Mr. Mai Son - Deputy Director of the Tax Department ( Ministry of Finance ) spoke at the Conference - Photo: VGP/HT

Synchronous deployment from population data to tax system

On June 25, at an online training conference on professional skills and information technology systems serving the implementation of personal identification numbers replacing tax codes, the leaders of the Tax Department (Ministry of Finance) announced an important change that will officially take effect from July 1, 2025.

Accordingly, all subjects such as business households, individual businesses, salaried employees, dependents, etc. will use the personal identification number on the citizen identification card instead of the tax code. This is one of the specific contents of the Government 's Project 06 on developing the application of population data, identification and electronic authentication to serve national digital transformation.

Speaking at the conference, Mr. Mai Son - Deputy Director of the Tax Department (Ministry of Finance) emphasized: "A person has only one tax code, which is the personal identification number. Applying identification numbers instead of tax codes not only creates convenience for people, but is also a breakthrough to help the Tax sector effectively connect with the national database on population."

"Taxpayers will not need to remember separate tax codes. Instead, they only need to use their personal identification numbers during the process of declaring, looking up or paying taxes. Thanks to that, tax transactions will become faster and more convenient, while contributing to minimizing errors due to information confusion. This change in tax code method also creates conditions for the Tax sector to complete the tax database, while serving the goal of digital transformation. In particular, synchronizing data between tax agencies and the national population database is one of the top priorities," said Mr. Mai Son.

According to the report of Mr. Nguyen Duc Huy - Deputy Head of the Professional Department, Tax Department: Currently, the tax authority is managing about 81 million personal tax codes. This number includes all codes of salaried employees, business households, business individuals and dependents.

However, in the process of reviewing and standardizing data in coordination with the Department of Administrative Police for Social Order (C06) - Ministry of Public Security , only 65 million tax codes have been authenticated and standardized, fully compatible with the citizen identification database. The remaining 15 million tax codes have not been authenticated due to mismatched information. Most of these belong to the group of dependents of taxpayers.

With an increasingly complete data system, the Tax sector has more basis to modernize management methods, reduce administrative costs and increase the efficiency of tax collection. However, Mr. Mai Son also noted that such a large-scale implementation in the initial stage will certainly encounter some difficulties, especially when the information technology system is still in the process of completion.

Reorganize the Tax sector apparatus in a streamlined and efficient manner

According to the tax sector leader: Tax officials and civil servants will need to make great efforts to ensure the smooth operation of the system, handle arising situations and support taxpayers. The conversion is not only a professional requirement, but also a political task associated with the Government's administrative reform policy.

In addition to implementing the new tax code, the Tax sector is also actively rearranging the organizational structure according to the two-level local government model, in line with the orientation of the Government and the Ministry of Finance in the process of perfecting the state administrative apparatus. Currently, from 20 regional tax branches as before, it will be reorganized into 34 provincial-level tax units, to ensure consistency with the administrative units of provinces and centrally run cities. Along with that, district-level tax teams will be converted into provincial-level grassroots tax units, enhancing the effectiveness and efficiency in local budget revenue management. According to the Tax Department, linking the tax apparatus with local administrative areas will facilitate the implementation of budget revenue collection tasks, while enhancing the ability to coordinate between tax agencies and local authorities in revenue generation.

Along with the organizational arrangement, tax inspection activities are also temporarily adjusted to match the progress of the organizational change. According to the urgent dispatch of the Tax Department, for inspection decisions that have been issued and are being implemented, inspection teams need to urgently complete the inspection and handle administrative procedures in accordance with regulations, ensuring that the results are updated on the system before July 1. For cases where inspection decisions have not been issued, tax branches must temporarily suspend the entire process until the new organizational structure is completed. This is to ensure continuity and efficiency in the organizational adjustment process, avoiding overlap and interruption when transferring work records between units. The renewal of tax codes and the arrangement of the Tax sector's apparatus not only have the meaning of administrative reform, but also are a solid premise for implementing more effective, fair and modern financial and budgetary policies. These efforts demonstrate the great determination of the Ministry of Finance as well as the entire Tax sector in meeting the development requirements of the digital economy, while contributing to building a streamlined and effective state administrative apparatus in accordance with the spirit of the Central Resolution and the direction of the Government.

Mr. Minh

Source: https://baochinhphu.vn/huong-dan-trien-khai-so-dinh-danh-ca-nhan-chinh-thuc-thay-ma-so-thue-tu-1-7-102250625180154013.htm

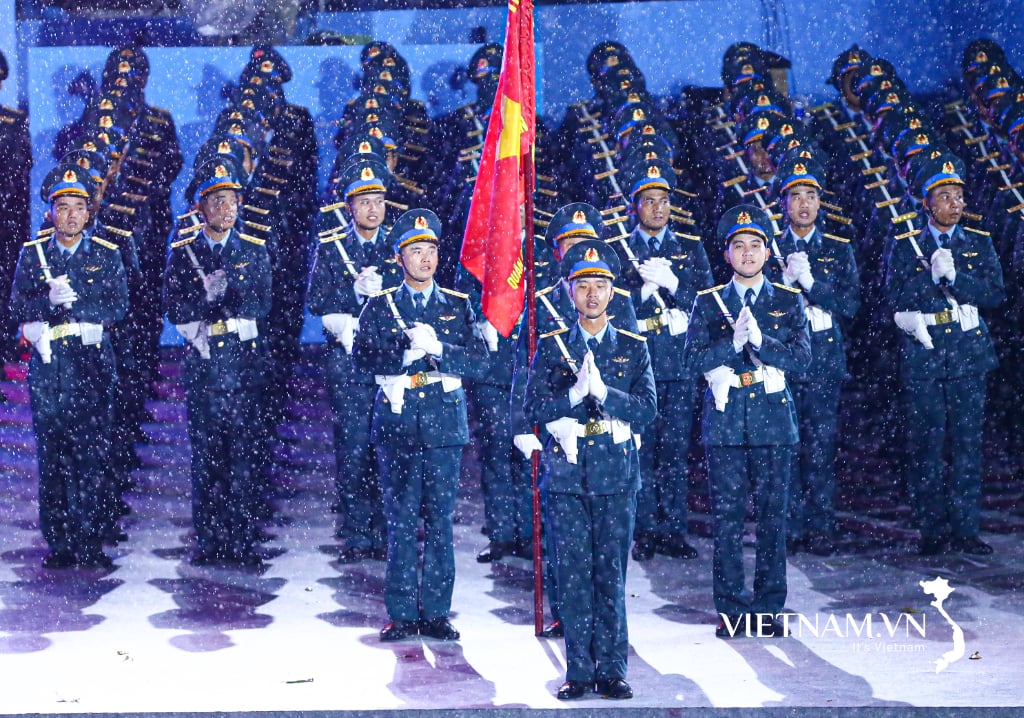

![[Photo] First training session in preparation for the parade to celebrate the 80th anniversary of National Day, September 2nd](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/ebf0364280904c019e24ade59fb08b18)

![[Photo] General Secretary To Lam works with the Standing Committee of Quang Binh and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/6acdc70e139d44beaef4133fefbe2c7f)

![[Photo] More than 124,000 candidates in Hanoi complete procedures for the 2025 High School Graduation Exam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/fa62985b10464d6a943b58699098ae3f)

Comment (0)