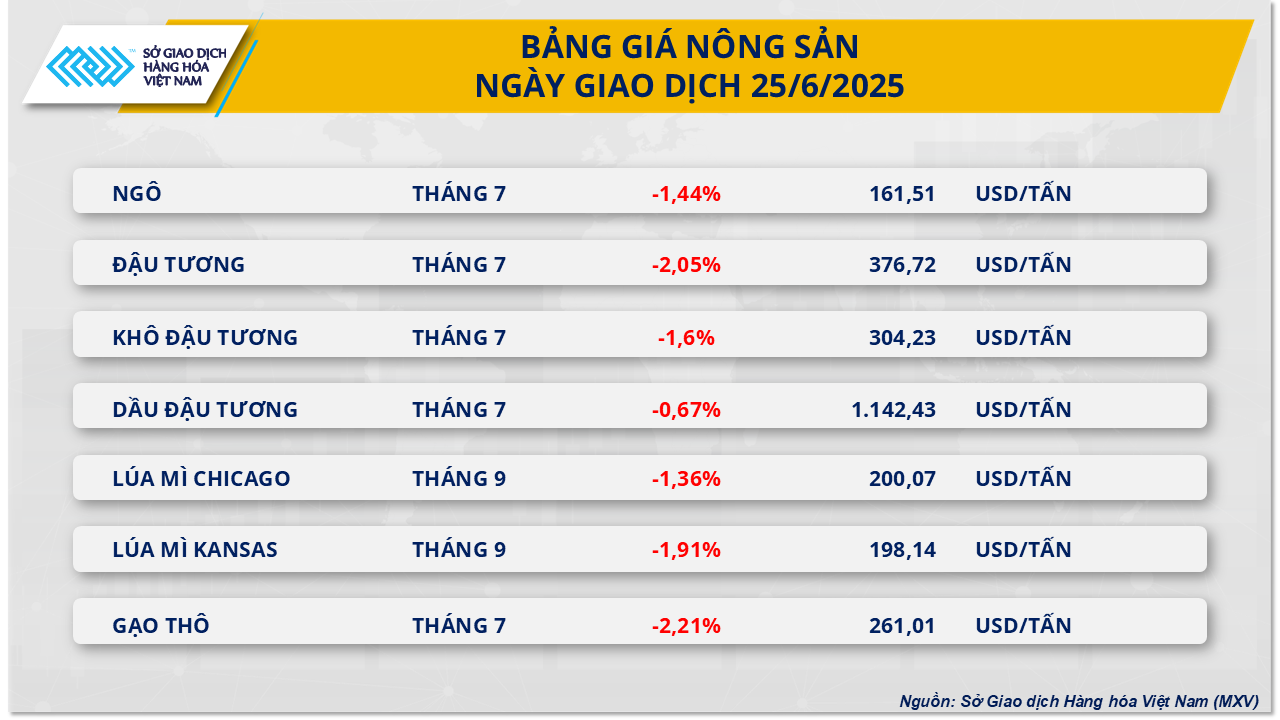

Agricultural commodity market is red hot. Source: MXV

Closing yesterday's trading session, the agricultural market experienced a fiery trading session, with prices of all 7 items in the group decreasing.

Of which, corn prices continued to weaken for the fourth consecutive session, losing 1.44% to 161.5 USD/ton, the lowest price since late October 2024.

According to MXV, this sharp decline is mainly due to supply and demand pressure, and investors tend to close positions due to the contract conversion date.

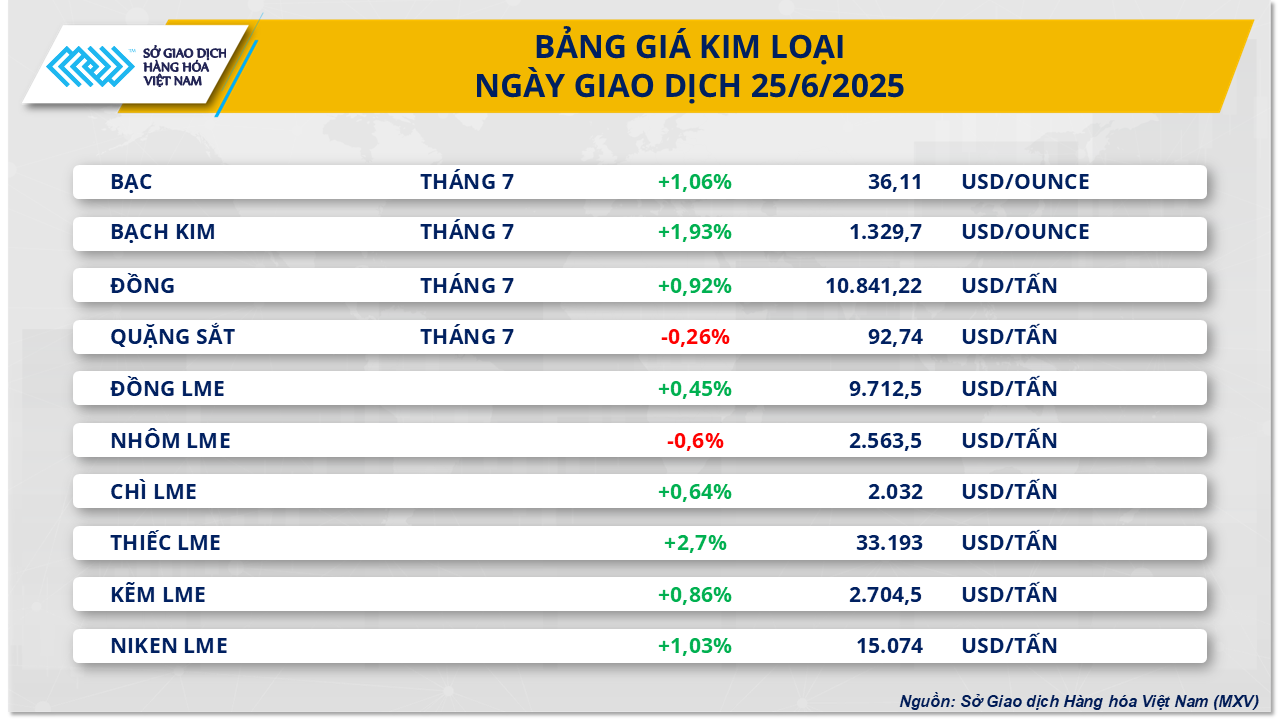

The metal commodity market is overwhelmingly green. Source: MXV

On the other hand, the metal market witnessed overwhelming buying power, with 8/10 items increasing in price. Of which, platinum price continued to increase by nearly 2% to 1,329 USD/ounce, COMEX copper price extended its increase to the third consecutive session, adding 0.92% to 10,841 USD/ton.

Platinum production in South Africa this year is expected to fall 6% to 3.9 million ounces, according to the World Platinum Investment Council (WPIC).

Meanwhile, platinum demand from the jewelry industry is forecast to increase by 5% this year to 2.1 million ounces. This imbalance in supply and demand is a factor that will create momentum for platinum prices in the coming time.

Meanwhile, COMEX copper prices continued to be supported by concerns about the risk of local supply shortages in the US if Washington expands tariffs on imported copper.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-chi-so-mxv-index-roi-khoi-vung-2-200-diem-706831.html

Comment (0)