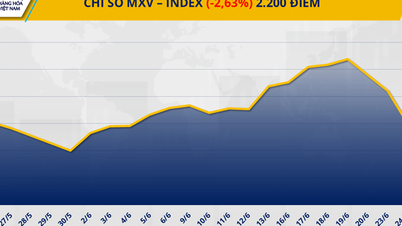

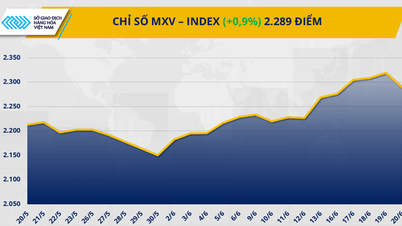

Closing, the trading week from June 23 to 29, overwhelming selling pressure caused the MXV-Index to plummet 3.3% to 2,213 points.

Energy commodity market in red. Source: MXV

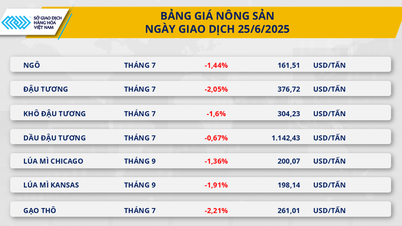

According to MXV, the global energy market has just experienced a volatile trading week when oil prices fell freely in the context of concerns about the risk of supply disruption from the Middle East being almost eliminated.

At the end of the week, most gasoline and oil products fell by more than 10%. In particular, the prices of both Brent and WTI oil products recorded record drops, at 12% and 11.27% respectively - far exceeding the sharpest declines since the beginning of the year.

At the end of the week, Brent oil price stopped at 67.8 USD/barrel, while WTI oil fell to 65.5 USD/barrel, marking the lowest price of both commodities in the past two weeks.

.png)

The metal commodity market is "bright green". Source: MXV

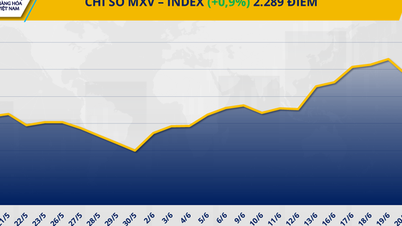

Meanwhile, the metal market recorded positive buying pressure across all 10 commodities in the group.

Notably, platinum prices rose more than 6% last week, reaching $1,340/ounce, marking the fourth consecutive week of increases. Notably, this is also the highest price range in nearly 11 years.

Concerns about supply shortages have supported the rally, according to MXV. In South Africa, which accounts for more than 70% of global platinum production, mining operations continue to face difficulties due to rising costs.

Meanwhile, platinum demand from the jewelry industry is expected to increase by 5% to 2.1 million ounces.

In the base metals market, COMEX copper prices jumped nearly 5% last week, to $11,174 per tonne.

The main driver for this price increase mainly comes from concerns about the possibility that Washington will impose import tariffs on copper metal, causing the market to worry about the risk of supply-demand imbalance.

Source: https://hanoimoi.vn/gia-nang-luong-lao-doc-bach-kim-cao-nhat-11-nam-707342.html

Comment (0)