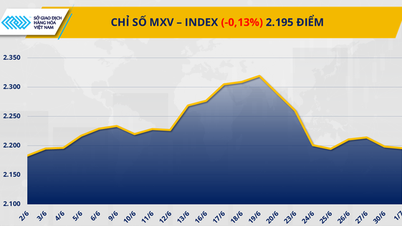

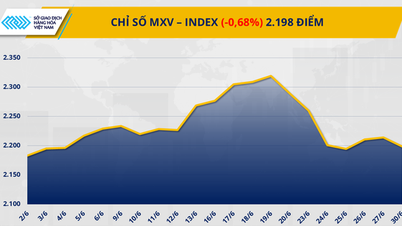

Oil prices approach $70/barrel mark

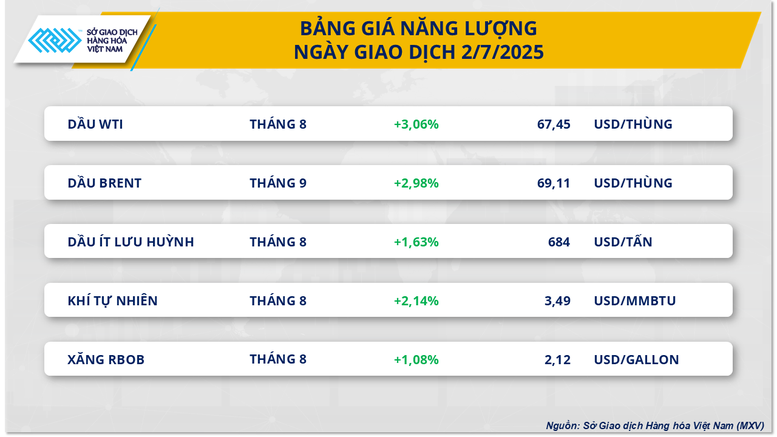

According to MXV, buying power dominated the energy market in yesterday's trading session. In particular, WTI oil price stopped at 67.45 USD/barrel, up 3.06%; Brent oil price is approaching the threshold of 70 USD/barrel, closing the session at 69.11 USD/barrel, up 2.98%.

The main reason supporting the increase in oil prices comes from positive signals from trade negotiations between the US and Vietnam and concerns about the risk of political tensions escalating again in the Middle East.

Concerns about the political situation in the Middle East continued to grow after Iranian President Masoud Pezeshkian signed a new law into effect yesterday, based on a decision passed by parliament earlier. According to the new regulations, any future inspections of Iran's nuclear energy facilities by the International Atomic Energy Agency (IAEA) must be approved by Tehran's Supreme National Security Council.

Responding to this move, US State Department spokeswoman Tammy Bruce affirmed that this was an “unacceptable” action. Previously, the long-standing disagreements between the US and Iran regarding Tehran’s controversial nuclear program had become the main cause of tension and conflict with Israel - a close ally of the US with a tough stance on Iran. This development had caused oil prices to skyrocket during the 12 days of conflict between the two countries.

On the other hand, data from the latest weekly report of the US Energy Information Administration (EIA) showed that commercial crude oil reserves in the US increased sharply by 3.8 million barrels in the week ending June 27. The American Petroleum Institute (API) also recorded a similar trend, with an estimated increase of 680,000 barrels.

U.S. crude inventories continued to rise, rising by 4.19 million barrels last week, while refinery supplies fell by 491,000 barrels. This development raises concerns about gasoline demand in the U.S. as the summer gets underway. Currently, gasoline demand in the U.S. is estimated at only 8.6 million barrels/day, lower than the 9 million barrels/day threshold that is considered stable during the peak season.

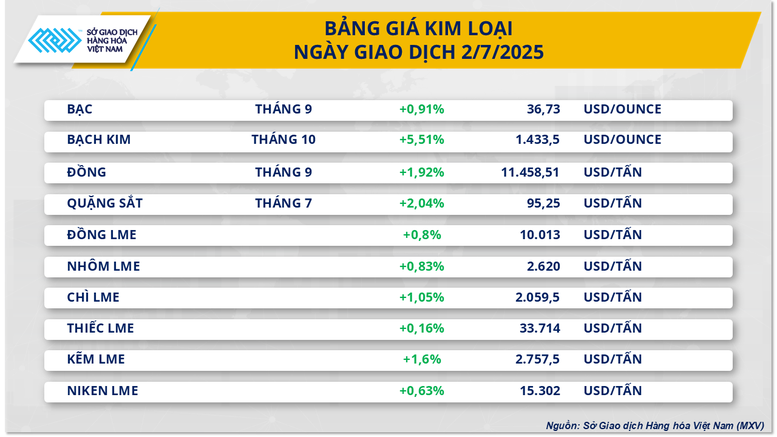

Platinum hits 11-year high, US copper hoarding surges

Yesterday's metal market also saw all 10 commodities in the group rise. According to MXV, this increase mainly came from market expectations that the US will loosen monetary policy and concerns about the risk of local supply shortages.

At the end of the session, platinum prices extended their upward trend by 5.51% to $1,433/ounce, continuing to anchor at a record price in nearly 11 years.

In the base metals market, COMEX copper prices continued to maintain an impressive upward momentum, recording an increase of 1.92% to 11,458 USD/ton. The increase in copper prices continued to be reinforced by growing concerns as Washington's reciprocal tariff deadline approached. Although the imposition of tariffs on copper is currently at a separate investigation stage, the market is still concerned that the wave of tariffs will soon expand to this metal, in order to support the goal of reducing dependence on imports and promoting domestic mining and production capacity in the US. However, with the fact that more than 40% of copper consumption in the US still relies on imports, realizing this goal is assessed to face many major challenges.

The hoarding mentality has fueled a strong wave of buying, leading to a surge in copper imports in April to more than 203,000 tonnes, 4.3 times higher than the same period last year. Notably, this development took place in the context of the global economy still facing slowing growth pressure and according to data from the International Copper Study Group (ICSG), the global refined copper market still recorded a surplus of 233,000 tonnes in the first four months of this year.

Source: https://baochinhphu.vn/my-viet-nam-dat-thoa-thuan-thuong-mai-tam-ly-tich-cuc-lan-toa-tren-thi-truong-hang-hoa-102250703101318468.htm

Comment (0)