Nvidia shares rose more than 2% in trading on July 9 (US time), bringing the company's market capitalization to over $4 trillion for the first time, according to CNBC .

Nvidia also became the first company in history to reach this record capitalization, although Microsoft and Apple were the first to reach the $3,000 billion mark. Microsoft is also one of Nvidia's largest and most important customers.

With a market capitalization of over $4 trillion , Nvidia is also the world's most valuable company, and investors continue to pour money into the chipmaker serving this generational AI wave.

The Road to the Throne

In 1999, Intel still dominated the semiconductor industry, while Nvidia debuted on the Nasdaq exchange. Less than three years later, the company joined the S&P 500 (a group of 500 largest companies in the US by market capitalization), replacing oil giant Enron.

|

Nvidia became the first company in history to reach a market capitalization of $4 trillion , although Microsoft and Apple were the first to reach the $3 trillion mark. Photo: Annabelle Chih/Bloomberg. |

Still, few expected Nvidia to maintain its momentum for a quarter of a century, with its stock up 591,078%. Much of the growth has come from the artificial intelligence (AI) craze, where investors see Nvidia as most successful in making chips to support the technology.

From its IPO in 1999 to its entry into the S&P 500 in 2001, Nvidia stock rose more than 1,600%, giving it a market capitalization of about $8 billion . That growth came amid a slump in tech stocks after the dot-com bubble burst.

According to Bloomberg , the key to Nvidia's early success was integrating technology into Microsoft Xbox and Sony PlayStation gaming consoles. Nvidia's graphics processing units (GPUs) became a sought-after commodity for gamers because of their high performance and realistic experience.

Rhys Williams, head of strategy at Wayve Capital Management, appreciates CEO Jensen Huang's vision.

"Jensen tells a beautiful story, and it's clear that GPUs are increasingly important. Each new generation of hardware improves performance, improves visual fidelity, and opens up a new era for PC gaming," Williams emphasized.

After the initial period of success, the next six years witnessed many ups and downs. Nvidia's stock fell in 2008 due to the financial crisis that weakened demand, at the same time as rival AMD rose.

Just a year later, however, Nvidia introduced GPUs for data center servers, supporting complex tasks like oil and gas exploration and weather forecasting.

This was the premise that helped Nvidia gain a foothold in the lucrative market later. However, those chips could not help Nvidia break out immediately, as it took nearly 9 years for Nvidia's stock to surpass the peak set in 2007.

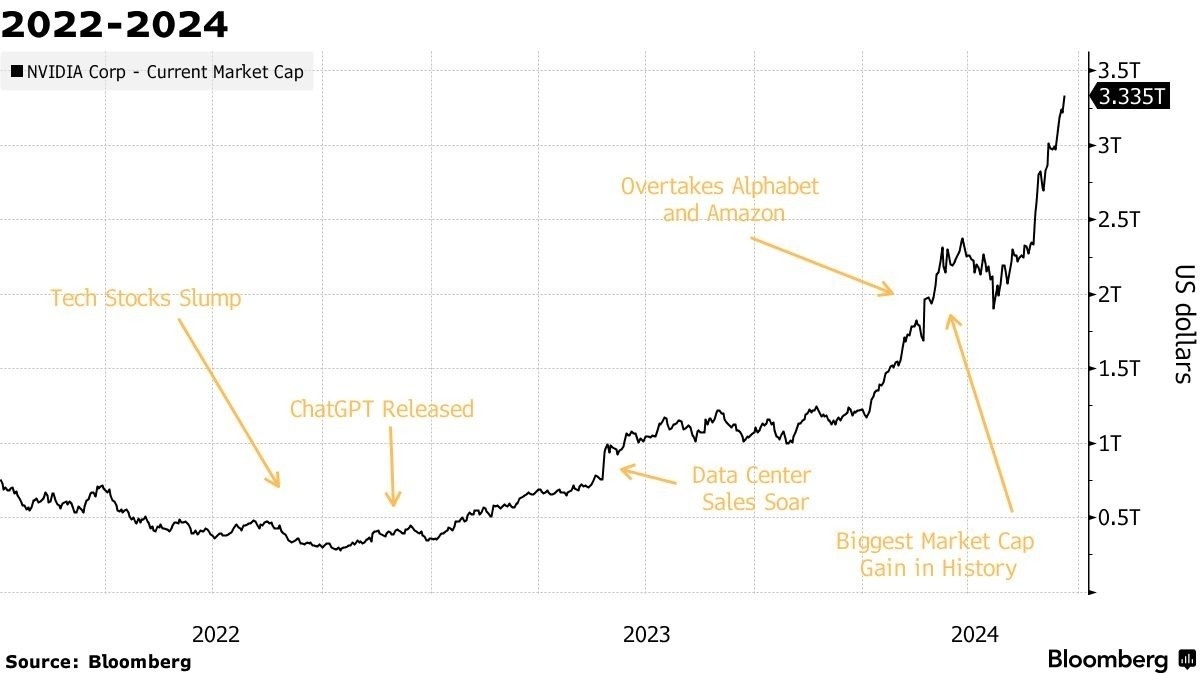

|

Nvidia's market capitalization in 2022-2024, the time when the AI trend explodes. Photo: Bloomberg. |

Nvidia's stock rebounded in 2015, a period when the company's GPUs powered many new technologies, from modern graphical interfaces to self-driving cars to a wave of AI products.

The rise of cloud computing and a greater focus on scientific computing has pushed Huang's company into a new frontier, where data centers are powered by Nvidia GPUs.

Since then, Nvidia GPU capabilities have been increasingly expanded. Most notably, cryptocurrency mining has been a time when Nvidia graphics cards were "out of stock" due to strong demand for a period of time.

The most important name in the AI wave

Since the 2010s, Nvidia has been making increasingly powerful chips, naming each new “architecture” or design after famous physicists and other scientists such as James Clerk Maxwell, Johannes Kepler, Alan Turing, and Ada Lovelace.

According to the Wall Street Journal , for the past two decades, Nvidia has maintained a pace of releasing a new generation of chips every 2-4 years. As AI technology has accelerated, that cycle has shortened significantly, with the company now aiming to maintain a pace of releasing a new generation of chips every year.

In fact, the company’s most important “product” is a wall that keeps customers and competitors at bay, built from software and tiny semiconductor chips.

According to the Wall Street Journal , the closed garden is the reason why Nvidia easily leads, despite all the competition from other chip makers, even Big Tech like Google and Amazon.

The key to unlocking Nvidia's closed garden lies in the CUDA software platform. Launched in 2007, the platform was a solution to a problem that no one had encountered at the time.

The chipmaker wanted to run non-graphics software, such as cryptography and cryptocurrency mining, using Nvidia’s dedicated processing units (GPUs), which are designed for heavy-duty applications like 3D graphics and gaming.

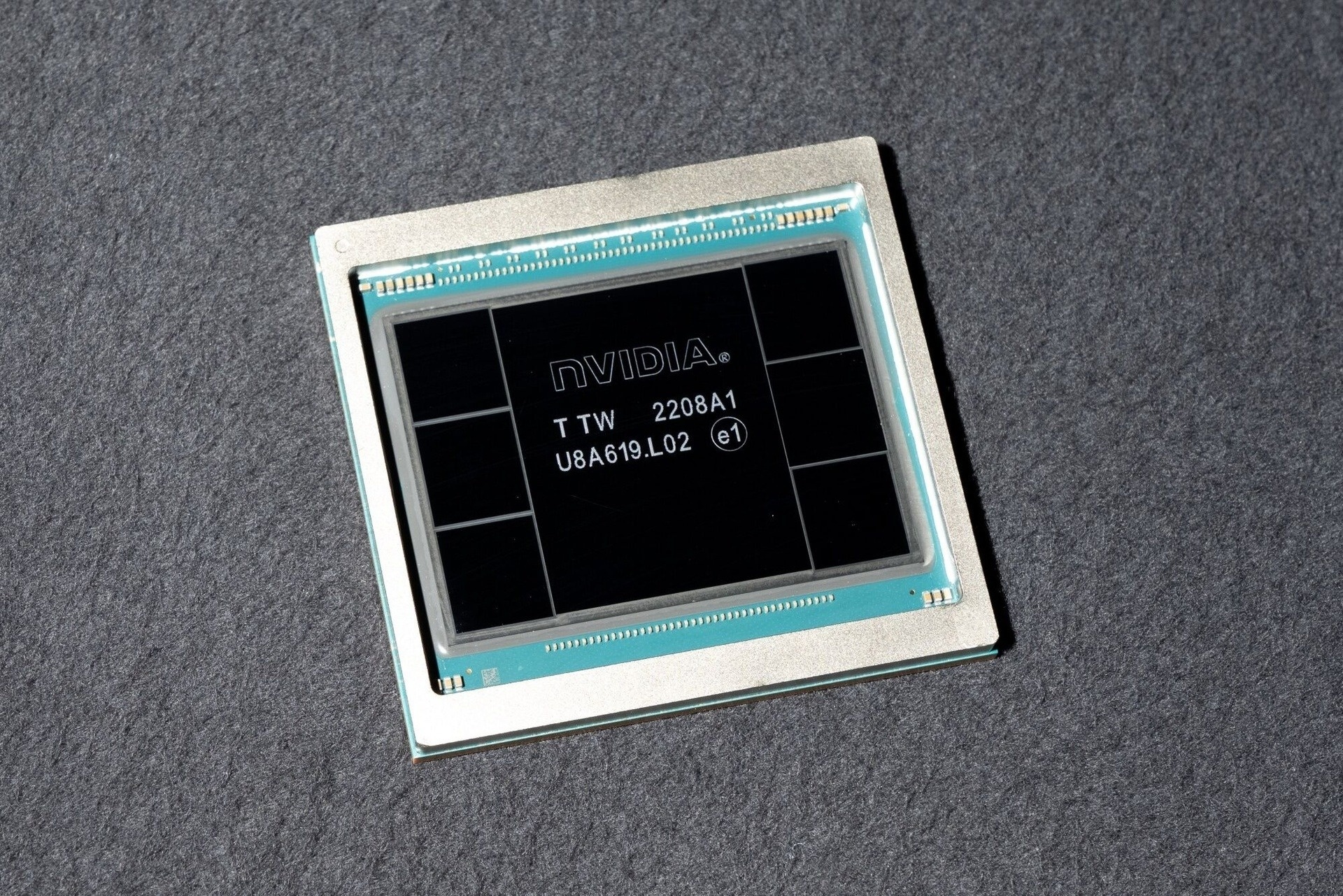

|

Nvidia's H100, priced at more than $40,000 , is expected to be out of stock in 2024. Photo: Bloomberg. |

CUDA enables all sorts of other computing capabilities on processors. AI software is one of the applications CUDA supports on Nvidia chips. It’s also a technology that has grown exponentially in recent years, making the AI chipmaker one of the world’s most valuable companies.

But CUDA was just the beginning. Over the years, Nvidia has responded to the needs of software developers by releasing libraries that provide specialized code that allows them to perform a huge range of tasks on GPUs at speeds that are impossible with conventional processors from Intel and AMD.

The power of the software platform explains why, over the years, Nvidia has invested more in building a software engineering team than a hardware engineering team at the corporation.

CEO Jensen Huang said Nvidia wants to focus on the combination of hardware and software, calling it “full-stack computing.” That means Nvidia makes everything from chips to software to build AI. The CEO also called Nvidia’s software the “operating system” of AI.

Every time a competitor announces a new AI chip to compete with Nvidia, it clashes with the systems that Nvidia customers have been using for more than 15 years to write mountains of code. Because they rely on Nvidia chips, that software can be difficult to port to a competitor’s new system.

At its June 2024 shareholder meeting, the AI chipmaker said CUDA now boasts more than 300 code libraries and 600 AI models, and supports 3,700 GPU-accelerated applications. The massive resource is used by more than 5 million developers at 40,000 companies.

The surge in demand has sent the memory chip giant's stock up more than 15-fold over the past five years. Nvidia's stock price has risen 22% year-to-date, with more than 15% in the past month alone.

Nvidia’s revenue has also grown in tandem with its stock price. Two years ago, the company had just $7.2 billion in revenue in the May quarter. In 2020 alone, that number has now reached $44.1 billion —a huge number for a company with gross margins above 70%.

Source: https://znews.vn/dieu-giup-nvidia-dat-cot-moc-4000-ty-usd-post1567587.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)