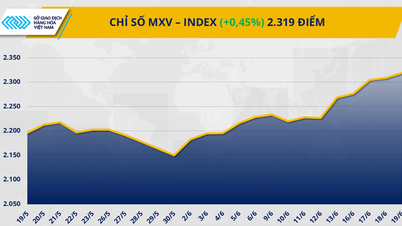

Oil prices increased sharply in the past trading week. Source: MXV

According to MXV, the energy market witnessed strong buying power across all five commodities in the group.

At the end of the week, the price of Brent oil for August contract recorded an increase of about 3.75%, stopping at 77.01 USD/barrel.

The price of WTI oil for July contract, which expires on June 20, also approached the $75/barrel mark, while the August contract is currently trading around $73.84/barrel, up 3.58%.

The focus of the week was the Israel-Iran conflict. Markets are increasingly concerned about supply disruptions from both Iran and its neighbors in the Gulf.

Risks to global oil supplies are increasing as the conflict threatens to spread and threaten the security of the strategic shipping route in the Strait of Hormuz, through which nearly a third of all commercial oil passes.

In particular, on June 21, when the US suddenly attacked three nuclear facilities in Iran, many organizations predicted that oil prices would skyrocket in the coming trading sessions.

Last week, coffee prices plummeted to a 13-month low. Source: MXV

Closing last week, Arabica coffee prices fell nearly 9%, reaching the lowest level in more than 5 months, at 6,945 USD/ton.

Robusta coffee prices also plummeted nearly 13% to $3,737 per ton - the lowest level in the past 13 months.

According to MXV, the main reason is the abundant supply from Brazil, Vietnam and Indonesia, as exports from these countries have increased sharply, thereby directly creating downward pressure on the global coffee market.

In May, Vietnam's coffee exports, mainly Robusta beans, increased by 61% year-on-year to 148.7 thousand tons.

At the same time, Brazil also recorded a remarkable increase in Robusta exports, with 195,700 bags, nearly equal to the total export volume of the whole month of May, which was 202,700 bags.

However, overall, the coffee market has been showing a supply shortage since the beginning of the year, but market sentiment has been dominated by the prospect of a bumper crop in 2025-2026 and the backdrop of global uncertainty. This is creating selling pressure from investors, causing coffee prices to decline.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-gia-dau-ca-phe-bien-dong-manh-706448.html

![[Photo] Prime Minister Pham Minh Chinh chairs the national online conference on combating smuggling, production and trade of counterfeit goods.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/4a682a11bb5c47d5ba84d8c5037df029)

![[Photo] Prime Minister Pham Minh Chinh holds meeting to launch exhibition of national achievements to celebrate 80th National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/0c0c37481bc64a9ab31b887dcff81e40)

![[Photo] Party Congress of the Central Internal Affairs Commission for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/5bf03821e6dd461d9ba2fd0c9a08037b)

Comment (0)