USD exchange rate today 7/9/2025

At the time of survey at 4:30 a.m. on July 9, the central exchange rate at the State Bank was currently 25,121 VND/USD, an increase of 8 VND compared to yesterday's trading session.

Specifically, at Vietcombank , the USD exchange rate is 25,915 - 26,305 VND/USD, down 25 VND in both directions, compared to yesterday's trading session.

NCB Bank is buying USD cash at the lowest price: 1 USD = 25,795 VND

VRB Bank is buying USD transfers at the lowest price: 1 USD = 25,930 VND

HSBC Bank is buying USD cash at the highest price: 1 USD = 26,030 VND

HSBC Bank is buying USD transfers at the highest price: 1 USD = 26,030 VND

HSBC Bank is selling USD cash at the lowest price: 1 USD = 26,266 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 26,266 VND

Nam A Bank is selling USD cash at the highest price: 1 USD = 26,376 VND

ABBank and SCB are selling USD transfers at the highest price: 1 USD = 26,360 VND

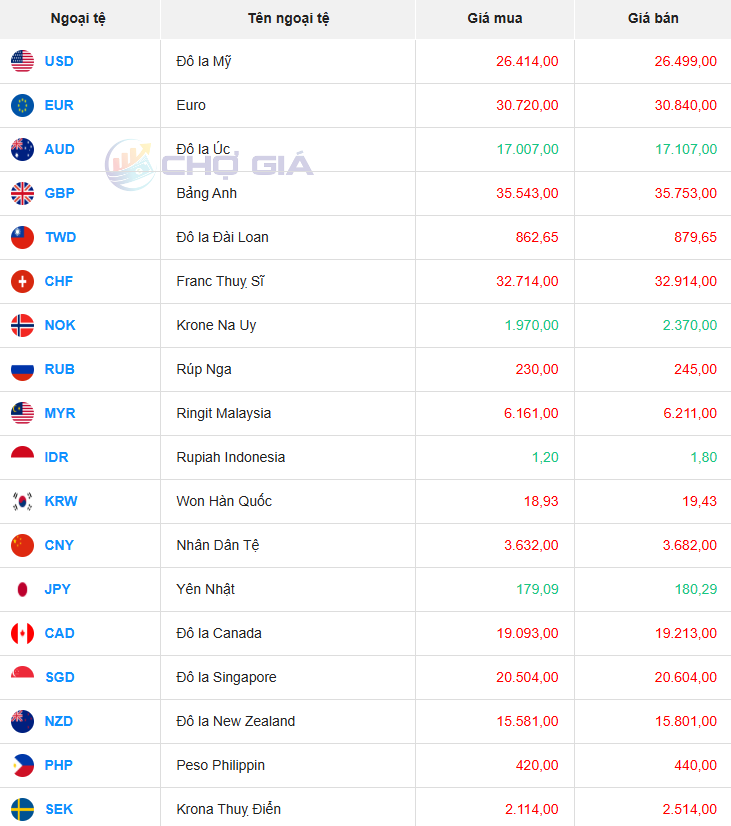

In the "black market", the black market USD exchange rate as of 4:30 a.m. on July 9, 2025 decreased by 19 VND in buying and 9 VND in selling, compared to yesterday's trading session, trading around 26,414 - 26,499 VND/USD.

USD exchange rate today July 9, 2025 on the world market

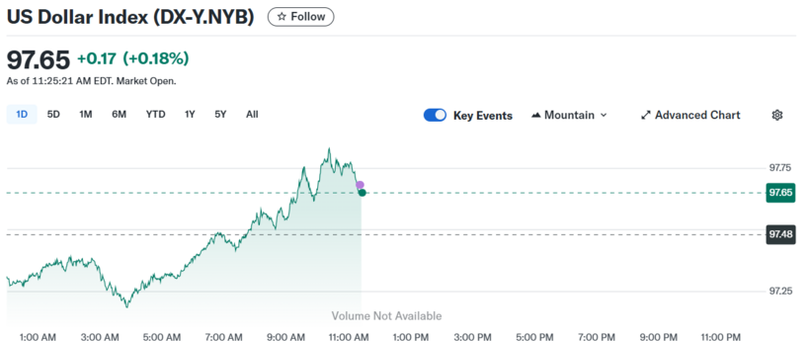

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 97.65 - up 0.33 points compared to July 8, 2025.

Although analysts and investors are leaning towards a scenario where the US dollar continues to weaken in the long term, some experts believe that the greenback could suddenly appreciate sharply in the second half of 2025. The main reason comes from the tense developments in global trade, especially the US re-imposing reciprocal tariffs under President Donald Trump's "Liberation Day" policy, which took effect on August 1.

According to financial expert Damir Tokic, the current stage can be considered "phase 1" in the trade war scenario that the US actively leads. The goal of this stage is to weaken the partner economies through high tariffs, thereby creating pressure for them to make concessions in negotiations. This scenario also shows that the USD can strengthen in the short term, regardless of long-term factors such as US public debt pressure, expectations of Fed interest rate cuts or protectionist economic policies.

Market developments in recent weeks have partly reflected this view. While US stocks and bond yields have fallen on recession fears, the US dollar has rebounded sharply, indicating a return to safe-haven sentiment for the greenback. In contrast to the reaction in April, when investors “sold off the US”, the US dollar is now benefiting from expectations that the global economy will be hit harder than the US if the trade war escalates.

In the short term, a strong dollar will help the US reduce imported inflation, as goods priced in dollars become cheaper. Strategically, this is also consistent with the goal of curbing domestic inflationary pressures. However, in the long term, analysts still believe that the USD will return to a downward trend when it enters "Phase 2" of the trade war, when major trading partners are forced to appreciate their currencies against the USD to reach a new agreement with the US.

Still, market sentiment is against the dollar at the moment. Short positions in the greenback are at their highest level in two years, according to data from the US Commodity Futures Trading Commission (CFTC). Many investors still expect the greenback to weaken amid rising economic risks, pressure on the Fed to cut interest rates and even the emergence of a “shadow Fed chair” if political pressure interferes with monetary policy.

In this context, investors should closely monitor the USD’s movements, especially against the Euro and the Australian dollar – two currencies considered “barometers” of global growth and most vulnerable to US tariff policies, experts said. While it is difficult to predict exactly how the trade war will escalate, the clearest signal at the moment is that the USD will likely continue to strengthen, at least until the macro storm subsides.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-972025-dong-usd-phuc-hoi-post291361.html

Comment (0)