World foreign exchange rates today

The dollar fell after Federal Reserve Governor Michelle Bowman said the US central bank should consider cutting interest rates in the near future, amid growing expectations that Iran's response to the US airstrikes on several nuclear facilities in Iran will be limited.

"Ms. Bowman is known as a 'hawk' (supporting tight monetary policy), so any sign that she is moving towards easing policy and lowering interest rates will weaken the USD," said Ms. Helen Given, Director of Trading at Monex USA in Washington.

Currently, the Fed's interest rate futures market has reflected expectations of 58 basis points of rate cuts this year, equivalent to two 25 basis point cuts as a certainty and a third cut is highly likely.

The dollar had been supported by the Fed's decision to leave interest rates unchanged last Wednesday - a move that was dubbed "hawkish" - as Fed Chairman Jerome Powell stressed that policymakers expect inflation to rise again in the summer due to tariffs imposed by the Trump administration.

The US dollar was also under pressure as it appeared Iran's response to the US airstrikes would be limited.

"Currently, there is no indication that Iran will receive military support from Russia or China in response," said Helen Given.

The US dollar had earlier gained as investors fled risky assets on fears that conflict in the Middle East could spread.

The dollar's rally last week was largely driven by investors closing out positions that used the dollar as a funding currency - such as bets on rising emerging market currencies, according to Marc Chandler, CEO of Bannockburn Global Forex.

The Japanese yen also recovered much of its earlier weakness, which was hit by concerns that rising oil prices would hurt Japan, which imports nearly all of its oil.

Strategists at Bank of America said that if oil prices remain high, the USD/JPY exchange rate could continue to rise, as Japan is almost entirely dependent on imported oil from the Middle East, while the US is almost energy independent.

The USD/JPY pair edged down 0.09% to 146.22 yen per dollar, after hitting its highest since May 13 at 148.02 yen.

The euro rose 0.39% to $1.1567. Data on Monday showed the eurozone economy barely grew in June, as the services sector improved slightly while manufacturing continued to weaken.

Domestic foreign exchange rates today

In the domestic market, at the beginning of the trading session on June 24, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 25,028 VND.

* The reference USD exchange rate at the State Bank's buying and selling exchange center has slightly decreased, currently at: 23,827 VND - 26,229 VND.

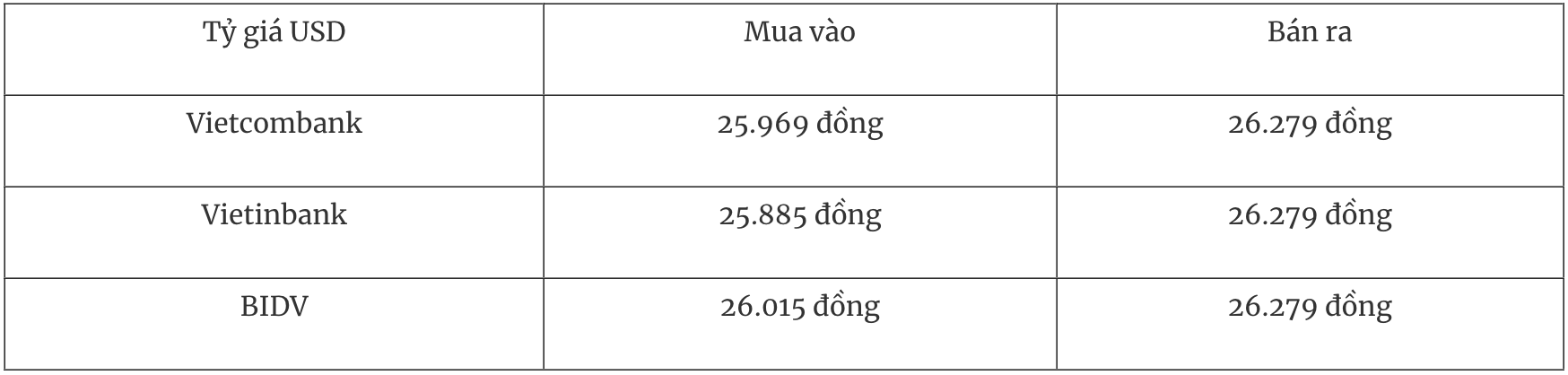

USD exchange rates at some commercial banks are as follows:

* The EUR exchange rate at the State Bank's buying and selling exchange center has decreased, currently at: 27,309 VND - 30,183 VND.

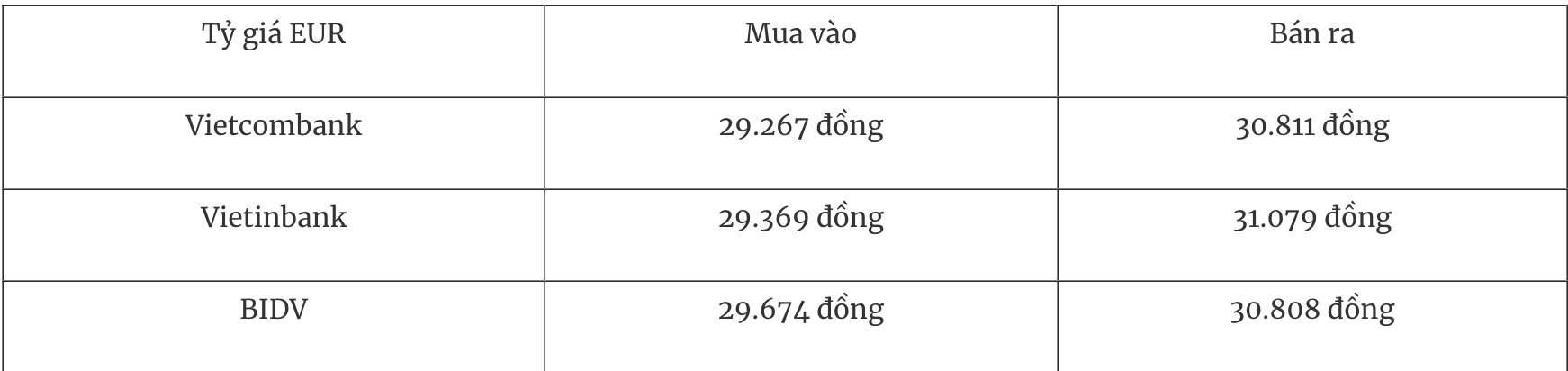

EUR exchange rates at some commercial banks are as follows:

* The Japanese Yen exchange rate at the State Bank's buying and selling exchange center has slightly decreased, currently at: 162 VND - 179 VND.

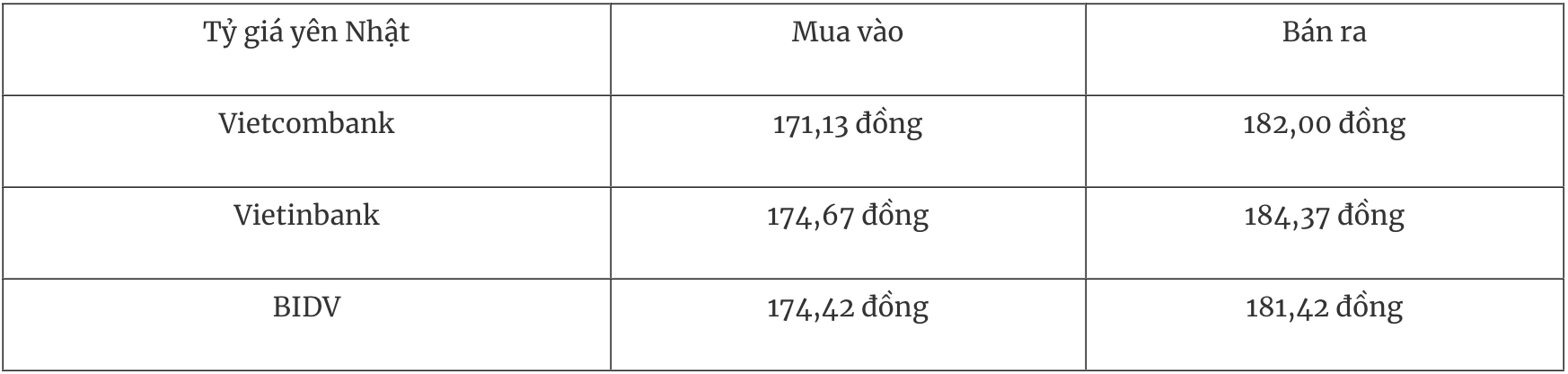

The YEN exchange rate at some commercial banks is as follows:

Source: https://baodaknong.vn/ty-gia-ngoai-te-hom-nay-24-6-ky-vong-fed-se-noi-long-chinh-sach-tien-te-256497.html

Comment (0)