Update domestic coffee prices today June 28, 2025

| Market | Medium | Change |

|---|---|---|

| Dak Lak | 94,200 | +400 |

| Lam Dong | 93,900 | +400 |

| Gia Lai | 94,100 | +400 |

| Dak Nong | 94,200 | +400 |

In Dak Lak, today's coffee price was recorded at 94,200 VND/kg, an increase of 400 VND/kg.

In Lam Dong, coffee price today is trading at 93,900 VND/kg, up 400 VND/kg.

In Gia Lai, today's coffee price is recorded at 94,100 VND/kg, an increase of 400 VND/kg.

In Dak Nong, the coffee purchase price is at 94,200 VND/kg, an increase of 400 VND/kg.

Update world coffee prices today June 28, 2025

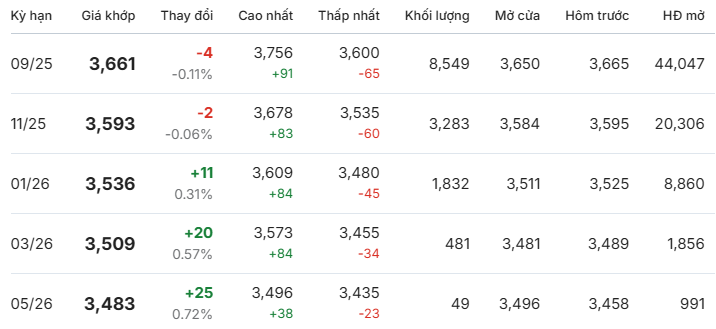

Robusta Coffee Price London June 28, 2025

According to the latest survey of Quang Nam Newspaper, today's coffee price June 26, 2025, robusta coffee price on the market fluctuates as follows:

September 2025 futures decreased by 4 USD/ton (-0.11%), to 3,661 USD/ton.

November 2025 futures fell $2/ton (-0.06%) to $3,593/ton.

January 2026 futures increased by 11 USD/ton (+0.31%), to 3,536 USD/ton.

March 2026 futures increased by 20 USD/ton (+0.57%), to 3,509 USD/ton.

May 2026 futures increased by 25 USD/ton (+0.72%), to 3,483 USD/ton.

New York Arabica coffee price on June 28, 2025

At the New York Stock Exchange, Arabica coffee prices tended to decrease in the trading session on June 26, 2025, specifically:

September 2025 futures fell 1.90 cents/lb (-0.62%) to 303.75 cents/lb.

December 2025 futures fell 3.00 cents/lb (-1.00%), to 297.40 cents/lb.

March 2026 futures fell 3.90 cents/lb (-1.32%) to 291.45 cents/lb.

May 2026 futures fell 4.20 cents/lb (-1.45%), to 286.45 cents/lb.

The Arabica coffee market is showing bearish developments and needs to be closely monitored in the coming time.

News, forecast of coffee prices tomorrow June 29, 2025

The world coffee market today recorded mixed fluctuations between the two main exchanges. While Robusta coffee prices in London increased slightly in the long-term, reflecting positive expectations about long-term supply and demand, Arabica prices in New York decreased simultaneously, indicating that short-term supply pressure is increasing. Factors such as abundant production from Brazil, favorable weather and a stronger USD are negatively affecting Arabica prices.

In contrast, the Robusta market is somewhat more optimistic as supply from Vietnam and Indonesia shows signs of slowing down. Domestically, coffee prices continue to increase, supporting the psychology of coffee growers. Overall, the market is still in the adjustment phase, with developments largely dependent on weather factors, exchange rates and year-end consumption demand.

Domestic coffee price forecast on June 29, 2025

Domestic coffee prices on June 29, 2025 are expected to continue to increase slightly in some localities, especially the Central Highlands, with fluctuations in the range of VND 93,500 - 94,200/kg, depending on quality and growing area. The main reason is that domestic purchasing power is showing signs of recovery, while supply is no longer as abundant as at the beginning of the season. However, the increase is forecast to be narrow and difficult to maintain in the long term if the international market continues to decline sharply in the early trading sessions next week.

International coffee price forecast June 29, 2025

The global coffee market is showing a downward trend due to financial factors such as fluctuations in exchange rates and interest rates. This puts pressure on domestic coffee prices in Vietnam, making it difficult for prices to maintain their upward momentum in the long term. Experts say that international coffee prices may continue to enter a period of accumulation within a narrow range, while factors from the Chinese market will play an important role in determining the medium-term trend.

Note for coffee growers

Coffee growers should note that this is an important period before the peak rainy season, which affects the transportation and storage of products. Limiting sales while prices are expected to be higher is a reasonable strategy to optimize profits. At the same time, it is necessary to closely monitor international and domestic market developments, especially financial factors and export policies, to have appropriate harvesting and sales plans, avoiding risks due to sudden price fluctuations.

Source: https://baoquangnam.vn/tin-tuc-du-bao-gia-ca-phe-ngay-mai-29-6-2025-ca-phe-viet-tang-the-gioi-chim-trong-bien-do-3157815.html

Comment (0)