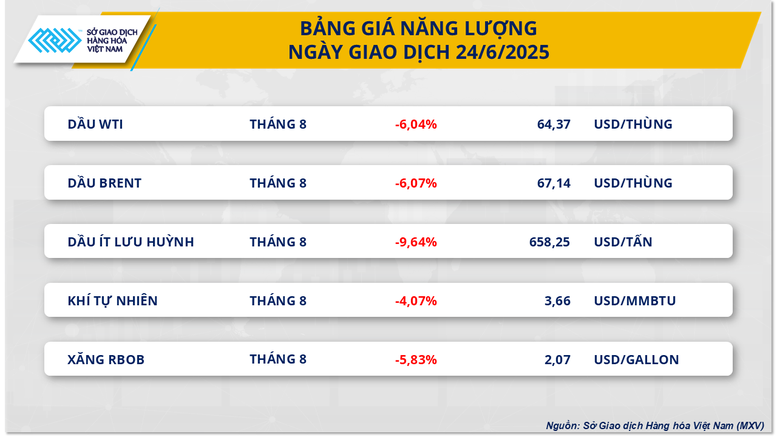

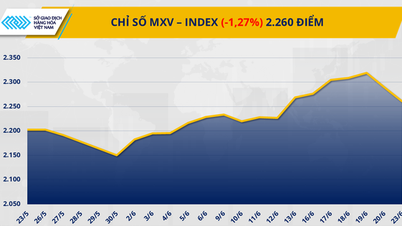

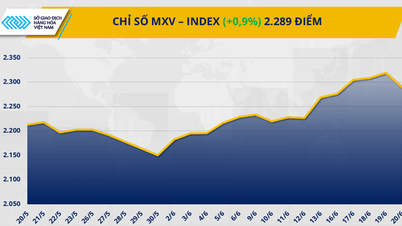

According to MXV, yesterday's trading session witnessed a sharp decline in the energy market, when all 5 key commodities in the group fell sharply in the context of concerns about the risk of supply disruption from the Middle East being almost eliminated.

At the end of the session, both Brent and WTI crude oil prices recorded a decrease of more than 6%. WTI crude oil prices fell to 64.37 USD/barrel, down 6.04%, while Brent crude oil prices also fell below the 70 USD/barrel threshold, stopping at 67.14 USD/barrel, down 6.07%. These are the lowest prices of both commodities in the past two weeks.

The main driver of the sell-off in the oil market came from the easing of tensions between Israel and Iran, especially after US President Donald Trump announced a ceasefire agreement between the two sides, aiming to end the conflict. Yesterday, both Israel and Iran issued statements expressing their goodwill to accept this ceasefire agreement.

Although the parties later accused each other of violating the ceasefire, this move still helped the market relieve concerns about the possibility of supply disruptions from many Persian Gulf countries, including many major crude oil producers in the world such as Saudi Arabia, Iraq or Iran itself.

Most Persian Gulf countries rely on the Strait of Hormuz, south of Iran, to export energy products to international markets. Amid escalating tensions between Israel and Iran, this vital route has repeatedly faced the risk of being blocked, raising concerns about the possibility of disruption to global oil and gas supplies. However, over the past two weeks, shipping through the Strait of Hormuz has remained stable, with no reports of serious disruptions.

In addition, oil prices are also under pressure from not-so-positive signals about the health of the US economy . According to newly released data, the US consumer confidence index in June fell to 93 points, significantly lower than the 98.4 points recorded in May. Analysts say the main reason comes from concerns about the job market as well as the existing macroeconomic instability, thereby leading to a decrease in expectations about future energy demand in the world's largest economy.

The market is waiting for data from the weekly petroleum report of the US Energy Information Administration (EIA), expected to be released today, to have more information about gasoline consumption demand in the US, especially when the peak travel season of Americans continues.

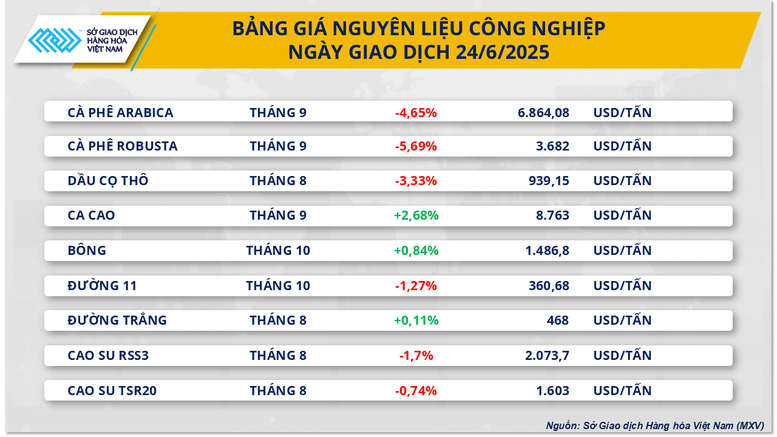

The industrial raw material market did not escape the general trend when most of the key commodities in the group fell sharply. In particular, the price of Arabica coffee fell more than 4.6% to 6,864 USD/ton, the price of Robusta coffee also turned around and lost more than 5.6% to 3,682 USD/ton. According to MXV, frost concerns have eased and abundant supply continued to put great pressure on coffee prices in yesterday's trading session.

In addition, according to a report from Rabobank, global coffee demand is expected to decline by 0.5% in 2025, mainly due to rising costs. The report also forecasts that the global coffee supply-demand balance will shift from a slight deficit of 900,000 bags in 2024-25 to a surplus of 1.4 million bags in 2025-26. Data from Eurostat shows that the EU's coffee imports in the first four months of the year fell by 9.7% compared to the same period last year, reaching 880,000 tons.

Source: https://baochinhphu.vn/chi-so-mxv-index-roi-xuong-vung-thap-nhat-ke-tu-dau-thang-6-102250625093700077.htm

![[Photo] More than 124,000 candidates in Hanoi complete procedures for the 2025 High School Graduation Exam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/fa62985b10464d6a943b58699098ae3f)

![[Photo] General Secretary To Lam works with the Standing Committee of Quang Binh and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/6acdc70e139d44beaef4133fefbe2c7f)

![[Photo] First training session in preparation for the parade to celebrate the 80th anniversary of National Day, September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/ebf0364280904c019e24ade59fb08b18)

Comment (0)