The first trading session of the week, July 14, saw the market open with a bang as a series of large-cap stocks surged, pushing the VN-Index up more than 13 points to over 1,470 points before cooling down to 1,465 points by the end of the morning. However, the index still temporarily increased by nearly 7.5 points. The VN30-Index also increased by more than 8 points and temporarily stopped at 1,602 points despite many other stocks facing profit-taking pressure.

VIC stock hit ceiling

The main driving force of the indices came from the ceiling increase of VIC shares of Vingroup and other member codes such as VHM, VPL, VRE.

As soon as it opened, VIC jumped 6.94% to VND115,500/share, contributing 6.63 points to the increase of VN-Index this morning.

With this increase, Vingroup's market capitalization has reached nearly VND437,000 billion, equivalent to USD17 billion. The value of the shares that billionaire Pham Nhat Vuong is holding has also increased by nearly VND14,000 billion, bringing the total value of his shares on the stock exchange to about VND256,000 billion.

At the same time, Forbes' real-time billionaire ranking recorded that Mr. Vuong's assets had increased to 11.9 billion USD, consolidating his position as the richest person in Vietnam and continuing to rise in the group of Asian billionaires.

Along with VIC shares, some other stocks in the VN30 basket (large-cap stocks) such as VPB, VHM, BID, GVR... also traded well. Liquidity on the HoSE increased this morning, when in just the morning, the trading value was approximately 15,200 billion VND.

VIC stock hits multi-year high

Previously, in the past week of strong growth, the VN-Index increased by more than 70 points and the Vingroup group alone (VIC, VHM, VRE) contributed 27 points.

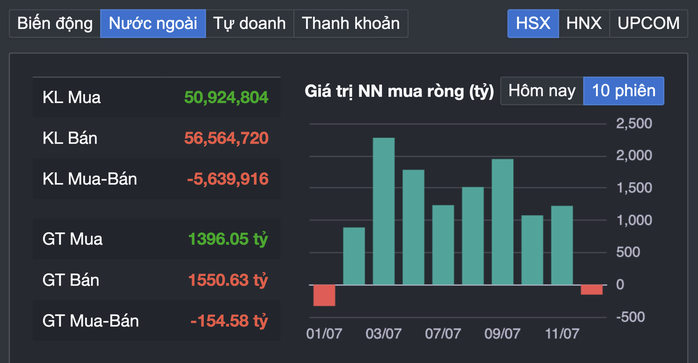

Foreign investors have been net buyers for many consecutive sessions in recent days, approximately 12,000 billion VND since the beginning of July until now.

Profit-taking pressure increases

Commenting on the market this week, MBS Securities Company said that despite a strong week of growth since the end of 2022, the trading volume reached a record level, but the cash flow was quite diversified.

The increase in liquidity and performance in the index was concentrated in a few groups of stocks: banking, securities, real estate, Vingroup, construction and building materials, and food.

"The fact that cash flow is quite concentrated in the context of liquidity at a historical peak could be a risk for the market at the present time. Investors should also closely observe the developments of foreign capital flows after 2 weeks of strong net buying.

Technically, the VN-Index may have a shake-up this week when the US tariffs attract attention with the imposition of 30% tax on Mexico and the EU. The VN-Index entering the historical peak of 1,500 points will make investors proactively take profits" - MBS Securities recommends.

Source: https://nld.com.vn/co-phieu-vic-cua-ti-phu-pham-nhat-vuong-tang-tran-196250714112759557.htm

![[Infographics] - Some new regulations on disciplinary action against officials and civil servants](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/14/4a2ea9dce8ec43e2847b72421bc0e06a)

Comment (0)