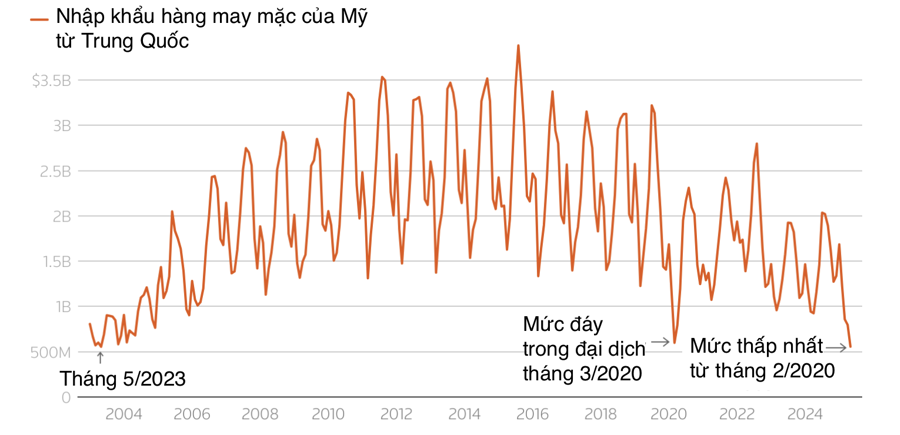

For years, China has been the largest exporter of apparel to the United States, but its share of the U.S. textile market has recently declined amid tensions between Beijing and Washington. In April, U.S. President Donald Trump imposed a 145 percent tariff on Chinese goods, prompting many U.S. retailers to source from other countries such as Vietnam, Bangladesh, India, and others to replace Chinese goods.

“The sharp decline in US apparel imports from China in May 2025 is completely natural,” said Professor Sheng Lu of the University of Delaware.

According to data from the US International Trade Commission (USITC), the US imported $556 million worth of apparel from China in May, down from $796 million in April, marking the fourth consecutive monthly decline. This is also the lowest monthly level of US textile imports from China since May 2003.

Earlier this year, anticipating Mr. Trump’s tariffs, American retailers ramped up their stockpiling of goods. As a result, in January, US apparel imports from China reached $1.69 billion, up 15% from $1.47 billion a year earlier.

Although the US and China have reached a truce in their bilateral trade war, most of the top US fashion companies still have plans to reduce their dependence on Chinese supplies, if not withdraw from China completely, Mr. Lu said.

The trend is also evident in the demand for factory surveys by U.S. retailers. Auditing firm QIMA said its data, based on thousands of factory surveys and audits globally, showed that U.S. retailers’ sourcing from China fell by nearly a quarter in the second quarter of this year compared to the same period last year, and from Southeast Asia rose by 29%.

USITC data also shows that Mexico is a beneficiary of the US’s reduced apparel imports from China. In May, the US imported $259 million worth of apparel from Mexico, up 12% from the same month last year.

The QIMA report said that the trend of shifting away from China is not new and that Southeast Asia's share of US apparel imports has been steadily increasing since 2023.

“Despite some significant changes in US tariff policy in the second quarter of this year, purchasing activity by US brands and retailers has continued to follow long-term trends that were established before the escalation of tensions this year,” QIMA said in its report. The coming months could be a new test for US supply chains as reciprocal tariff suspensions with partners that have not yet reached a trade agreement with the US expire, just as the holiday shopping season begins.

After Mr. Trump sent a letter imposing tariffs on 14 countries on Monday, the Yale Budget Lab research organization estimated that the average US tariff had increased to 17.6%, up from 15.8% previously and the highest level in 9 decades.

The Trump administration is treating tariffs as a major source of revenue. Treasury Secretary Scott Bessent said tariffs have already reached about $100 billion this year and could reach $300 billion by the end of the year. In recent years, annual tariffs have totaled about $80 billion.

Source: https://baolaocai.vn/nhap-khau-hang-may-mac-cua-my-tu-trung-quoc-xuong-thap-nhat-22-nam-post648403.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)