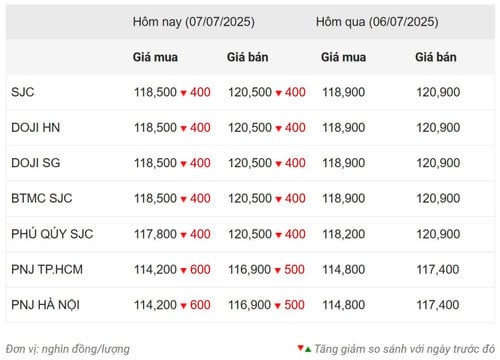

This morning, in the domestic market, the gold prices of domestic brands all adjusted down following the world price. The price of SJC gold bars decreased by 400,000 VND to 120.5 million VND/tael.

Currently, the domestic gold bar price is about 15 million VND/tael higher than the world price (excluding taxes and fees).

specifically, at 10:00 am on July 7, Saigon Jewelry Company (SJC) listed the buying and selling price of SJC gold bars at 118.5-120.5 million VND/tael, down 400,000 VND compared to the closing price at the end of last week. The difference between buying and selling is 2 million VND/tael.

SJC 9999 gold ring price is 114.3 million VND/tael for buying and 116.8 million VND/tael for selling.

DOJI gold bar price in Hanoi and Ho Chi Minh City is trading at 118.5 million VND/tael for buying and 120.5 million VND/tael for selling, down 400,000 VND compared to the previous session.

This brand listed the buying and selling price of Doji Hung Thinh Vuong 9999 gold ring at 115-117 million VND/tael.

PNJ Gold is currently buying at 114.2 million VND/tael and selling at 116.9 million VND/tael, down 600,000 VND and 500,000 VND compared to the previous session.

As of 10:00 am on July 7 (Vietnam time), gold price World prices fell 18.13 USD compared to the previous session's close to 3,307.08 USD/ounce.

World gold prices unexpectedly fell this morning, contradicting the predictions of many experts and investors in a Kitco News survey last weekend.

Kitco News' weekly gold survey found that five analysts, or 36%, of 14 Wall Street professionals see gold prices rising this week; four analysis, or 28%, see prices falling; the other five, or 36%, are neutral.

In addition, 143 retail investors (59%) of the 243 Main Street investors surveyed were optimistic that gold prices would rise this week. Forty-nine (20%) said gold prices would fall. The remaining 51 investors (21%) believed in a sideways scenario.

The US Federal Reserve (FED) is expected to release the minutes of its June meeting this week, with predictions that the bank will soon cut its base interest rate. If the FED cuts interest rates, precious metal prices will benefit.

Gold prices have risen about 25% in the first half of 2025. As the world is overspending and debt is rising, gold prices are likely to rise in the near term, said Rich Checkan, chairman and CEO of Asset Strategies International.

Adrian Day Asset President Adrian Day believes that the combination of several tariff agreements, speculation of a July Fed rate cut, and slowing central bank buying could cause gold prices to experience a pullback. However, the precious metal will not fall far and will only be down in the short term.

This morning, the USD-Index fluctuated around a 3-year low, down slightly at 97.08 points; the yield on 10-year US Treasury bonds was at 4.329%; US stocks are currently trading at their peak, Asian stocks lost momentum due to unpredictable US tariffs; world oil prices fell slightly, trading at 67.87 USD/barrel for Brent oil and 66.09 USD/barrel for WTI oil.

Source: https://baoquangninh.vn/gia-vang-ngay-7-7-trong-nuoc-the-gioi-dong-loat-giam-3365687.html

Comment (0)