The energy market is very volatile.

According to MXV, the energy market witnessed strong buying power across all five commodities in the group as political tensions between Israel and Iran dominated the market and raised concerns about the risk of disruption to the global supply chain.

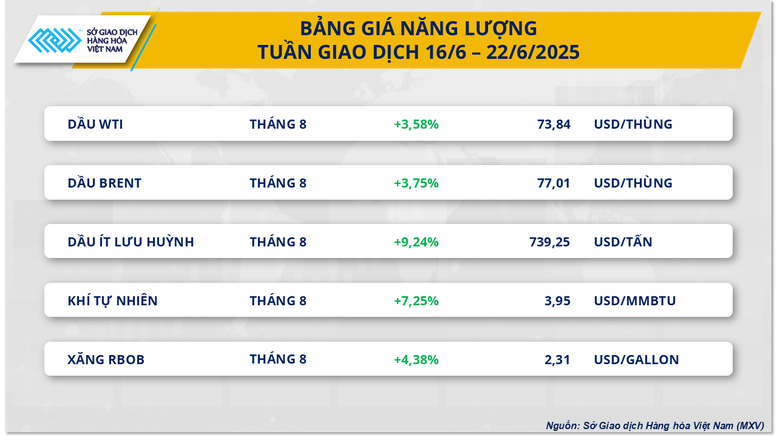

At the end of the week, the price of Brent crude oil for August contract recorded a weekly increase of about 3.75%, stopping at the level of 77.01 USD/barrel. The price of WTI crude oil for July contract, which expires on June 20, also approached the level of 75 USD/barrel, while the WTI contract for August is currently trading around 73.84 USD/barrel, up 3.58% for the week.

The Israel-Iran conflict has been a major focus of the past trading week, with markets increasingly concerned about supply disruptions from both Iran and its neighbors in the Persian Gulf.

Iranian crude oil has been hit by multiple sanctions from the US government over Tehran's controversial nuclear program. Iran has now temporarily pulled out of Oman-mediated talks with the US, citing military attacks on the country.

With the two sides unable to find common ground on the nuclear issue, the possibility of the US lifting sanctions on Iran’s oil and energy exports is increasingly remote. This further increases the risk to global oil supplies, especially when the conflict threatens to spread and threaten the security of strategic shipping routes such as the Strait of Hormuz, through which nearly a third of the world’s seaborne oil trade passes.

A number of major oil and gas exporting countries such as Saudi Arabia, Iran and Iraq depend on this vital shipping route to bring energy products to the international market. According to analysts and forecasters, if this shipping route is disrupted due to escalating conflicts, oil prices could spike to over $120 per barrel in a short time.

In addition, on June 21, the US suddenly launched an attack on three Iranian nuclear facilities, officially marking its direct involvement in this conflict. This move immediately raised concerns about the risk of disruption of oil supplies from the Middle East, which is expected to continue to push oil prices up in the coming trading sessions.

In addition to geopolitical factors, the rise in crude oil prices was also supported by two reports on US commercial crude oil reserves released by the American Petroleum Institute (API) and the US Energy Information Administration (EIA). Both reports showed that US crude oil reserves fell sharply in the week ending June 13, with a decline of 10.1 million barrels according to the API and 11.5 million barrels according to the EIA. Notably, the EIA report also recorded the fourth consecutive week of decline in US commercial crude oil reserves.

In another development, the Organization of the Petroleum Exporting Countries (OPEC) released its June oil market report. Of which, total production in May of the OPEC+ group reached 41.23 million barrels/day, an increase of only 180,000 barrels/day compared to April, lower than the initial plan of increasing 411,000 barrels/day in May.

The reason is that the increase in production is not as high as expected from Saudi Arabia, Kuwait and the United Arab Emirates (UAE). At the same time, some countries have implemented production cuts exceeding the allowed quota, notably Iraq. Although the situation of excess production continues, especially in Kazakhstan, the production increase is not as strong as expected by OPEC+ also supports the increase in oil prices.

Supply pressure weighs on coffee prices

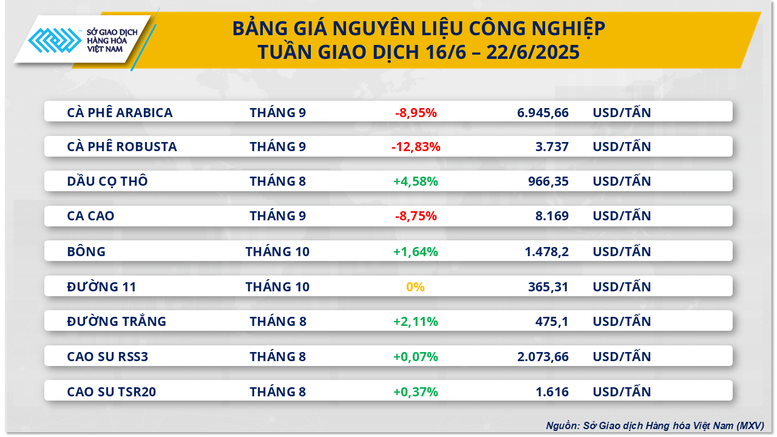

Meanwhile, the industrial raw material market has just experienced a volatile trading week, especially for the coffee market. At the end of the week, Arabica coffee prices fell by nearly 9%, reaching the lowest level in more than 5 months, at 6,945 USD/ton, while Robusta coffee prices also plunged by nearly 13% to 3,737 USD/ton - the lowest level in the past 13 months.

According to MXV, coffee prices have continuously decreased in recent times mainly due to abundant supply from major producing countries such as Brazil, Vietnam and Indonesia, as exports from these countries have increased sharply, thereby directly creating downward pressure on prices on the global coffee market.

Source: https://baochinhphu.vn/trung-dong-cang-thang-thi-truong-nang-luong-bien-dong-rat-manh-102250623093648087.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the national online conference on combating smuggling, production and trade of counterfeit goods.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/4a682a11bb5c47d5ba84d8c5037df029)

![[Photo] Prime Minister Pham Minh Chinh holds meeting to launch exhibition of national achievements to celebrate 80th National Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/0c0c37481bc64a9ab31b887dcff81e40)

![[Photo] Party Congress of the Central Internal Affairs Commission for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/23/5bf03821e6dd461d9ba2fd0c9a08037b)

Comment (0)