USD exchange rate today 7/4/2025

At the time of survey at 4:30 a.m. on July 4, the central exchange rate at the State Bank was currently 25,091 VND/USD, an increase of 21 VND compared to yesterday's trading session.

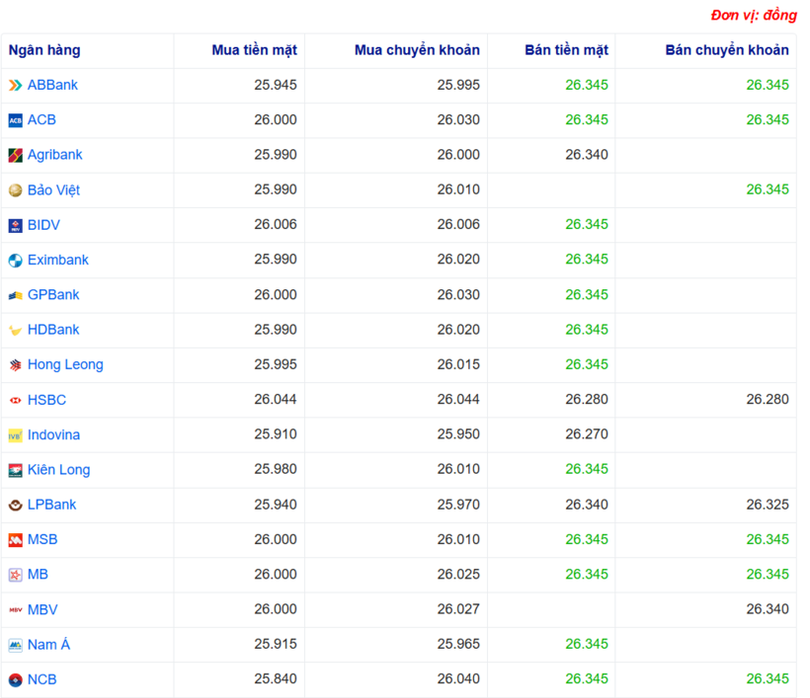

Specifically, at Vietcombank , the USD exchange rate is 25,975 - 26,345 VND/USD, an increase of 42 VND in both directions, compared to yesterday's trading session.

VietinBank is buying USD cash at the lowest price: 1 USD = 25,800 VND

VietinBank is buying USD transfers at the lowest price: 1 USD = 25,770 VND

Sacombank is buying USD cash at the highest price: 1 USD = 26,055 VND

Sacombank is buying USD transfers at the highest price: 1 USD = 26,055 VND

OCB Bank is selling USD cash at the lowest price: 1 USD = 26,260 VND

SeABank is selling USD transfers at the lowest price: 1 USD = 26,279 VND

ABBank, ACB, BIDV, Eximbank, GPBank, HDBank, Hong Leong, Kien Long, MSB, MB, Nam A, NCB, PGBank, PublicBank, Sacombank, Saigonbank, Techcombank, UOB, VIB, VietABank, VietCapitalBank, Vietcombank, VPBank, VRB are selling USD cash at the highest price: 1 USD = 26,345 VND

ABBank, ACB, Bao Viet, MSB, MB, NCB, PublicBank, Sacombank, TPB, VCBNeo, VietBank are selling USD transfers at the highest price: 1 USD = 26,345 VND

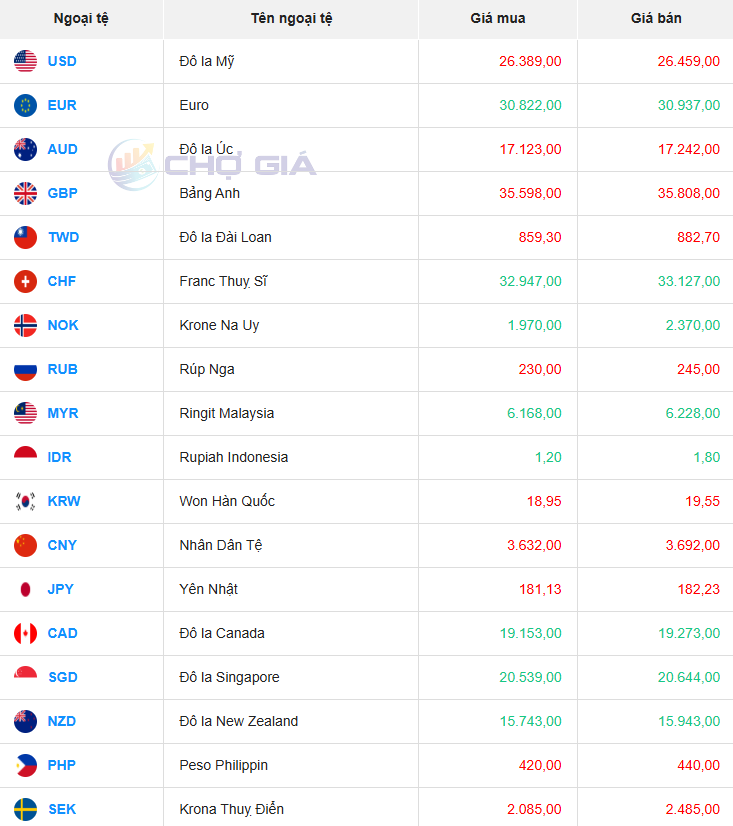

In the "black market", the black market USD exchange rate as of 4:30 a.m. on July 4, 2025 increased by 13 VND in both buying and selling directions, compared to yesterday's trading session, trading around 26,389 - 26,459 VND/USD.

USD exchange rate today July 4, 2025 on the world market

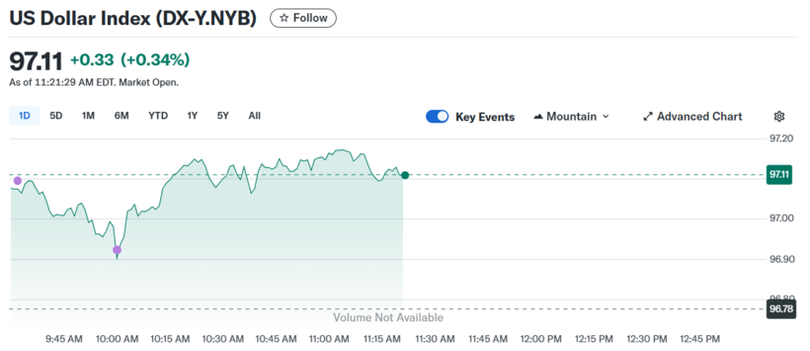

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 97.11 - up 0.31 points compared to July 3, 2025.

Nonfarm payrolls rose by 147,000 in June, far exceeding the 110,000 forecast by economists polled by Reuters, according to data released by the U.S. Labor Department on Thursday. The report was released a day early due to the July 4th holiday.

“With the labor market as strong as it is, it’s going to be very difficult for the Fed to cut rates right now,” said Axel Merk, president and chief investment officer of Merk Hard Money Funds in California. “The argument that Jerome Powell made that the Fed should stay out of the game for now continues to be valid.”

The Dollar Index, which measures the greenback against a basket of currencies including the yen and euro, rose 0.27% to 97.01, heading for a second straight session of gains, though it remains near multi-year lows.

The dollar’s rise after the jobs report was also accompanied by a rise in US government bond yields. Specifically, the yield on the 2-year bond, which usually fluctuates according to expectations of interest rate increases, rose 9.1 basis points to 3.88%. Meanwhile, the yield on the benchmark 10-year bond also increased 4.1 basis points to 4.344%.

In the stock market, major Wall Street indexes such as the Dow Jones, S&P 500 and Nasdaq all gained points in today's trading session.

Also on the same day, the Republican-controlled US House of Representatives pushed President Donald Trump's massive tax cut and spending bill closer to a final vote.

On another positive note, the U.S. lifted some export restrictions on chip design software developers and ethane producers to China, a sign that trade tensions between the world’s two largest economies are easing. The dollar edged up 0.06% against the offshore Chinese yuan to 7.164.

In the UK, the pound rebounded slightly after falling in the previous session due to a sell-off in government bonds. British Prime Minister Keir Starmer's office voiced support for Finance Minister Rachel Reeves, helping to ease speculation about her political future. As a result, the pound rose 0.15% to trade at $1.3656.

Source: https://baohatinh.vn/ty-gia-usd-hom-nay-472025-dong-usd-tiep-tuc-tang-gia-post291062.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)