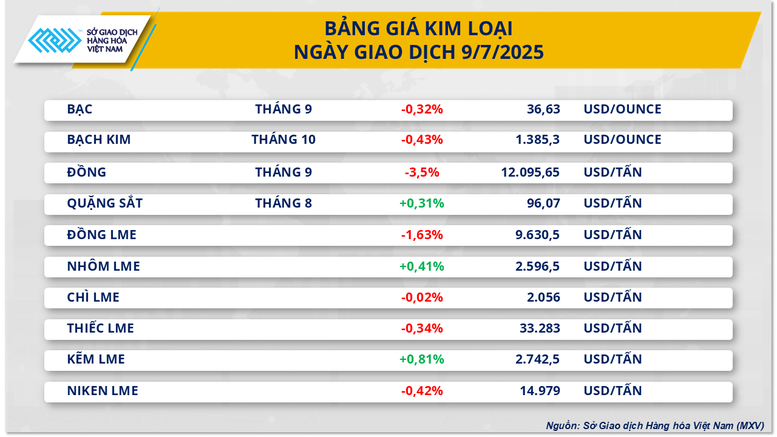

Silver prices continue to decline for the fourth consecutive session

Closing yesterday's trading session, the metal market witnessed clear divergence as investors continued to cautiously monitor the latest developments in trade negotiations between the US and its partner countries.

At the end of the trading session on July 9, silver prices continued to lose 0.32%, falling to $36.63/ounce, marking the fourth consecutive session of weakness.

According to MXV, cautious sentiment is dominating the precious metals market ahead of the release of the minutes from the US Federal Reserve's June meeting.

The Dollar Index (DXY) rose to 97.5 points yesterday, while the yield on the 10-year US government bond fluctuated near a three-week high, putting pressure on precious metals such as silver - a non-yielding asset.

Market sentiment was somewhat eased after the Trump administration decided to postpone the reciprocal tariff deadline to August 1. This move has reduced the demand for safe havens in the market in the short term, as investors temporarily eased concerns about geopolitical and trade risks.

Meanwhile, the outlook for silver consumption in China - a country that accounts for about 40% of global industrial demand for the commodity - is becoming less optimistic. According to the latest data, the producer price index (PPI) in China continued to fall sharply by 3.6% compared to the same period last year, marking the sharpest decline since July 2023. Selling prices of manufacturing enterprises continued to fall, clearly reflecting the weak demand and increasing profit pressure in the industrial sector.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-nguyen-lieu-the-gioi-quay-dau-giam-do-lo-ngai-thue-quan-tu-my-102250710084645634.htm

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)