Domestic gold price today 7/4/2025

As of 4:30 p.m. on July 4, 2025, the domestic gold bar price decreased slightly compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 118.9-120.9 million VND/tael (buy - sell), a decrease of 400 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.9-120.9 million VND/tael (buy - sell), a decrease of 400 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119.7-120.7 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 100 thousand VND/tael for buying and 300 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by the enterprise at 118.9-120.9 million VND/tael (buy - sell), the price decreased by 400 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.2-120.9 million VND/tael (buy - sell), gold price decreased 400 thousand VND/tael in both buying and selling directions compared to yesterday.

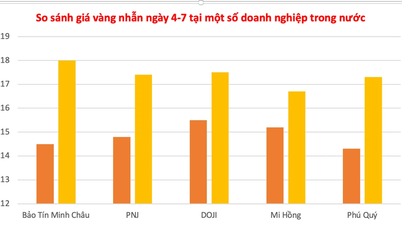

As of the afternoon of July 4, 2025, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 115.5-117.5 million VND/tael (buy - sell); the price decreased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell); the gold price decreased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 4, 2025 is as follows:

| Gold price today | July 4, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118.9 | 120.9 | -400 | -400 |

| DOJI Group | 118.9 | 120.9 | -400 | -400 |

| Red Eyelashes | 119.7 | 120.7 | -100 | -300 |

| PNJ | 118.9 | 120.9 | -400 | -400 |

| Bao Tin Minh Chau | 118.9 | 120.9 | -400 | -400 |

| Phu Quy | 118.2 | 120.9 | -400 | -400 |

| 1. DOJI - Updated: 7/4/2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,900 ▼400K | 120,900 ▼400K |

| AVPL/SJC HCM | 118,900 ▼400K | 120,900 ▼400K |

| AVPL/SJC DN | 118,900 ▼400K | 120,900 ▼400K |

| Raw material 9999 - HN | 108,300 ▼500K | 112,500 ▼500K |

| Raw material 999 - HN | 108,200 ▼500K | 112,400 ▼500K |

| 2. PNJ - Updated: 7/4/2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,890 | 12,090 |

| PNJ 999.9 Plain Ring | 11,480 | 11,740 |

| Kim Bao Gold 999.9 | 11,480 | 11,740 |

| Gold Phuc Loc Tai 999.9 | 11,480 | 11,740 |

| 999.9 gold jewelry | 11,410 | 11,660 |

| 999 gold jewelry | 11,398 | 11,648 |

| 9920 jewelry gold | 11,327 | 11,577 |

| 99 gold jewelry | 11,303 | 11,553 |

| 750 Gold (18K) | 8,010 | 8,760 |

| 585 Gold (14K) | 6,086 | 6,836 |

| 416 Gold (10K) | 4,116 | 4,866 |

| PNJ Gold - Phoenix | 11,480 | 11,740 |

| 916 Gold (22K) | 10,441 | 10,691 |

| 610 Gold (14.6K) | 6,378 | 7,128 |

| 650 Gold (15.6K) | 6,844 | 7,594 |

| 680 Gold (16.3K) | 7,194 | 7,944 |

| 375 Gold (9K) | 3,638 | 4,388 |

| 333 Gold (8K) | 3,113 | 3,863 |

| 3. SJC - Updated: 7/4/2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,900 ▼400K | 120,900 ▼400K |

| SJC gold 5 chi | 118,900 ▼400K | 120,920 ▼400K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,900 ▼400K | 120,930 ▼400K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,300 ▼200K | 116,800 ▼200K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,300 ▼200K | 116,900 ▼200K |

| Jewelry 99.99% | 114,300 ▼200K | 116,200 ▼200K |

| Jewelry 99% | 110,740 ▼198K | 115,240 ▼198K |

| Jewelry 68% | 72,410 ▼136K | 79,310 ▼136K |

| Jewelry 41.7% | 41,790 ▼83K | 48,690 ▼83K |

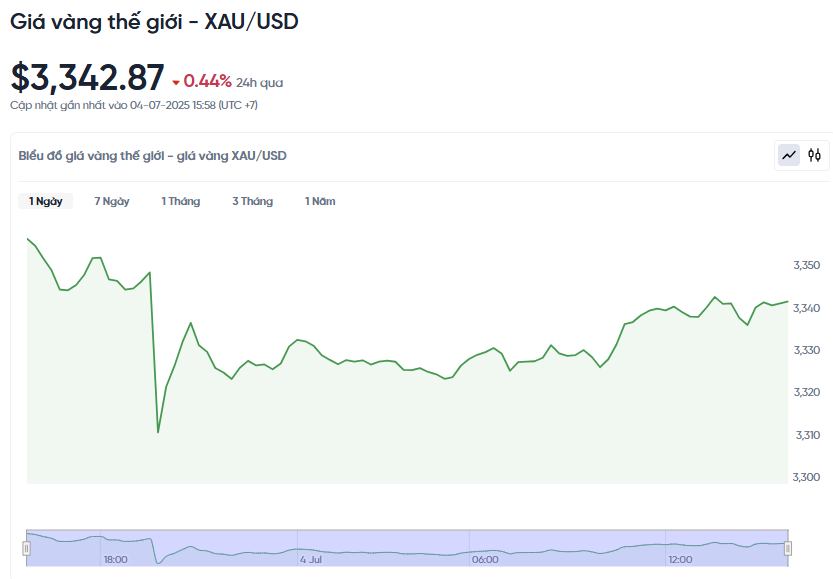

World gold price today July 4, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. on July 4, Vietnam time, was 3,342.87 USD/ounce. Today's gold price decreased by 14.84 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,350 VND/USD), the world gold price is about 109.67 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.23 million VND/tael higher than the international gold price.

World gold prices ended the week slightly higher, as investors rushed into safe-haven assets amid fiscal concerns after the US Congress passed former President Donald Trump’s tax and spending cuts. At the same time, a weaker US dollar also contributed to the rise in gold prices.

At 4:30 p.m. on July 4, the spot gold price fell 0.44%. For the week, the gold price increased by about 1.72%. Meanwhile, the gold futures price in the US also increased by 0.16%, to 3,342.78 USD/ounce.

On Thursday, Mr. Trump’s tax cut bill cleared its final hurdle in Congress, making the 2017 tax cuts permanent while funding immigration controls and adding tax incentives for the 2024 election campaign.

The bill does not improve the US fiscal situation, so in the long run it could be bad for the US dollar and support gold prices, according to Marex analyst Edward Meir. The nonpartisan Congressional Budget Office estimates that the bill would add $3.4 trillion to the current $36.2 trillion public debt over a decade.

The dollar index (.DXY) is on track for a second straight weekly decline, making gold cheaper for foreign investors. Trump also said that tariff notices would begin to be sent out on Friday, marking a change from his original plan for individual trade deals.

According to Meir, if Mr. Trump sticks to the July 9 deadline, the USD could continue to weaken and gold prices could rise. Previously, on April 2, Mr. Trump announced tariffs from 10% to 50%, then reduced to 10% until July 9 to facilitate negotiations.

Labor market data showed that U.S. businesses added 147,000 jobs in June, more than expected, while the unemployment rate fell to 4.1%. This strengthens the case that the Federal Reserve will keep interest rates unchanged.

Meanwhile, physical gold demand in Asian markets remained weak as high prices kept consumers on edge. However, discounts in India narrowed due to lower imports.

Besides gold, spot silver was steady at $36.83 an ounce, while platinum rose 0.9 percent to $1,382.63. Palladium, on the other hand, fell 0.4 percent to $1,132.87.

Gold Price Forecast

After holding support around $3,250 an ounce, gold is on track to end the short trading week with a significant gain. This is a positive sign for investors, showing that gold still retains its appeal despite some volatility.

The recent sell-off in gold is not surprising, as markets are recalibrating interest rate expectations, said Ole Hansen, head of commodity strategy at Saxo Bank. However, he said the long-term bullish trend for gold remains intact, despite the current narrow range.

Mr. Hansen said that gold needs a signal of a rate cut to gain further momentum. In the coming weeks, with low market liquidity, gold needs to stay above $3,245/ounce to avoid a deeper correction. However, he remains optimistic because the fundamentals supporting gold still exist and will continue to do so in the coming period.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, said that based on recent employment data, the US Federal Reserve (Fed) may delay cutting interest rates until the end of the third quarter or even the fourth quarter.

If the Fed keeps interest rates high for longer, it could put negative pressure on gold prices. Higher interest rates increase the opportunity cost of holding gold, while supporting the US dollar and US Treasury yields.

Therefore, in the short term, gold prices may continue to move sideways or weaken slightly, as investors do not have strong motivation to buy but are waiting for clearer signals from the Fed or new economic data.

Robert Minter, director of ETF strategy at abrdn, points out that the US public debt has officially surpassed $37 trillion, a worrying figure for the financial situation. However, the US is not the only country with budget deficit problems. Many European countries have also increased spending recently, reflecting a global trend.

According to Mr. Minter, the currency depreciation is clearly reflected in the price of gold, as the metal continues to maintain a record high against most major currencies. He believes that the price above $ 3,000 / ounce is completely reasonable in the context of high global debt, and it is unlikely that the price of gold will fall below this level again.

Mr. Minter predicts that once the Fed starts cutting interest rates, gold prices could rise another $300 an ounce, bringing prices close to $3,500 an ounce. This shows that the long-term outlook for gold remains very positive, especially in the context of the global economy facing many financial and inflation risks.

Source: https://baonghean.vn/gia-vang-chieu-nay-4-7-2025-gia-vang-trong-nuoc-giam-nhe-vang-the-gioi-kho-vuot-ai-3-350-usd-10301575.html

Comment (0)