At the beginning of the week, the market performed positively when VN-Index broke out decisively from the 1,370 point mark and maintained continuous strength in trading sessions, approaching the 1,400 point mark.

This week also marked the time when the reciprocal tax rates between the US and Vietnam were preliminarily announced and the general trading picture showed a relatively positive reception. After a period of waiting, the Securities industry stocks also recovered.

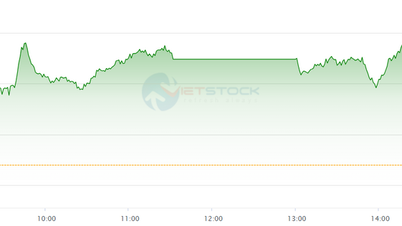

In the last session of the week, VN-Index quickly recovered to regain green after the previous slight correction. The positive point was that the demand increased quite strongly, absorbing all the selling pressure due to investors' fluctuating psychology before the recently announced tax negotiation information. However, the increase was not too strong and liquidity decreased compared to the previous session, showing that the anxiety has not yet subsided.

With 4 increasing sessions and 1 decreasing session, the VN-Index ended the trading week of June 30 - July 4 at 1,386.97 points, up 15.53 points (+1.13%). This is the third consecutive week of increase for the market.

Average weekly liquidity on the Ho Chi Minh City Stock Exchange reached VND23,320 billion, up 8.96%. Notably, according to experts from Vietnam Construction Securities Joint Stock Company, after a period of net selling, foreign investors made a sudden net purchase last week with a value of VND5,167 billion on the Ho Chi Minh City Stock Exchange, a record net purchase week in the past 2 years.

Market breadth is quite positive, maintaining recovery rotation. The prominent groups are seaport codes, securities, seafood, agriculture , information technology, insurance, banking... While the textile and garment groups, industrial parks... are under adjustment pressure under the pressure of high announced tariffs.

This business expert believes that the increase in points on July 4 was not strong enough to completely overwhelm the profit-taking selling signal that increased in the previous session, so the upward momentum could not rebound strongly in the following sessions.

It is highly likely that the current upward momentum of VN-Index will continue for several sessions next week and head towards the expected resistance level (1,398 - 1,418 points). At this level, there is a high probability that there will be large profit-taking selling pressure after 3 consecutive months of increase. Although the upward trend is dominant, at the present time after 3 consecutive months of increase, plus the resistance level is quite close, investors need to be more cautious in opening new buying positions; Along with that, sell and realize partial profits when VN-Index gradually approaches the above resistance level.

Meanwhile, expert Phan Tan Nhat, Head of Analysis Group, Saigon - Hanoi Securities Joint Stock Company (SHS), expressed his opinion that the VN-Index is under correction pressure at the 1,400 point and 1,500 point levels. These are strong resistance zones, historical peaks in 2021 and 2022. Investors should maintain a reasonable proportion. The investment target is towards codes with good fundamentals, leading in strategic industries, and outstanding growth of the economy .

Source: https://hanoimoi.vn/nha-dau-tu-ngoai-mua-rong-ky-luc-tuan-qua-708200.html

Comment (0)